Title: Understanding North Carolina's Annual Expense Report: A Comprehensive Overview Introduction: In North Carolina, the Annual Expense Report is a crucial financial document that provides a detailed breakdown of the state's expenditures over a fiscal year. This report ensures transparency and accountability in fiscal management, allowing citizens and government officials to assess where public funds are allocated. In this article, you will gain a comprehensive understanding of what the North Carolina Annual Expense Report entails, its types, key components, and the significance of this financial document. 1. North Carolina Annual Expense Report Explained: The North Carolina Annual Expense Report is an essential financial report prepared by the state government, recording all expenditures made in accordance with state laws and regulations. It covers various sectors of government spending, ranging from education, healthcare, public safety, infrastructure, and social services. This comprehensive report plays a pivotal role in facilitating effective budget planning and assessing fiscal decisions. 2. Types of North Carolina Annual Expense Reports: There are several types of Annual Expense Reports conducted in North Carolina, each focusing on a specific aspect of government spending. Some key types include: a) General Fund Expense Report: This report provides an overview of expenditures from the General Fund, representing the primary operating fund for most governmental activities. b) Special Revenue Fund Expense Report: This report focuses on expenditures from various special revenue funds like federal grants, dedicated fees, and specific taxes that must be allocated to particular purposes. c) Capital Projects Fund Expense Report: This report outlines expenditures related to capital improvement projects, such as constructing buildings, infrastructure development, and equipment acquisitions. d) Enterprise Fund Expense Report: This report focuses on expenditures related to self-supporting services provided by governmental entities, such as utilities, transit systems, or airports. 3. Key Components of the North Carolina Annual Expense Report: The North Carolina Annual Expense Report consists of various essential components that offer an in-depth analysis of the state's financial activities: a) Expenditure Breakdown by Category: This section categorizes expenses into distinct sectors, including education, healthcare, public safety, transportation, debt service, employee benefits, and more. b) Department-by-Department Expenditures: A detailed breakdown of expenses incurred by each department, providing insights into their spending patterns and the relative importance of different sectors. c) Revenue Sources: This component showcases the primary revenue sources contributing to the state's overall expenditures, including taxes, federal grants, fees, fines, and more. d) Comparative Analysis: Comparative data from previous years are included to identify trends, changes in spending patterns, and assess the effectiveness of initiatives and policy measures. Conclusion: The North Carolina Annual Expense Report serves as an indispensable tool in ensuring financial transparency, accountability, and effective allocation of resources. By providing a comprehensive analysis of the state's expenditures, it enables citizens, policymakers, and government officials to make informed decisions regarding budget planning, fiscal policies, and program evaluations. Understanding the different types and key components of this report empowers individuals to actively participate in the state's financial governance, ultimately fostering a better future for North Carolina and its citizens.

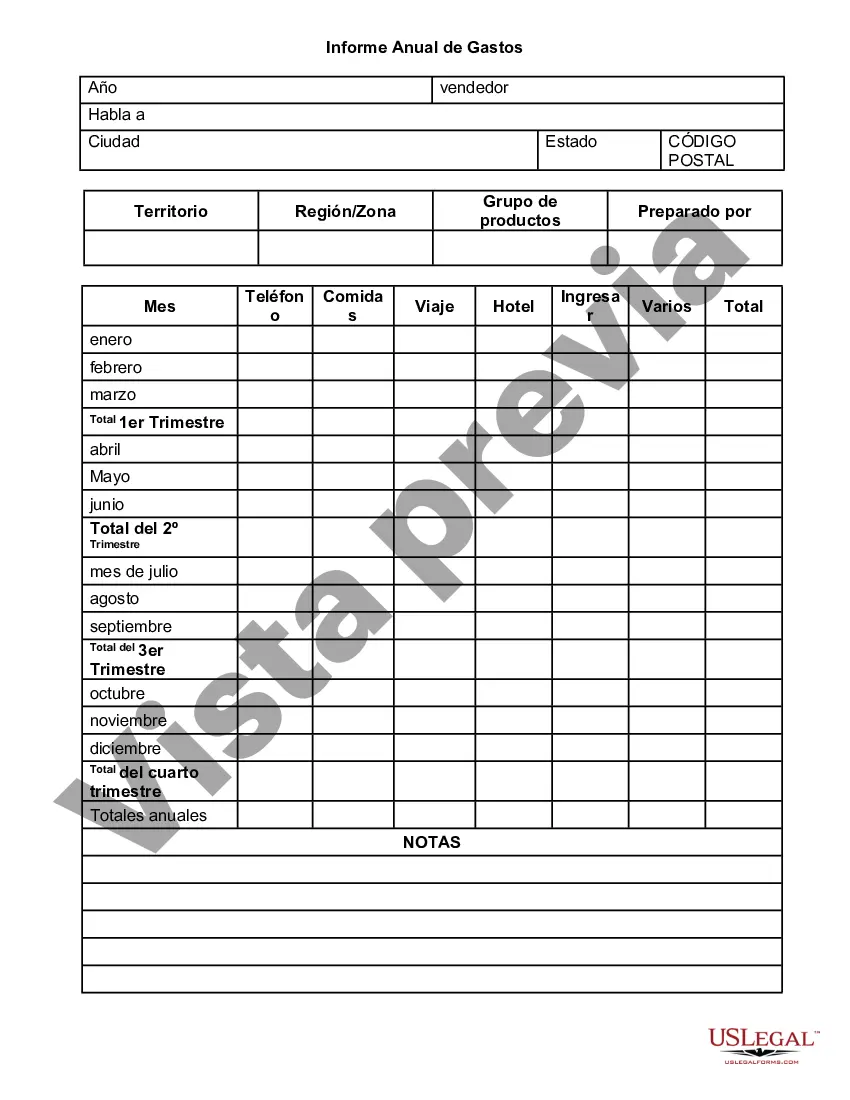

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Informe Anual de Gastos - Annual Expense Report

Description

How to fill out North Carolina Informe Anual De Gastos?

If you have to total, download, or print out legal record web templates, use US Legal Forms, the greatest variety of legal kinds, that can be found on-line. Utilize the site`s basic and hassle-free lookup to discover the files you need. A variety of web templates for organization and individual uses are sorted by types and claims, or key phrases. Use US Legal Forms to discover the North Carolina Annual Expense Report in just a couple of clicks.

When you are currently a US Legal Forms client, log in to your accounts and then click the Down load button to find the North Carolina Annual Expense Report. You can also accessibility kinds you previously saved from the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your appropriate city/country.

- Step 2. Utilize the Review option to examine the form`s articles. Do not forget about to learn the description.

- Step 3. When you are unhappy with the form, use the Research field towards the top of the display screen to get other models of the legal form template.

- Step 4. After you have discovered the shape you need, click on the Acquire now button. Select the costs prepare you choose and put your credentials to register for the accounts.

- Step 5. Method the deal. You should use your credit card or PayPal accounts to complete the deal.

- Step 6. Pick the structure of the legal form and download it on your own gadget.

- Step 7. Complete, change and print out or sign the North Carolina Annual Expense Report.

Each legal record template you get is your own property permanently. You have acces to every form you saved in your acccount. Go through the My Forms portion and pick a form to print out or download once more.

Compete and download, and print out the North Carolina Annual Expense Report with US Legal Forms. There are millions of expert and state-specific kinds you can use for your organization or individual requirements.