Title: Understanding the North Carolina Assignment of Mortgage: Types and Key Concepts Introduction: The North Carolina Assignment of Mortgage is a legal document that allows the transfer of a mortgage lien from one party (the assignor) to another (the assignee) for the property located within the state of North Carolina. This process enables lenders and investors to transfer their interests, ensuring the smooth flow of the mortgage market. In this article, we will delve into the details of what the North Carolina Assignment of Mortgage entails, its purpose, and explore any types that exist within the state. Key Concepts Related to North Carolina Assignment of Mortgage: Assignment of Mortgage Definition: The Assignment of Mortgage involves the transfer of ownership rights and interests in the mortgage loan from one party to another. It explicitly outlines the terms and conditions of the transfer, including the names of the parties involved, property details, and the outstanding balance on the mortgage. Purpose of Assignment of Mortgage: The primary purpose of a North Carolina Assignment of Mortgage is to provide documented evidence of the change in ownership or transfer of the mortgage lien. It ensures transparency and accountability during transactions involving mortgage loans, protecting the rights of all parties involved. Types of North Carolina Assignment of Mortgage: 1. Absolute Assignment: An absolute assignment of mortgage refers to the complete transfer of all rights, interests, and privileges associated with the mortgage from the assignor to the assignee. The assignor relinquishes all rights and obligations, making the assignee the new mortgagee. 2. Collateral Assignment: A collateral assignment occurs when the assignor transfers only a portion of the mortgage rights to the assignee, usually as a form of security or collateral for a loan or debt. In this case, the assignor may still retain certain rights or interests related to the mortgage. 3. Assignment of Assignment: This type of assignment occurs when an existing assignee transfers their rights as an assignee to a new party. It includes the transfer of both the mortgage rights and obligations from the initial assignee to the new assignee, maintaining the continuity of the mortgage lien transfer. 4. Assignment in Blank: An assignment in blank happens when the assignor does not specify the assignee's name during the assignment of mortgage, creating a bearer instrument. This enables the assignment to be transferred or negotiated further to other parties without needing additional written assignments. Conclusion: Understanding the North Carolina Assignment of Mortgage and its different types is crucial for parties involved in mortgage transactions within the state. Whether it's a complete transfer, a collateral arrangement, or subsequent assignments, having a clear understanding of the assignment process ensures legal compliance and protects the interests of both mortgagees and assignees. Remember, legal advice from an attorney specializing in real estate law is always recommended when executing or dealing with any assignment of mortgage.

North Carolina Assignment of Mortgage

Description

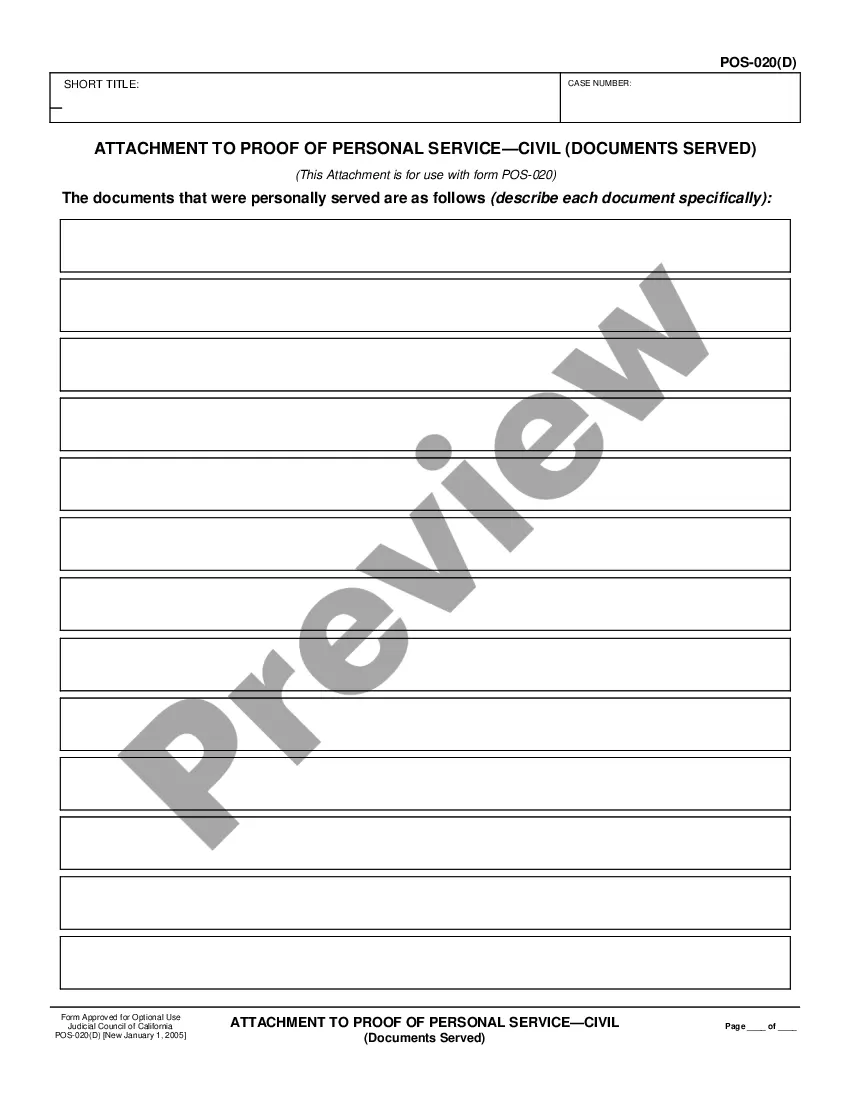

How to fill out North Carolina Assignment Of Mortgage?

You can commit hrs on the Internet searching for the lawful record template that fits the state and federal needs you require. US Legal Forms supplies a huge number of lawful varieties that are examined by specialists. You can easily down load or produce the North Carolina Assignment of Mortgage from our services.

If you have a US Legal Forms accounts, it is possible to log in and click on the Download option. Following that, it is possible to total, modify, produce, or indicator the North Carolina Assignment of Mortgage. Every single lawful record template you purchase is your own property for a long time. To have another backup of the obtained kind, proceed to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms website initially, keep to the simple guidelines below:

- Initial, ensure that you have chosen the correct record template for the area/area of your choosing. See the kind explanation to ensure you have picked the right kind. If readily available, utilize the Preview option to search throughout the record template also.

- In order to find another model of your kind, utilize the Search industry to discover the template that fits your needs and needs.

- When you have identified the template you desire, just click Acquire now to proceed.

- Select the costs program you desire, type in your references, and register for your account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal accounts to fund the lawful kind.

- Select the structure of your record and down load it to your product.

- Make changes to your record if possible. You can total, modify and indicator and produce North Carolina Assignment of Mortgage.

Download and produce a huge number of record templates utilizing the US Legal Forms site, which provides the greatest variety of lawful varieties. Use expert and state-particular templates to deal with your small business or personal demands.