The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

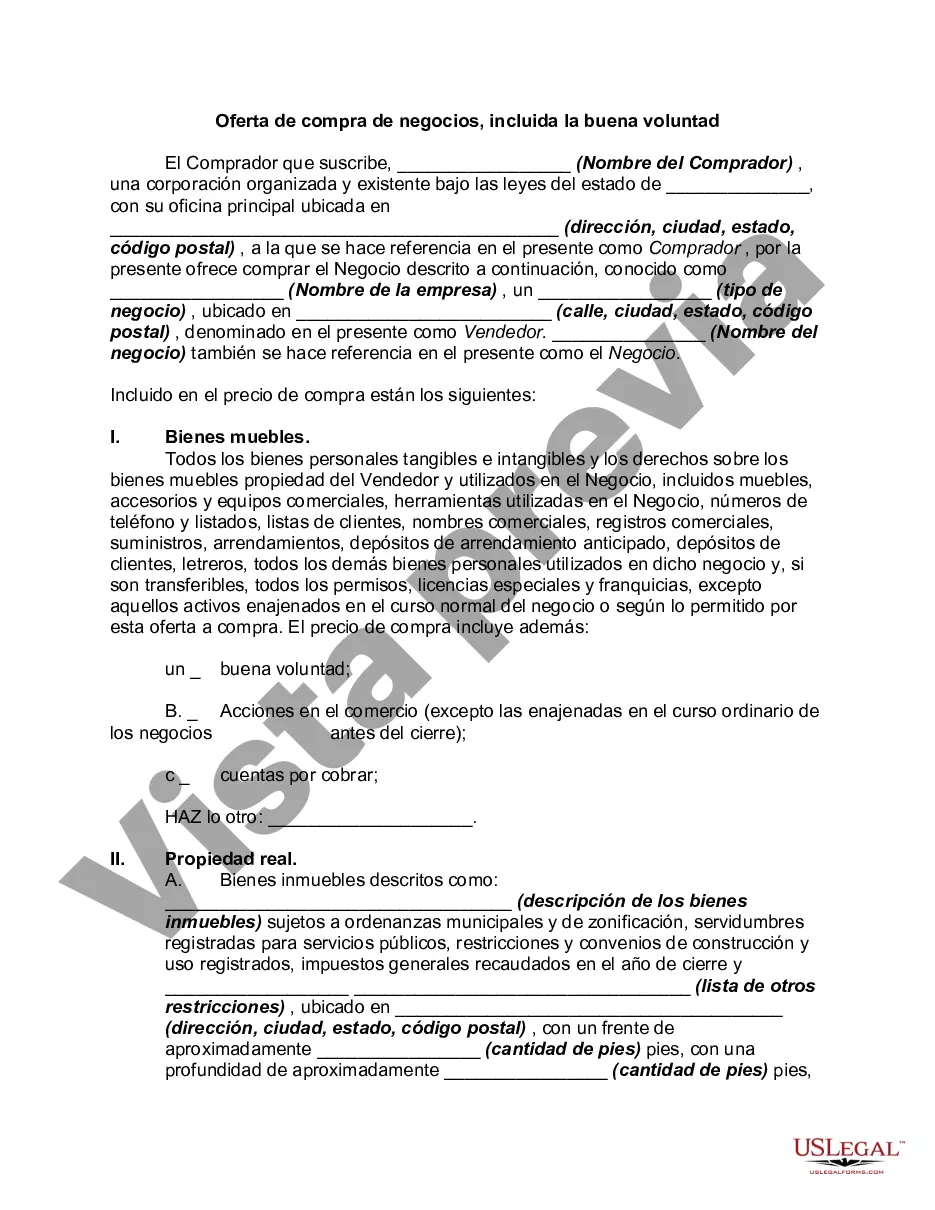

North Carolina Offer to Purchase Business, Including Good Will: A Comprehensive Guide Introduction: The North Carolina Offer to Purchase Business, Including Good Will, is a legal document used in the state of North Carolina when buying a business. This document outlines the terms and conditions of the purchase, including the transfer of business assets, real estate, as well as the intangible asset of Good Will. It serves as a binding agreement between the buyer and seller, ensuring a smooth and transparent transaction. In North Carolina, there are various types of Offer to Purchase Business, Including Good Will, tailored to specific circumstances and industries. Key Components of a North Carolina Offer to Purchase Business, Including Good Will: 1. Identification of Parties: The Offer to Purchase Business identifies the buyer and seller, including their legal names, addresses, and contact information. It is crucial to accurately define the parties involved to maintain transparency throughout the transaction. 2. Business Description: This section provides a comprehensive description of the business being sold, including the company name, legal structure, industry, current assets, equipment, and inventory. It is essential to provide sufficient detail to avoid any ambiguity regarding the nature of the business. 3. Purchase Price and Payment Terms: The Offer to Purchase Business specifies the agreed-upon purchase price, including any down payments, financing arrangements, or contingencies. The document also outlines the payment terms, including the schedule of payments, interest rates, and penalties for early or delayed payments. 4. Assets and Liabilities: In this section, the Offer to Purchase Business outlines the specific assets and liabilities being transferred, such as real estate, equipment, intellectual property, contracts, and licenses. It is vital to conduct a thorough due diligence process to ensure all relevant assets and liabilities are accounted for. 5. Good Will: Good Will represents the intangible asset of a business, including its reputation, customer base, brand recognition, and relationships with suppliers. The Offer to Purchase Business specifies the agreed-upon value of Good Will and outlines the terms of its transfer to the buyer. 6. Restrictive Covenants: To protect the seller's interests, the Offer to Purchase Business may include restrictive covenants, such as non-compete agreements, non-disclosure agreements, and non-solicitation agreements. These clauses aim to prevent the seller from competing against the buyer or disclosing confidential information. Different Types of North Carolina Offer to Purchase Business, Including Good Will: 1. Asset Purchase Agreement: This type of Offer to Purchase Business focuses on the acquisition of specific assets, rather than the purchase of the entire business entity. It allows the buyer to selectively acquire assets, assuming only desired liabilities. 2. Stock Purchase Agreement: In a stock purchase transaction, the buyer purchases all outstanding shares of the target company, resulting in the acquisition of both assets and liabilities. This type of agreement is often preferred when maintaining the business entity's legal status is crucial. Conclusion: The North Carolina Offer to Purchase Business, Including Good Will, plays a vital role in ensuring a smooth and legally binding transaction between a buyer and seller. Whether it is an asset purchase or a stock purchase, this document establishes the terms and conditions of the sale, safeguarding the interests of all parties involved. It is essential to consult legal professionals familiar with North Carolina business laws to draft an Offer to Purchase Business tailored to your specific needs and industry.North Carolina Offer to Purchase Business, Including Good Will: A Comprehensive Guide Introduction: The North Carolina Offer to Purchase Business, Including Good Will, is a legal document used in the state of North Carolina when buying a business. This document outlines the terms and conditions of the purchase, including the transfer of business assets, real estate, as well as the intangible asset of Good Will. It serves as a binding agreement between the buyer and seller, ensuring a smooth and transparent transaction. In North Carolina, there are various types of Offer to Purchase Business, Including Good Will, tailored to specific circumstances and industries. Key Components of a North Carolina Offer to Purchase Business, Including Good Will: 1. Identification of Parties: The Offer to Purchase Business identifies the buyer and seller, including their legal names, addresses, and contact information. It is crucial to accurately define the parties involved to maintain transparency throughout the transaction. 2. Business Description: This section provides a comprehensive description of the business being sold, including the company name, legal structure, industry, current assets, equipment, and inventory. It is essential to provide sufficient detail to avoid any ambiguity regarding the nature of the business. 3. Purchase Price and Payment Terms: The Offer to Purchase Business specifies the agreed-upon purchase price, including any down payments, financing arrangements, or contingencies. The document also outlines the payment terms, including the schedule of payments, interest rates, and penalties for early or delayed payments. 4. Assets and Liabilities: In this section, the Offer to Purchase Business outlines the specific assets and liabilities being transferred, such as real estate, equipment, intellectual property, contracts, and licenses. It is vital to conduct a thorough due diligence process to ensure all relevant assets and liabilities are accounted for. 5. Good Will: Good Will represents the intangible asset of a business, including its reputation, customer base, brand recognition, and relationships with suppliers. The Offer to Purchase Business specifies the agreed-upon value of Good Will and outlines the terms of its transfer to the buyer. 6. Restrictive Covenants: To protect the seller's interests, the Offer to Purchase Business may include restrictive covenants, such as non-compete agreements, non-disclosure agreements, and non-solicitation agreements. These clauses aim to prevent the seller from competing against the buyer or disclosing confidential information. Different Types of North Carolina Offer to Purchase Business, Including Good Will: 1. Asset Purchase Agreement: This type of Offer to Purchase Business focuses on the acquisition of specific assets, rather than the purchase of the entire business entity. It allows the buyer to selectively acquire assets, assuming only desired liabilities. 2. Stock Purchase Agreement: In a stock purchase transaction, the buyer purchases all outstanding shares of the target company, resulting in the acquisition of both assets and liabilities. This type of agreement is often preferred when maintaining the business entity's legal status is crucial. Conclusion: The North Carolina Offer to Purchase Business, Including Good Will, plays a vital role in ensuring a smooth and legally binding transaction between a buyer and seller. Whether it is an asset purchase or a stock purchase, this document establishes the terms and conditions of the sale, safeguarding the interests of all parties involved. It is essential to consult legal professionals familiar with North Carolina business laws to draft an Offer to Purchase Business tailored to your specific needs and industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.