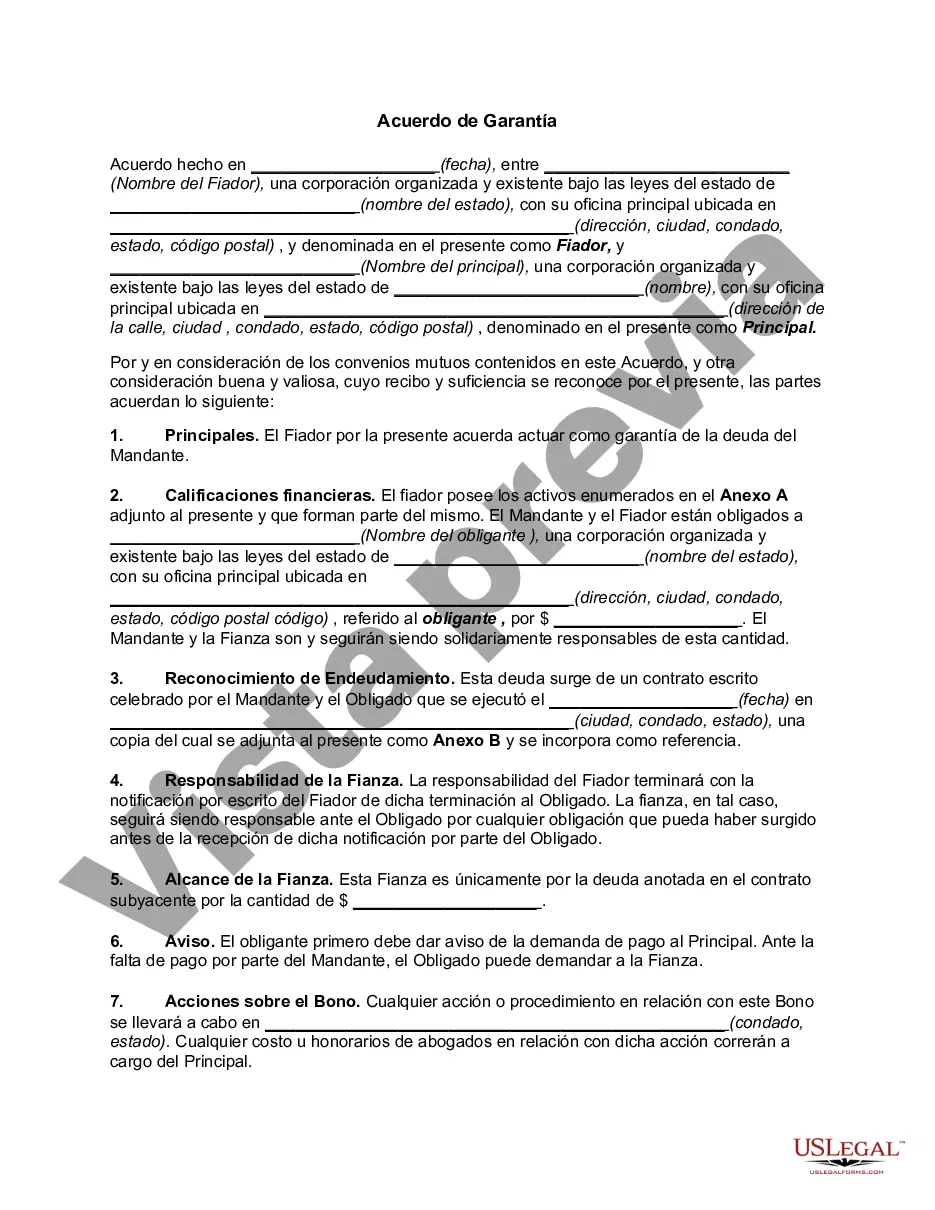

A North Carolina Surety Agreement is a legally binding contract that ensures the performance or fulfillment of obligations by one party to another. It is a type of agreement commonly used in various industries such as construction, real estate, and finance, where a third-party surety (usually an insurance company) guarantees to compensate the obliged (the party that receives the surety) in the event of a default or failure to meet contractual terms by the principal (the party undertaking the obligation). Within North Carolina, there are several types of surety agreements that serve different purposes and cater to specific needs: 1. Bid Bond: A bid bond is frequently used in the construction industry. It guarantees that the successful bidder will enter into a contract and provide the required performance and payment bonds if awarded the project. 2. Performance Bond: A performance bond ensures that the principal will complete a project according to the terms and conditions agreed upon in the underlying contract. It offers protection to the obliged against financial loss caused by the principal's failure to fulfill their obligations. 3. Payment Bond: This type of bond guarantees that the principal will compensate subcontractors, suppliers, and laborers involved in the project for their work and materials. It acts as a safeguard against non-payment and helps maintain a smooth flow of funds in the construction project. 4. License and Permit Bond: Required by certain government agencies, this bond ensures the principal will adhere to regulations and obligations associated with licenses or permits. It protects the public and helps ensure compliance with laws and regulations. 5. Court Bond: These bonds are usually required by courts for various legal proceedings, such as appeals, guardianship appointments, and fiduciary appointments. They provide financial protection in case of any financial losses resulting from the principal's actions. 6. Fidelity Bond: Primarily used by employers, fidelity bonds protect against dishonest acts committed by employees, such as theft, fraud, or embezzlement. They provide compensation for any financial losses suffered due to employee misconduct. North Carolina Surety Agreements play a vital role in promoting confidence and reducing risk in a wide range of business transactions and projects. They provide assurance that parties involved will honor their contractual commitments, and the agreed-upon penalties are payable if obligations are not met. Any business or individual seeking legal protection or mitigating risk in North Carolina should consider employing the appropriate type of surety agreement to safeguard their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Acuerdo de Garantía - Surety Agreement

Description

How to fill out North Carolina Acuerdo De Garantía?

US Legal Forms - one of several biggest libraries of legal varieties in America - gives an array of legal file layouts you may down load or print out. Utilizing the website, you will get thousands of varieties for enterprise and specific uses, sorted by groups, says, or keywords.You can find the latest models of varieties like the North Carolina Surety Agreement in seconds.

If you currently have a subscription, log in and down load North Carolina Surety Agreement in the US Legal Forms library. The Obtain key can look on each and every develop you see. You gain access to all in the past delivered electronically varieties in the My Forms tab of the account.

In order to use US Legal Forms the first time, allow me to share easy recommendations to help you started off:

- Be sure you have selected the best develop to your area/county. Click the Review key to examine the form`s content material. Browse the develop information to actually have selected the proper develop.

- In case the develop does not satisfy your specifications, use the Look for discipline towards the top of the screen to get the one which does.

- When you are pleased with the form, confirm your selection by clicking on the Acquire now key. Then, opt for the pricing program you prefer and supply your accreditations to register on an account.

- Approach the purchase. Make use of your credit card or PayPal account to finish the purchase.

- Select the file format and down load the form on the system.

- Make changes. Load, edit and print out and indication the delivered electronically North Carolina Surety Agreement.

Each and every web template you added to your money does not have an expiration day and is also yours permanently. So, if you want to down load or print out another copy, just proceed to the My Forms portion and click on on the develop you want.

Gain access to the North Carolina Surety Agreement with US Legal Forms, one of the most extensive library of legal file layouts. Use thousands of professional and condition-particular layouts that fulfill your organization or specific needs and specifications.

Form popularity

FAQ

Surety Bonds are contracts guaranteeing that specific obligations will be fulfilled. The obligation may involve meeting a contractual commitment, paying a debt or performing certain duties. Under the terms of a bond, one party becomes answerable to a third party for the acts or non-performance of a second party.

You can now apply for a surety online or via the phone. What you will need is information about yourself and your business, the type of bond that you require, and your financial information. The surety company will then review your application and determine your eligibility for a bond.

North Carolina contractors are often required to post a surety bond as a condition of a license or permit by local municipalities, counties, or the state government. Bond amounts are based on the type and volume of work performed.

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

Lottery bonds lottery retailers in North Carolina are typically required to be bonded when carrying out their services. The bond ensures that retailers will properly remit payments from the sale of lottery tickets to the required parties, and as specified in the contract.

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.

Bonds up to $5,000 are issued instantly and cost $100. Bonds up to $25,000 are also issued instantly, but the cost is calculated at a rate of $20 per $1,000 of coverage. If you need a bond larger than $25,000, your premium will be determined by an underwriter.

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

Surety bonds are typically required for contractors who seek to work on high-cost government contracts. Even when not compulsory, surety bonds make sense when a contract requires performance, because they help compensate obligees when principals fail to meet their contractual obligations.