Dear [Name], I hope this letter finds you well. I am writing to provide you with detailed information about cash advances in North Carolina, including relevant keywords to help you understand the process and options available. A cash advance, also known as a payday loan or short-term loan, is a small, short-term loan that is typically repaid on the borrower's next payday. It is often used to cover unexpected expenses or bridge financial gaps until the next paycheck. In North Carolina, cash advances are regulated by state laws to protect consumers from predatory lending practices. As of now, payday lending is illegal in the state; therefore, there are no legally operating payday lenders offering cash advances in North Carolina. This regulation is in place to ensure that consumers are not trapped in a cycle of debt with high interest rates. However, it's important to note that there are alternative options available to North Carolina residents who need quick cash. Some of these options include: 1. Personal Installment Loans: These are available from traditional lenders such as banks or credit unions. They provide borrowers with a lump sum of money that can be repaid through fixed monthly installments over a specific period of time. 2. Credit Card Cash Advances: If you have a credit card, you may be able to withdraw cash from an ATM or obtain a cash advance directly from your credit card provider. However, it's important to be aware of the high interest rates and fees associated with such advances. 3. Online Lenders: There are online lenders that offer personal loans to residents of North Carolina. These lenders often have a streamlined application process and quick funding options. It's important to carefully research and compare different lenders before choosing one. When considering any type of cash advance, it is crucial to read and understand the terms and conditions, including the interest rates, fees, repayment terms, and any legal limitations. It's advisable to borrow only what you can afford to repay and to explore alternative options first, such as budgeting, negotiating with creditors, or seeking assistance from non-profit credit counseling agencies. Please remember that I am not a financial advisor, and it is always a good idea to consult with a professional before making any financial decisions. I hope this information clarifies the types of cash advances available in North Carolina while highlighting the limitations imposed by the state's regulation. If you have any further questions or need additional assistance, please do not hesitate to contact me. Thank you for your attention, and I wish you all the best in your financial endeavors. Sincerely, [Your Name]

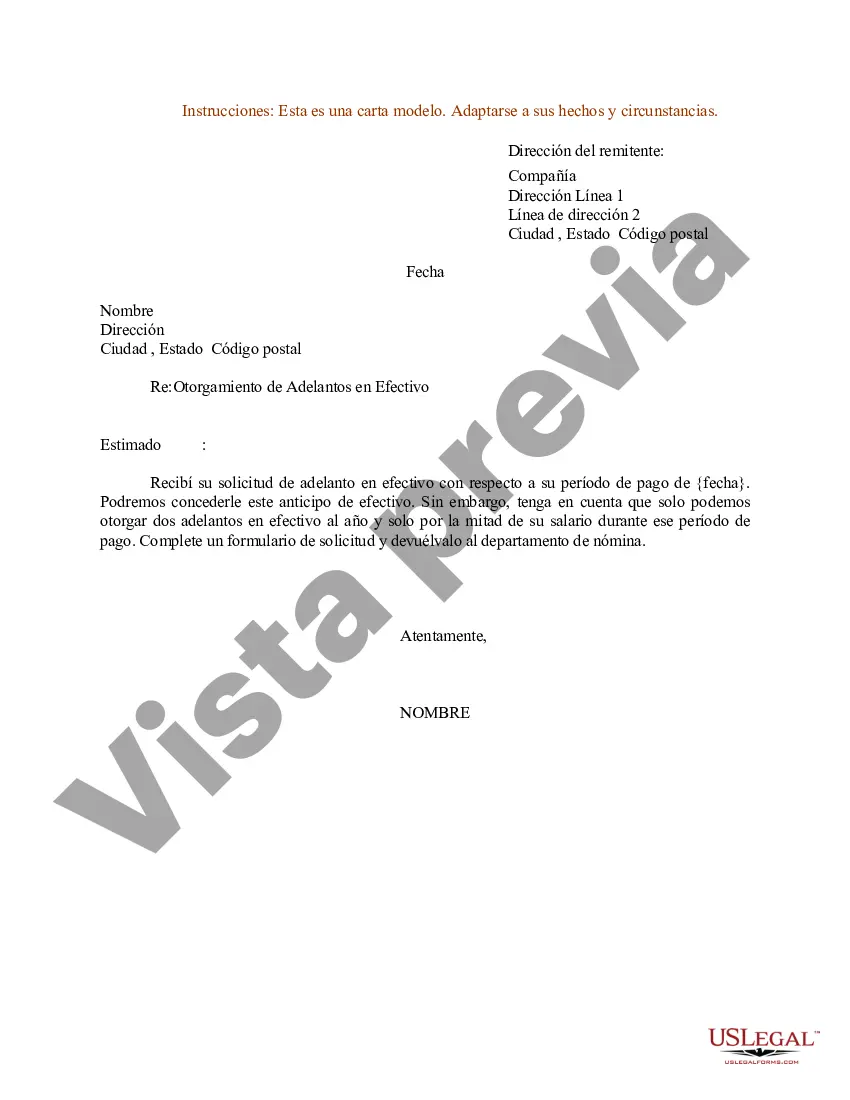

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Modelo de carta para adelantos en efectivo - Sample Letter for Cash Advances

Description

How to fill out North Carolina Modelo De Carta Para Adelantos En Efectivo?

If you want to complete, acquire, or print out legitimate file themes, use US Legal Forms, the biggest collection of legitimate varieties, that can be found on the Internet. Use the site`s basic and practical lookup to find the documents you require. A variety of themes for enterprise and individual purposes are sorted by types and claims, or key phrases. Use US Legal Forms to find the North Carolina Sample Letter for Cash Advances in a few mouse clicks.

When you are currently a US Legal Forms client, log in for your account and click the Obtain button to have the North Carolina Sample Letter for Cash Advances. Also you can accessibility varieties you in the past downloaded within the My Forms tab of the account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for your correct town/nation.

- Step 2. Use the Preview option to examine the form`s articles. Do not overlook to read through the description.

- Step 3. When you are unsatisfied together with the form, utilize the Search discipline on top of the display screen to get other versions in the legitimate form format.

- Step 4. After you have located the form you require, go through the Acquire now button. Opt for the prices prepare you favor and add your references to sign up for the account.

- Step 5. Procedure the purchase. You can utilize your bank card or PayPal account to complete the purchase.

- Step 6. Pick the format in the legitimate form and acquire it on your product.

- Step 7. Complete, edit and print out or signal the North Carolina Sample Letter for Cash Advances.

Each and every legitimate file format you get is yours permanently. You possess acces to each form you downloaded inside your acccount. Select the My Forms section and select a form to print out or acquire once more.

Remain competitive and acquire, and print out the North Carolina Sample Letter for Cash Advances with US Legal Forms. There are thousands of professional and condition-particular varieties you can use for your enterprise or individual requires.