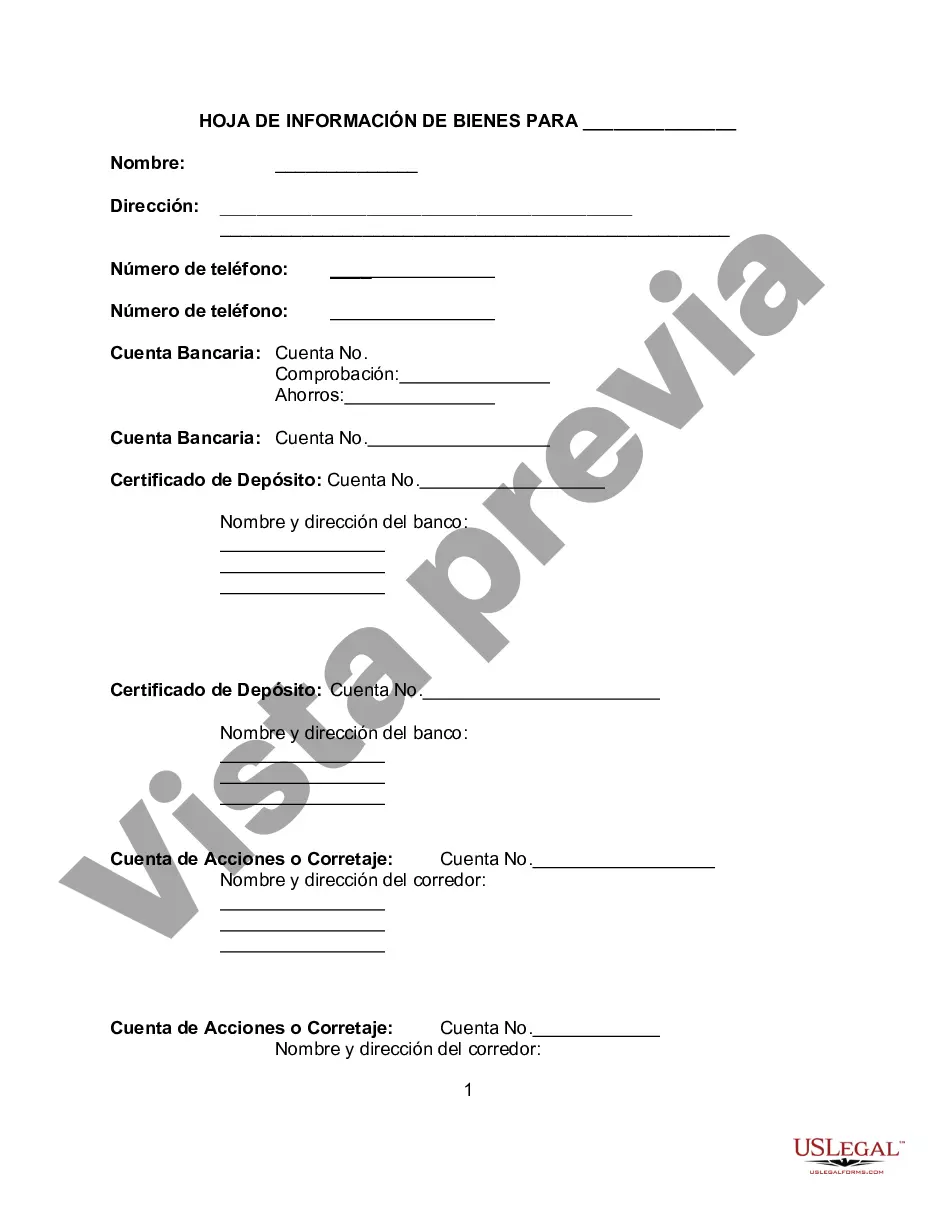

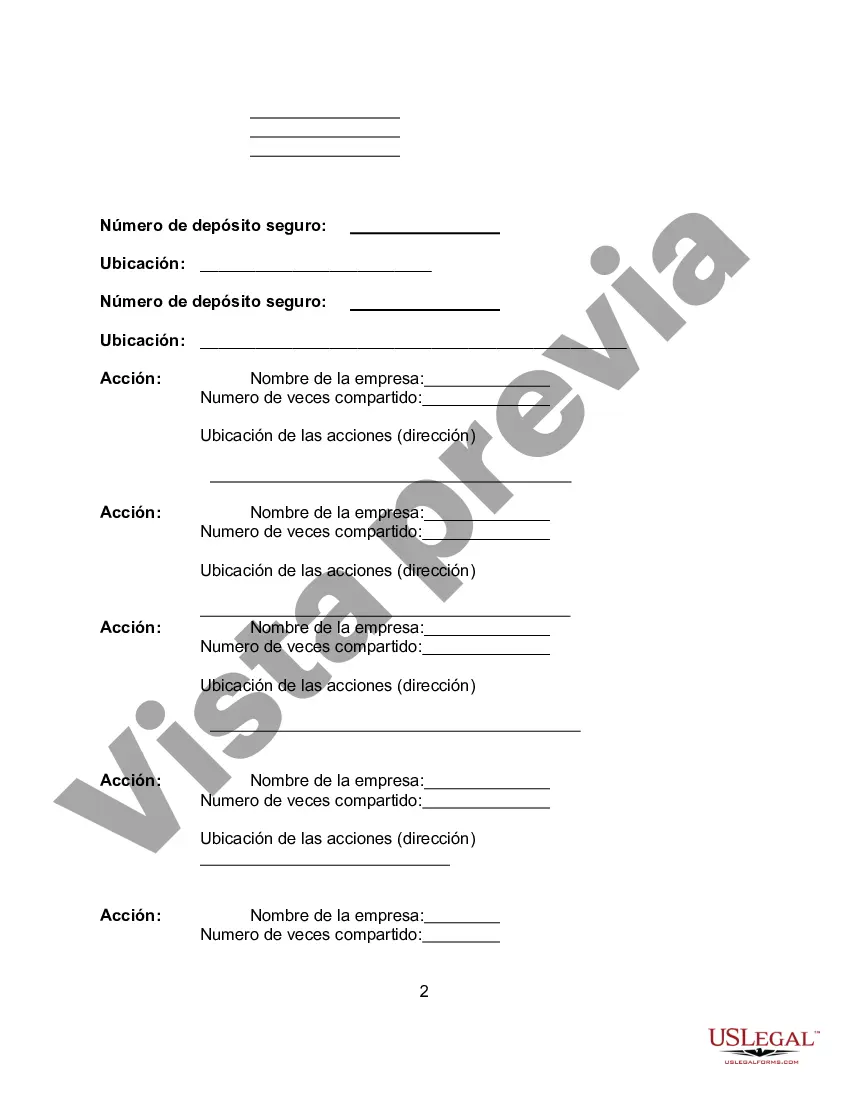

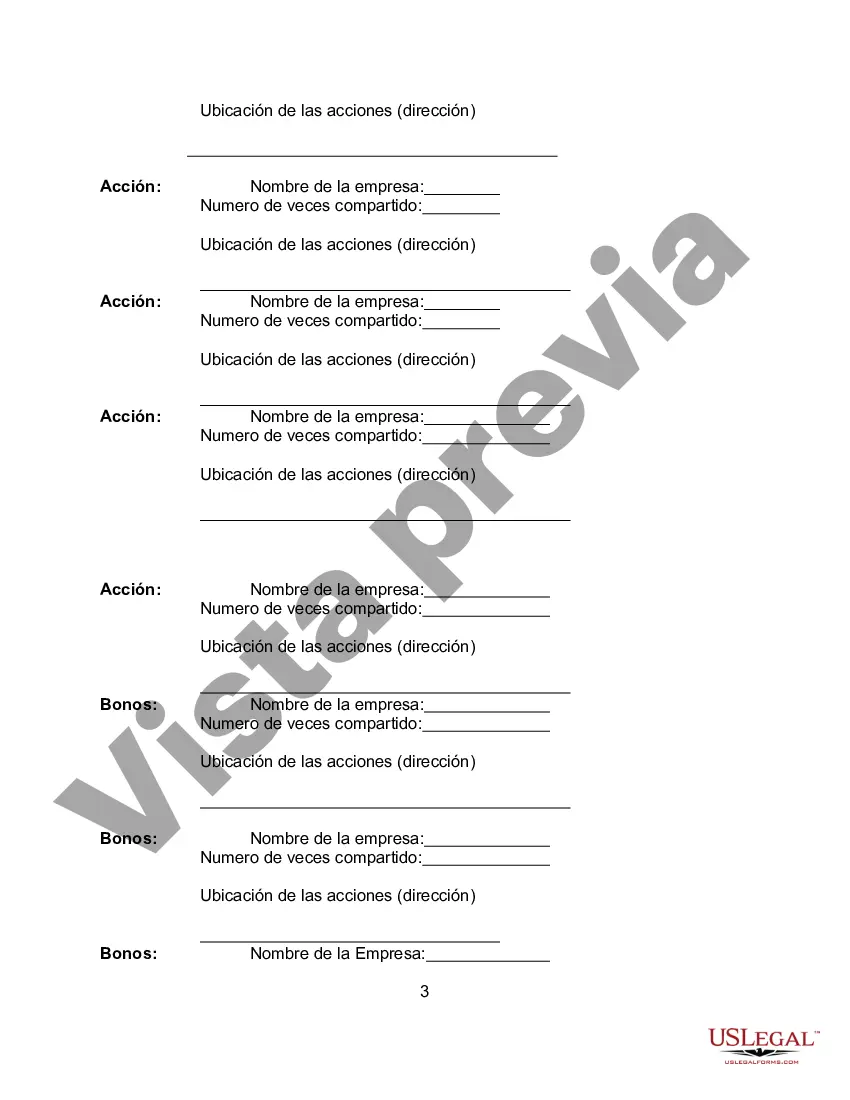

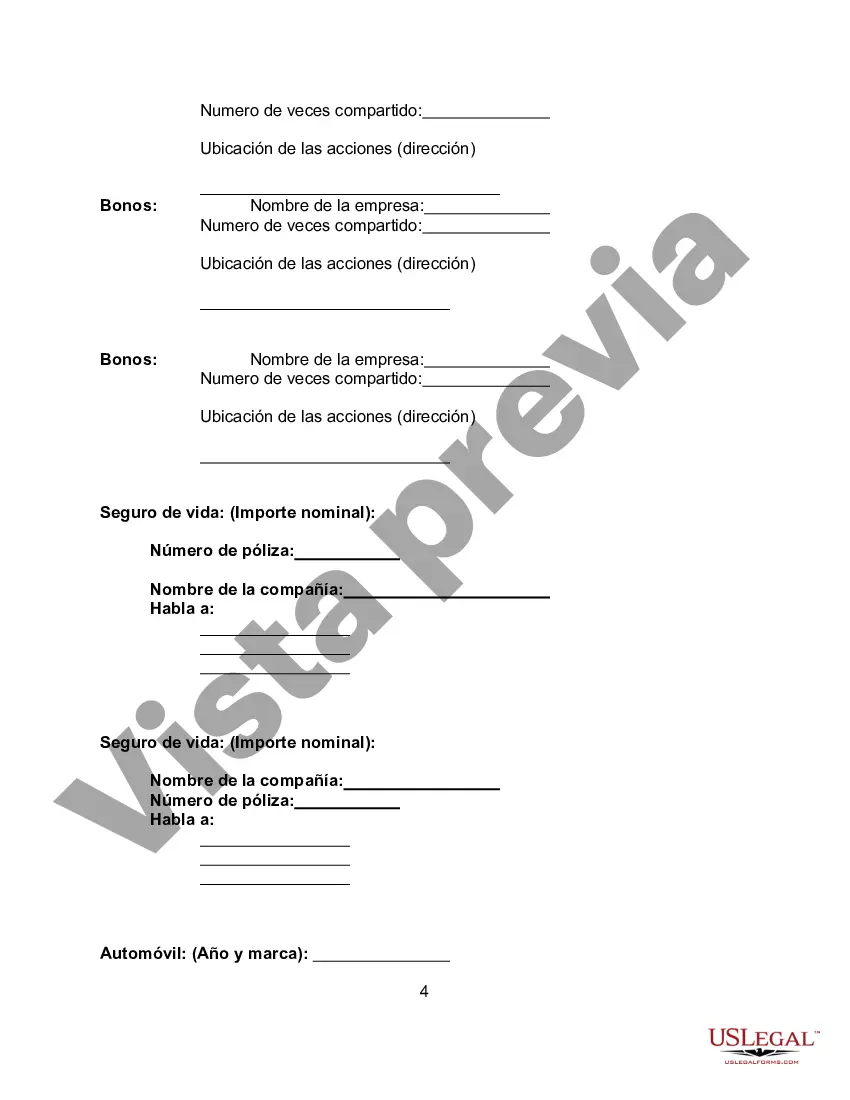

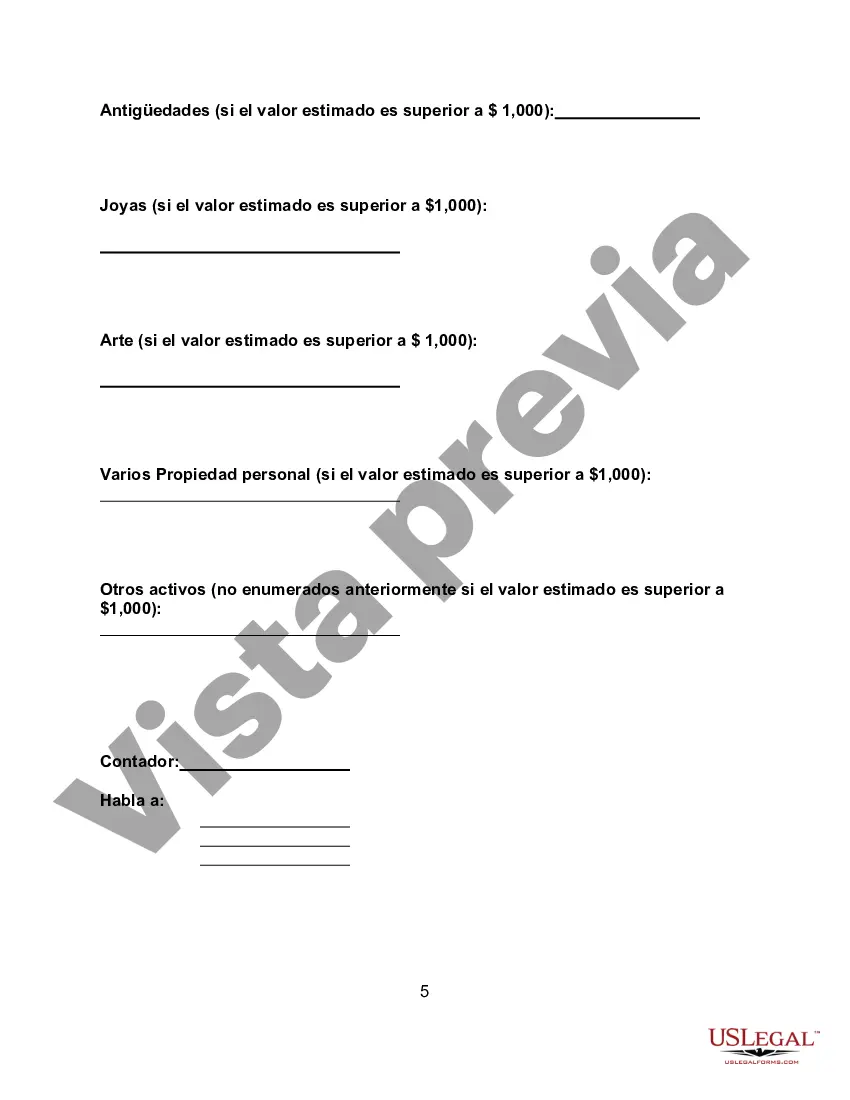

North Carolina Asset Information Sheet is a comprehensive document that provides detailed information about various assets owned or held by individuals, businesses, or organizations in the state of North Carolina. It serves as a crucial tool for organizing and managing assets, as well as for legal and financial purposes. The sheet contains relevant keywords that facilitate quick and accurate search, categorization, and analysis of assets. The North Carolina Asset Information Sheet encompasses different types of assets, each having its own specific section and details. Some different types of sheets under this category include: 1. Real Estate Asset Information Sheet: This sheet focuses on providing information related to land, buildings, and properties owned in North Carolina. It includes details such as property location, size, legal description, assessed value, market value, mortgage information, tax information, and any liens or encumbrances. 2. Financial Asset Information Sheet: This sheet primarily focuses on financial assets held in North Carolina, such as bank accounts, investment accounts, retirement plans, stocks, bonds, and other securities. It includes information about the financial institution, account numbers, types of accounts, balances, interest rates, maturity dates, and any beneficiary designations. 3. Personal Property Asset Information Sheet: This sheet covers all movable and tangible assets owned or possessed, excluding real estate. It includes assets like vehicles, boats, artwork, jewelry, furniture, electronics, and collectibles. Information provided may include descriptions, make and model, purchase price, current value, insurance coverage, and any financing arrangements. 4. Intellectual Property Asset Information Sheet: This sheet focuses on intangible assets that have value through intellectual or creative efforts, such as patents, trademarks, copyrights, and trade secrets. It includes information regarding registration, ownership, expiration, licensing agreements, and any associated revenue or royalties. 5. Business Asset Information Sheet: This sheet aims to capture assets owned by businesses or organizations operating in North Carolina. It includes assets like inventory, equipment, machinery, vehicles, fixtures, and any intangible assets specific to the business. Relevant information may include a description of assets, purchase cost, current value, depreciation, financing details, and any liens or encumbrances. The North Carolina Asset Information Sheet acts as a comprehensive snapshot of an individual's or entity's asset portfolio. It enables effective financial planning, tax reporting, estate planning, risk assessment, and asset management. Designed to be highly organized and keyword-rich, it ensures easy retrieval, analysis, and utilization of asset-related information.

North Carolina Asset Information Sheet is a comprehensive document that provides detailed information about various assets owned or held by individuals, businesses, or organizations in the state of North Carolina. It serves as a crucial tool for organizing and managing assets, as well as for legal and financial purposes. The sheet contains relevant keywords that facilitate quick and accurate search, categorization, and analysis of assets. The North Carolina Asset Information Sheet encompasses different types of assets, each having its own specific section and details. Some different types of sheets under this category include: 1. Real Estate Asset Information Sheet: This sheet focuses on providing information related to land, buildings, and properties owned in North Carolina. It includes details such as property location, size, legal description, assessed value, market value, mortgage information, tax information, and any liens or encumbrances. 2. Financial Asset Information Sheet: This sheet primarily focuses on financial assets held in North Carolina, such as bank accounts, investment accounts, retirement plans, stocks, bonds, and other securities. It includes information about the financial institution, account numbers, types of accounts, balances, interest rates, maturity dates, and any beneficiary designations. 3. Personal Property Asset Information Sheet: This sheet covers all movable and tangible assets owned or possessed, excluding real estate. It includes assets like vehicles, boats, artwork, jewelry, furniture, electronics, and collectibles. Information provided may include descriptions, make and model, purchase price, current value, insurance coverage, and any financing arrangements. 4. Intellectual Property Asset Information Sheet: This sheet focuses on intangible assets that have value through intellectual or creative efforts, such as patents, trademarks, copyrights, and trade secrets. It includes information regarding registration, ownership, expiration, licensing agreements, and any associated revenue or royalties. 5. Business Asset Information Sheet: This sheet aims to capture assets owned by businesses or organizations operating in North Carolina. It includes assets like inventory, equipment, machinery, vehicles, fixtures, and any intangible assets specific to the business. Relevant information may include a description of assets, purchase cost, current value, depreciation, financing details, and any liens or encumbrances. The North Carolina Asset Information Sheet acts as a comprehensive snapshot of an individual's or entity's asset portfolio. It enables effective financial planning, tax reporting, estate planning, risk assessment, and asset management. Designed to be highly organized and keyword-rich, it ensures easy retrieval, analysis, and utilization of asset-related information.

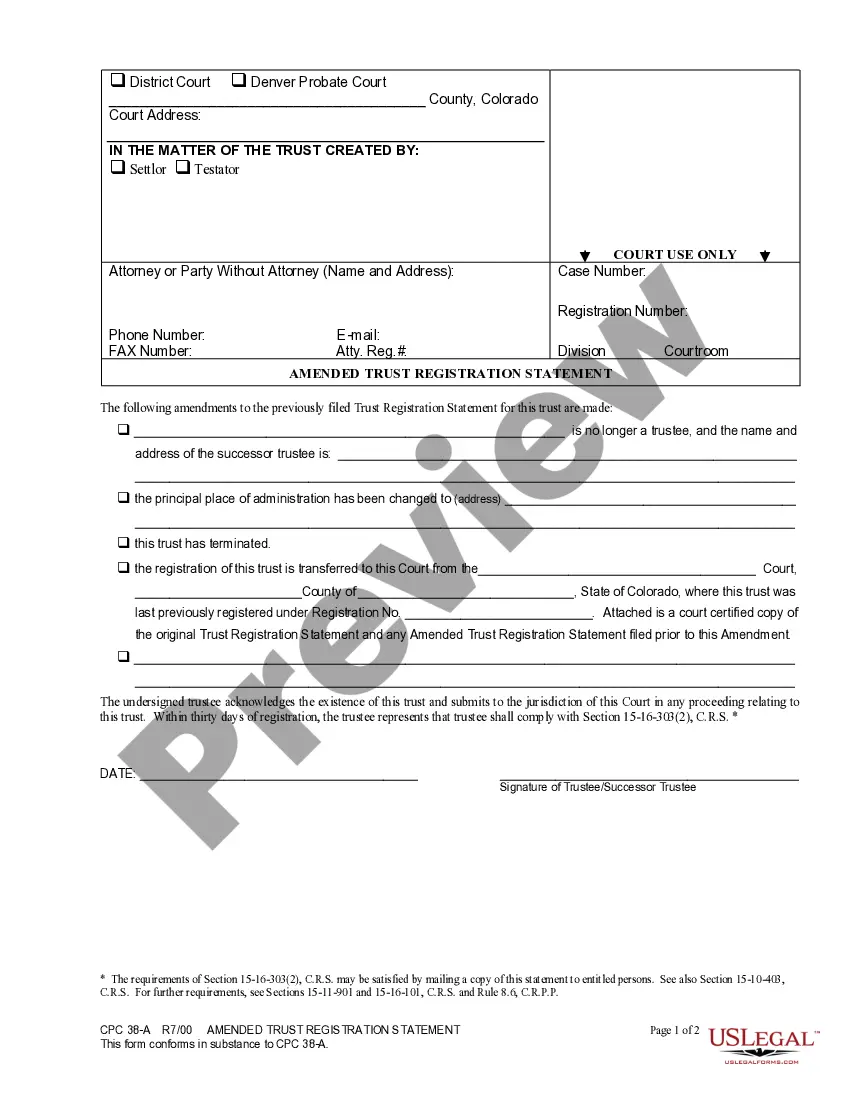

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.