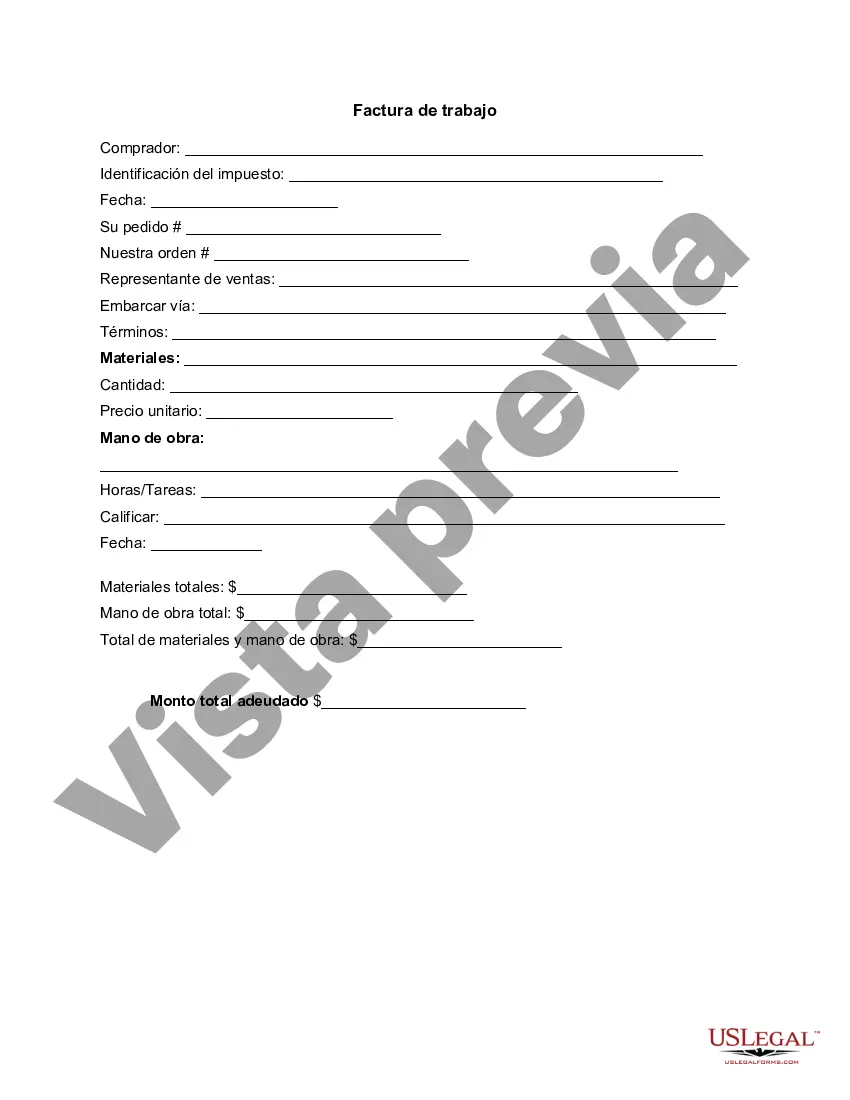

A North Carolina Invoice Template for Consultant is a ready-to-use document that helps consultants in the state of North Carolina to streamline their billing process. It is a comprehensive and customizable tool designed specifically for consultants working in various industries such as marketing, management, IT, finance, and more. This template enables consultants to create professional invoices effortlessly, ensuring accurate and timely payment collection. The North Carolina Invoice Template for Consultant typically includes the following key components: 1. Header: The header section contains essential information such as the consultant's name, business name, address, phone number, and email address. It also includes the invoice number, date, and due date for easy identification and tracking. 2. Client Information: This section captures the client's details, including their name, business name, address, contact person, and contact information. It is crucial to include accurate client information to avoid any payment delays or confusion. 3. Services Rendered: Here, consultants list the specific services provided or tasks performed for the client. It is essential to describe the services concisely and clearly to avoid any misunderstandings. Consultants may include service descriptions, hourly rates, quantities, or any other relevant information. 4. Time and Expense Tracking: For consultants who bill clients based on hourly rates, this section allows them to record the number of hours worked on each task or project. Additionally, consultants can include any reimbursable expenses incurred during the provision of services, such as travel expenses, supplies, or research costs. 5. Rates and Totals: This section provides a breakdown of the charges, including hourly rates, quantity, unit price, and the total amount for each line item. It also calculates the subtotal, any applicable taxes (e.g., sales tax), and adds them to obtain the total amount due from the client. 6. Payment Terms: It is crucial to outline the payment terms clearly to avoid payment delays or disputes. This section may specify the accepted payment methods, payment due dates, late payment penalties or discounts for early payment, and any other relevant payment-related information. Different types of North Carolina Invoice Templates for Consultants may include variations such as: 1. Hourly Rate Invoice Template: Ideal for consultants who bill clients based on the number of hours worked. 2. Project-Based Invoice Template: Suitable for consultants charging a fixed fee for delivering a specific project or service. 3. Retainer Invoice Template: Used when the consultant works with a client under retainer agreements, typically involving a predetermined number of hours or a fixed monthly fee. 4. Expense Invoice Template: Specifically designed for consultants who need to itemize and bill clients for reimbursable expenses incurred during their services. 5. Recurring Invoice Template: Enables consultants to set up recurring invoices for clients with ongoing projects or long-term service contracts. Using a North Carolina Invoice Template for Consultant helps consultants in the state to maintain professionalism, clarity, and accuracy in their invoicing process, allowing them to efficiently manage their finances and focus more on delivering exceptional consulting services.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Plantilla de factura para consultor - Invoice Template for Consultant

Description

How to fill out North Carolina Plantilla De Factura Para Consultor?

Are you currently in a place that you need to have documents for possibly organization or individual purposes almost every time? There are tons of authorized papers layouts available online, but getting kinds you can depend on isn`t easy. US Legal Forms provides a large number of form layouts, such as the North Carolina Invoice Template for Consultant, that happen to be published to satisfy state and federal demands.

In case you are previously knowledgeable about US Legal Forms site and also have a free account, merely log in. After that, you are able to download the North Carolina Invoice Template for Consultant format.

Unless you offer an accounts and need to begin to use US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is for your proper city/region.

- Take advantage of the Preview option to review the shape.

- Look at the outline to ensure that you have selected the correct form.

- If the form isn`t what you`re trying to find, utilize the Search area to obtain the form that suits you and demands.

- Whenever you obtain the proper form, simply click Get now.

- Pick the rates program you would like, submit the necessary information and facts to produce your money, and buy the transaction with your PayPal or bank card.

- Decide on a hassle-free data file format and download your duplicate.

Locate all of the papers layouts you may have purchased in the My Forms food list. You may get a more duplicate of North Carolina Invoice Template for Consultant any time, if needed. Just select the needed form to download or print the papers format.

Use US Legal Forms, probably the most substantial variety of authorized forms, to conserve efforts and avoid mistakes. The services provides professionally produced authorized papers layouts that you can use for an array of purposes. Generate a free account on US Legal Forms and commence creating your lifestyle a little easier.