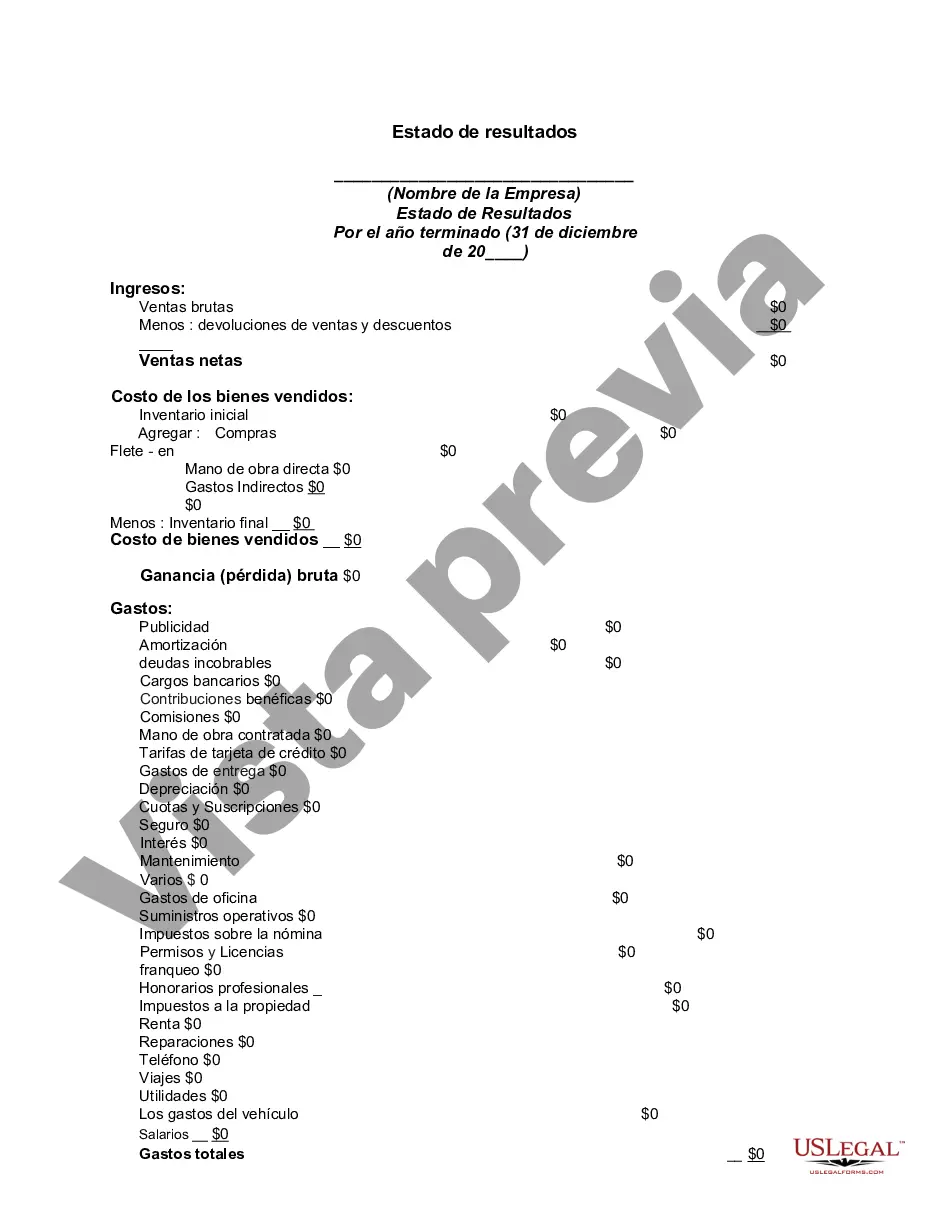

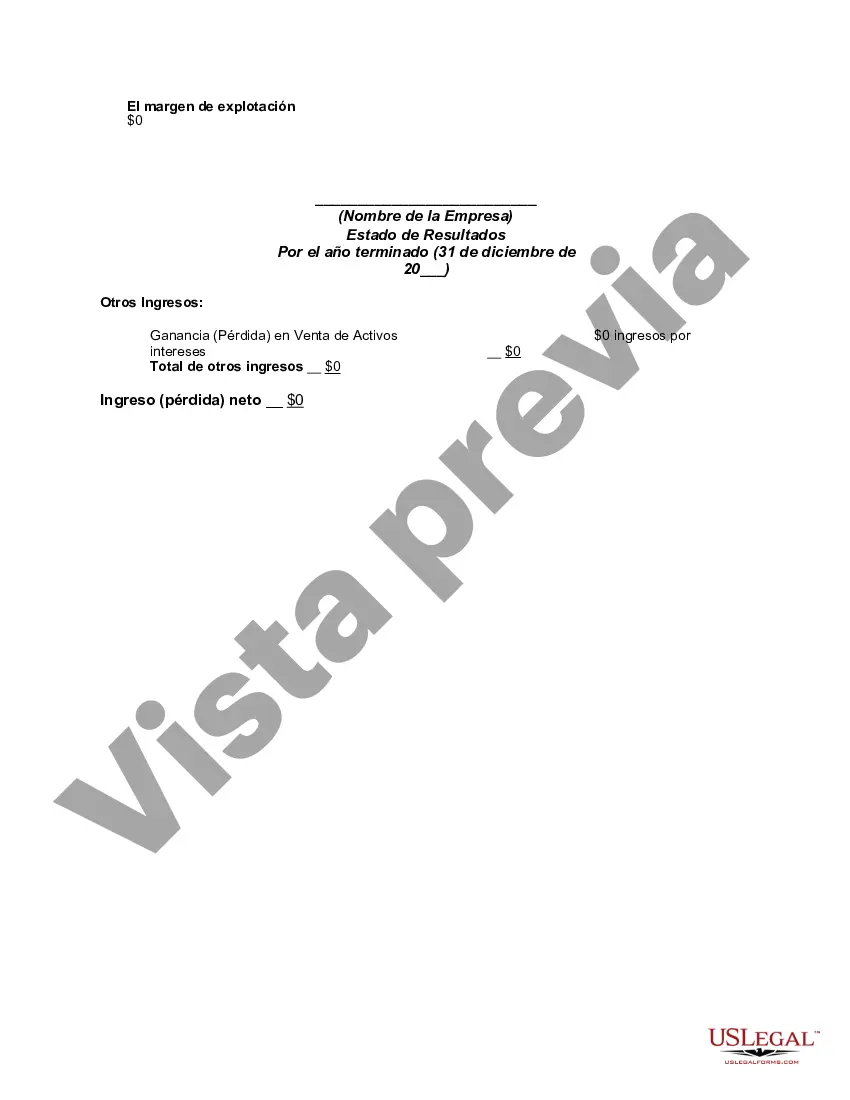

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The North Carolina Income Statement is a financial document that provides a detailed overview of the financial performance of an individual, business, or organization operating in the state of North Carolina. This statement highlights the revenue, expenses, and resulting net income or loss during a specific period. The North Carolina Income Statement is a crucial tool for assessing the financial health and profitability of an entity. It is primarily used by businesses, nonprofits, and individuals residing or operating in North Carolina to track their income and expenses, and to determine taxable income for state income tax purposes. Keywords: North Carolina Income Statement, financial performance, revenue, expenses, net income, profitability, businesses, nonprofits, individuals, taxable income, state income tax. There are several types of income statements used in North Carolina, based on the entity's structure and reporting requirements. These include: 1. Individual Income Statement: This type of income statement is used by individuals residing in North Carolina to report their personal income. It showcases various income sources, such as wages, salaries, self-employment earnings, rental income, investment income, and more. Deductions, exemptions, and credits applicable to North Carolina state taxes are also included. 2. Business Income Statement: A business operating in North Carolina prepares this income statement to assess its financial performance. It reflects revenue generated from various sources like sales, services, or other business operations. Expenses incurred during the reporting period, such as salaries, rent, utilities, marketing costs, and supplies, are deducted from revenue to determine the net income or loss for state tax purposes. 3. Nonprofit Income Statement: Nonprofit organizations in North Carolina prepare this income statement to evaluate their financial sustainability. It includes revenue sources unique to nonprofits, like charitable contributions, grants, program service fees, and investment income. Expenses related to program services, fundraising, administration, and other operational costs are deducted to calculate the net income or loss specific to the organization's mission and activities. 4. Partnership or S Corporation Income Statement: Partnerships or S Corporations operating in North Carolina are required to prepare income statements that reflect their revenue, expenses, and net income or loss. These statements serve multiple purposes, including calculating distributive shares of income or loss for each partner or shareholder, and determining the entity's overall tax liability. Keywords: Individual Income Statement, Business Income Statement, Nonprofit Income Statement, Partnership Income Statement, S Corporation Income Statement, revenue sources, deductions, expenses, net income, financial sustainability, distributive shares, tax liability. In conclusion, the North Carolina Income Statement is a critical financial tool used by individuals, businesses, nonprofits, and partnerships/S corporations operating in North Carolina to track income, expenses, and determine the resulting net income or loss. The various types of income statements reflect the unique characteristics and reporting requirements of different entities in North Carolina.The North Carolina Income Statement is a financial document that provides a detailed overview of the financial performance of an individual, business, or organization operating in the state of North Carolina. This statement highlights the revenue, expenses, and resulting net income or loss during a specific period. The North Carolina Income Statement is a crucial tool for assessing the financial health and profitability of an entity. It is primarily used by businesses, nonprofits, and individuals residing or operating in North Carolina to track their income and expenses, and to determine taxable income for state income tax purposes. Keywords: North Carolina Income Statement, financial performance, revenue, expenses, net income, profitability, businesses, nonprofits, individuals, taxable income, state income tax. There are several types of income statements used in North Carolina, based on the entity's structure and reporting requirements. These include: 1. Individual Income Statement: This type of income statement is used by individuals residing in North Carolina to report their personal income. It showcases various income sources, such as wages, salaries, self-employment earnings, rental income, investment income, and more. Deductions, exemptions, and credits applicable to North Carolina state taxes are also included. 2. Business Income Statement: A business operating in North Carolina prepares this income statement to assess its financial performance. It reflects revenue generated from various sources like sales, services, or other business operations. Expenses incurred during the reporting period, such as salaries, rent, utilities, marketing costs, and supplies, are deducted from revenue to determine the net income or loss for state tax purposes. 3. Nonprofit Income Statement: Nonprofit organizations in North Carolina prepare this income statement to evaluate their financial sustainability. It includes revenue sources unique to nonprofits, like charitable contributions, grants, program service fees, and investment income. Expenses related to program services, fundraising, administration, and other operational costs are deducted to calculate the net income or loss specific to the organization's mission and activities. 4. Partnership or S Corporation Income Statement: Partnerships or S Corporations operating in North Carolina are required to prepare income statements that reflect their revenue, expenses, and net income or loss. These statements serve multiple purposes, including calculating distributive shares of income or loss for each partner or shareholder, and determining the entity's overall tax liability. Keywords: Individual Income Statement, Business Income Statement, Nonprofit Income Statement, Partnership Income Statement, S Corporation Income Statement, revenue sources, deductions, expenses, net income, financial sustainability, distributive shares, tax liability. In conclusion, the North Carolina Income Statement is a critical financial tool used by individuals, businesses, nonprofits, and partnerships/S corporations operating in North Carolina to track income, expenses, and determine the resulting net income or loss. The various types of income statements reflect the unique characteristics and reporting requirements of different entities in North Carolina.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.