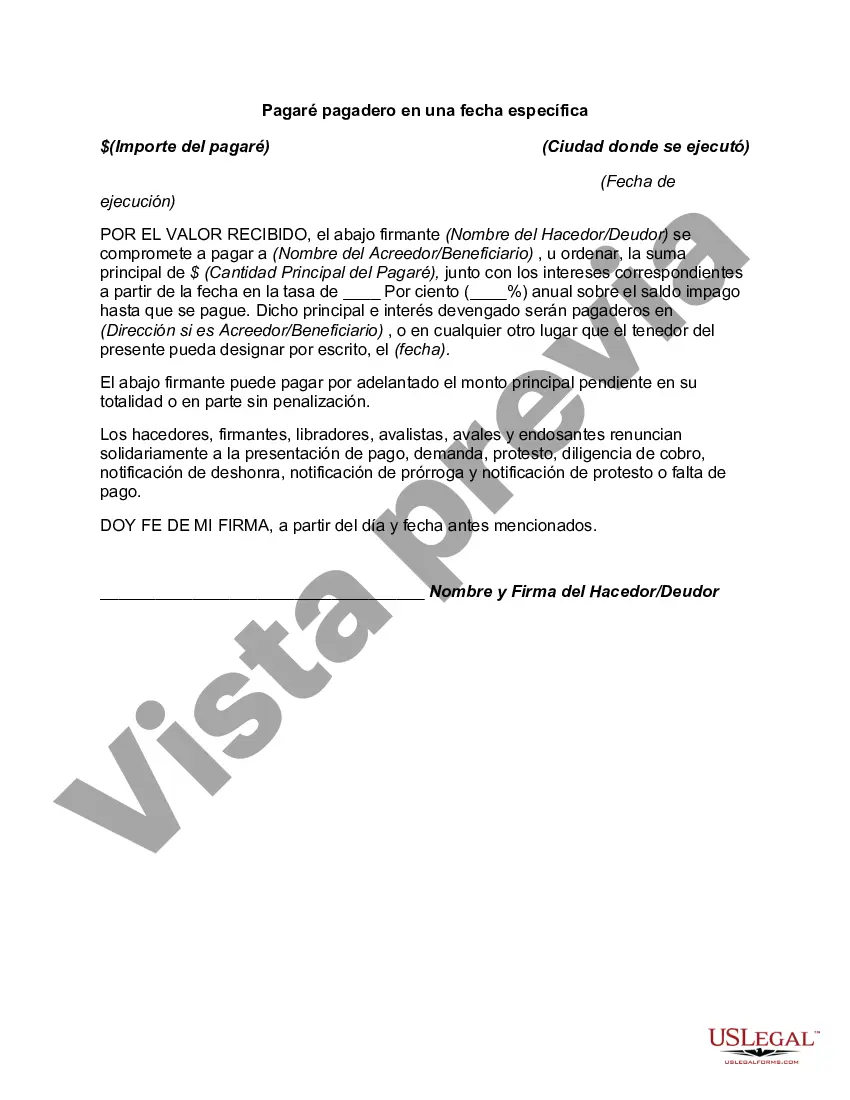

A North Carolina Promissory Note Payable on a Specific Date, also known as a promissory note or simply a note, is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of North Carolina. This type of promissory note is unique as it requires repayment of the loan on a specific date. The North Carolina Promissory Note Payable on a Specific Date typically includes the following key elements: 1. Parties involved: The note identifies the lender, who is providing the loan, and the borrower, who is receiving the loan. Both parties' legal names and contact information are mentioned. 2. Loan details: The note describes the loan amount, including any interest or fees to be paid. It highlights the purpose of the loan and how it will be used. 3. Repayment terms: This section outlines the repayment schedule, specifying the specific date when the full loan amount, including any accrued interest, must be repaid. It may also stipulate the frequency of payments, such as monthly or quarterly. 4. Interest rate and penalties: The note outlines the interest rate charged on the loan, if applicable, and any late payment penalties or fees if the borrower fails to repay the loan by the specified date. 5. Collateral and security: If the loan is secured by collateral, such as property or assets, this information will be documented in the note. It may also include provisions regarding what happens in the event of default. Different types of North Carolina Promissory Notes Payable on a Specific Date include: 1. Simple Promissory Note: This is a basic document that includes the essential terms and conditions of the loan, such as the loan amount, repayment date, and interest rate. 2. Installment Promissory Note: This type of note establishes a schedule of payments to be made over a set period, including both principal and interest, with a final payment due on a specific date. 3. Balloon Promissory Note: This note requires regular interest payments over the loan term, with a larger final payment, known as the balloon payment, due on the specified repayment date. 4. Demand Promissory Note: This type of note allows the lender to demand repayment of the loan in full at any time, after providing the borrower with a specific notice period. It is important to note that these descriptions and examples are provided as general guidance and should not be taken as legal advice. When entering into a loan agreement, it is always recommended consulting with an attorney to ensure compliance with North Carolina laws and specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out North Carolina Pagaré Pagadero En Una Fecha Específica?

Are you presently in a situation the place you need to have paperwork for possibly enterprise or individual reasons nearly every working day? There are a lot of authorized record web templates available online, but finding versions you can depend on is not effortless. US Legal Forms gives a huge number of develop web templates, such as the North Carolina Promissory Note Payable on a Specific Date, that happen to be published in order to meet state and federal demands.

In case you are already acquainted with US Legal Forms site and get your account, just log in. Afterward, you may acquire the North Carolina Promissory Note Payable on a Specific Date web template.

If you do not provide an account and wish to begin using US Legal Forms, abide by these steps:

- Obtain the develop you require and ensure it is for your correct town/state.

- Make use of the Review switch to review the form.

- Browse the description to actually have selected the correct develop.

- In case the develop is not what you`re seeking, utilize the Lookup industry to find the develop that meets your needs and demands.

- If you find the correct develop, click Acquire now.

- Choose the prices prepare you desire, fill out the specified information and facts to produce your account, and purchase an order utilizing your PayPal or charge card.

- Pick a handy data file formatting and acquire your copy.

Locate each of the record web templates you have purchased in the My Forms food selection. You can aquire a further copy of North Carolina Promissory Note Payable on a Specific Date at any time, if necessary. Just click the essential develop to acquire or printing the record web template.

Use US Legal Forms, by far the most substantial assortment of authorized varieties, in order to save time and stay away from mistakes. The service gives appropriately produced authorized record web templates that you can use for a range of reasons. Generate your account on US Legal Forms and start making your lifestyle a little easier.