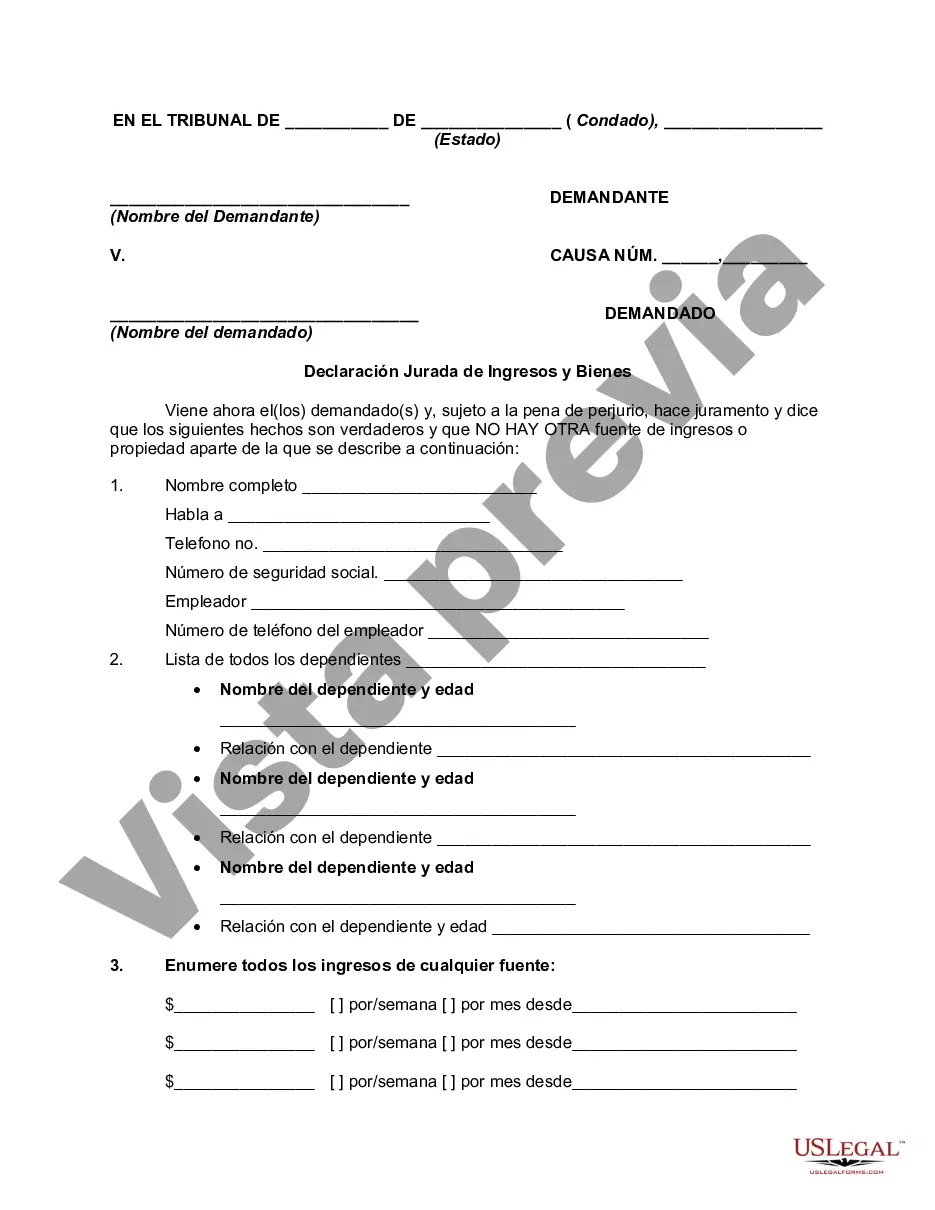

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities The North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document that provides a detailed disclosure of an individual's financial information. It is typically used in various legal proceedings, such as divorce, child custody, or bankruptcy cases, to establish one's ability to pay debts, determine child or spousal support, or assess eligibility for financial assistance. The affidavit requires individuals to list their sources of income, including employment earnings, rental income, pension, or social security benefits. It also requires the disclosure of any other income sources, such as investments, dividends, or royalties. Offering comprehensive information about income ensures an accurate portrayal of one's financial capacity. Regarding property and assets, the affidavit mandates the declaration of both real estate and personal property. Real estate includes all owned properties such as houses, apartments, or land, while personal property encompasses vehicles, jewelry, artwork, and valuable possessions. Providing accurate details about property and assets assists in determining an individual's overall financial worth. Liabilities, or debts, form a crucial aspect of the affidavit. It requires individuals to list all current debts, such as mortgages, car loans, credit card balances, student loans, or any other outstanding loans. The aim is to assess an individual's financial obligations and evaluate their ability to manage or pay off these debts. Different types of North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities may include: 1. Affidavit of Income and Property for Child Support: This specific affidavit is used in child support cases to analyze the income and property information of the non-custodial parent. It helps in determining the appropriate amount of child support that should be paid. 2. Affidavit of Income and Property for Alimony or Spousal Support: In divorce or separation cases, this affidavit is utilized to determine the financial capacity of one spouse to provide spousal support or alimony to the other. It includes detailed information on income, property, and liabilities. 3. Affidavit of Income and Property for Bankruptcy: When filing for bankruptcy, individuals are required to submit an affidavit detailing their income, assets, and liabilities. This affidavit aids bankruptcy trustees and courts in understanding the debtor's financial situation and determining the most appropriate bankruptcy chapter. 4. Affidavit of Income and Property for Public Assistance Application: Individuals applying for public assistance programs, such as Medicaid or food stamps, may need to complete this affidavit. It helps the authorities assess the applicant's eligibility and determine the level of financial aid required. 5. Affidavit of Income and Property for Loan Application: Some lenders may require applicants to provide an affidavit disclosing their income, property, and liabilities. This ensures that borrowers have the financial stability necessary to repay the loan. In conclusion, the North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities is a comprehensive document that plays a significant role in various legal proceedings. It assists in evaluating one's financial capacity, determining child or spousal support, assessing eligibility for public assistance, filing for bankruptcy, or obtaining loans.North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities The North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document that provides a detailed disclosure of an individual's financial information. It is typically used in various legal proceedings, such as divorce, child custody, or bankruptcy cases, to establish one's ability to pay debts, determine child or spousal support, or assess eligibility for financial assistance. The affidavit requires individuals to list their sources of income, including employment earnings, rental income, pension, or social security benefits. It also requires the disclosure of any other income sources, such as investments, dividends, or royalties. Offering comprehensive information about income ensures an accurate portrayal of one's financial capacity. Regarding property and assets, the affidavit mandates the declaration of both real estate and personal property. Real estate includes all owned properties such as houses, apartments, or land, while personal property encompasses vehicles, jewelry, artwork, and valuable possessions. Providing accurate details about property and assets assists in determining an individual's overall financial worth. Liabilities, or debts, form a crucial aspect of the affidavit. It requires individuals to list all current debts, such as mortgages, car loans, credit card balances, student loans, or any other outstanding loans. The aim is to assess an individual's financial obligations and evaluate their ability to manage or pay off these debts. Different types of North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities may include: 1. Affidavit of Income and Property for Child Support: This specific affidavit is used in child support cases to analyze the income and property information of the non-custodial parent. It helps in determining the appropriate amount of child support that should be paid. 2. Affidavit of Income and Property for Alimony or Spousal Support: In divorce or separation cases, this affidavit is utilized to determine the financial capacity of one spouse to provide spousal support or alimony to the other. It includes detailed information on income, property, and liabilities. 3. Affidavit of Income and Property for Bankruptcy: When filing for bankruptcy, individuals are required to submit an affidavit detailing their income, assets, and liabilities. This affidavit aids bankruptcy trustees and courts in understanding the debtor's financial situation and determining the most appropriate bankruptcy chapter. 4. Affidavit of Income and Property for Public Assistance Application: Individuals applying for public assistance programs, such as Medicaid or food stamps, may need to complete this affidavit. It helps the authorities assess the applicant's eligibility and determine the level of financial aid required. 5. Affidavit of Income and Property for Loan Application: Some lenders may require applicants to provide an affidavit disclosing their income, property, and liabilities. This ensures that borrowers have the financial stability necessary to repay the loan. In conclusion, the North Carolina Affidavit or Proof of Income and Property — Assets and Liabilities is a comprehensive document that plays a significant role in various legal proceedings. It assists in evaluating one's financial capacity, determining child or spousal support, assessing eligibility for public assistance, filing for bankruptcy, or obtaining loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.