The North Carolina Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a legal tool used in estate planning to provide financial security and asset protection for minors. This type of trust allows parents to set aside assets or property for their child's future while maintaining control over the distribution of those assets. The primary purpose of a Crummy Trust Agreement is to take advantage of the annual gift tax exclusion. By creating this trust, parents can utilize the gift tax exemption by making annual contributions to the trust on behalf of their child. These contributions are considered gifts, and therefore, not subject to gift taxes up to a certain amount, currently set at $15,000 per year per donor. The trust agreement is named after the landmark case of Crummy v. Commissioner, which established the legal precedent allowing the beneficiaries of such trusts to receive annual withdrawal rights. These withdrawal rights enable the beneficiaries (in this case, the child) to withdraw the gifted assets within a specific time frame, usually 30 days after the contribution is made. The Crummy Trust Agreement offers several benefits for both the child and the parents. Firstly, it provides a structured approach to managing the child's inheritance, ensuring that the assets are invested and disbursed in a controlled manner. Secondly, it enables the parents to minimize their estate taxes by spreading out the gifting over time. Thirdly, it protects the assets from potential creditors, as they are held within a separate legal entity. While the North Carolina Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a general concept, there can be variations depending on specific circumstances or preferences. Here are a few examples of potential variations or types of Crummy Trust Agreements: 1. Irrevocable Crummy Trust: This type of trust cannot be altered or revoked after its establishment, providing more certainty and asset protection. 2. Testamentary Crummy Trust: Created through a will, this trust becomes effective only upon the death of the parents, ensuring assets are distributed according to their wishes. 3. Special Needs Crummy Trust: Designed for children with special needs, this trust allows for the preservation of government benefits while providing supplemental financial support. 4. Education Crummy Trust: Focused on funding the child's education, this trust provides tax-advantaged savings for educational expenses such as tuition, books, and supplies. 5. General Crummy Trust: An all-encompassing trust that covers a wider range of purposes and can be adapted to various financial goals and family needs. These are just a few examples of the potential types of North Carolina Crummy Trust Agreements; they can be customized and tailored to meet specific objectives, ensuring the child's future financial stability and well-being while offering tax advantages and asset protection for the parents. It is essential for individuals seeking to establish a Crummy Trust to consult with a qualified estate planning attorney in North Carolina to navigate the specific legal requirements and ensure compliance with relevant laws and regulations.

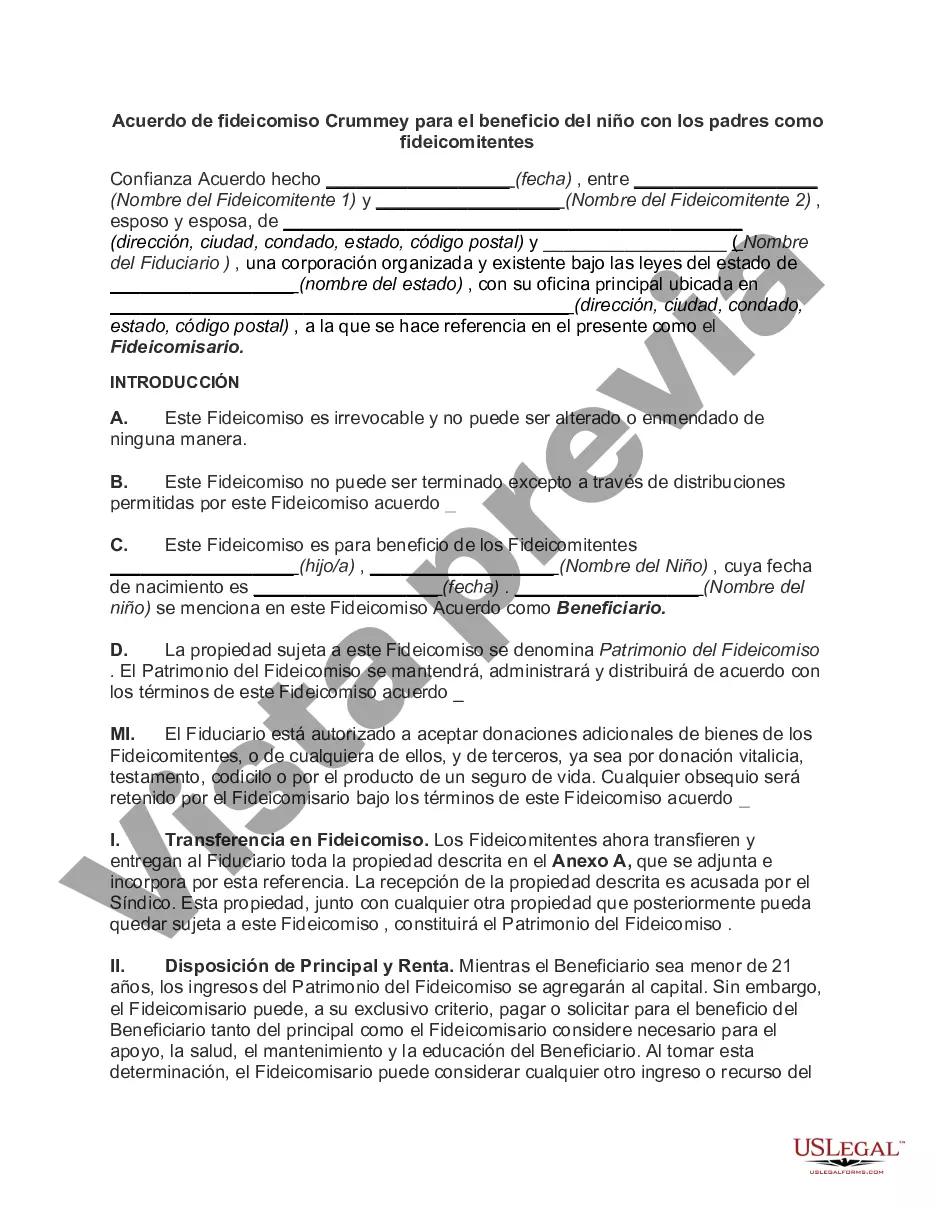

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out North Carolina Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

Are you presently in the place where you require files for sometimes organization or individual uses virtually every time? There are plenty of legal papers layouts available on the Internet, but discovering versions you can rely is not straightforward. US Legal Forms gives 1000s of form layouts, such as the North Carolina Crummey Trust Agreement for Benefit of Child with Parents as Trustors, that are created to fulfill federal and state demands.

In case you are currently familiar with US Legal Forms internet site and also have your account, just log in. Afterward, you may acquire the North Carolina Crummey Trust Agreement for Benefit of Child with Parents as Trustors format.

Should you not come with an account and want to begin to use US Legal Forms, abide by these steps:

- Get the form you need and ensure it is for that right city/area.

- Utilize the Preview option to review the shape.

- See the description to actually have chosen the correct form.

- In the event the form is not what you are searching for, utilize the Lookup industry to obtain the form that meets your requirements and demands.

- Whenever you get the right form, click on Buy now.

- Opt for the costs prepare you need, submit the required information to produce your bank account, and pay for your order with your PayPal or charge card.

- Pick a hassle-free file structure and acquire your version.

Find all the papers layouts you have bought in the My Forms food list. You can obtain a more version of North Carolina Crummey Trust Agreement for Benefit of Child with Parents as Trustors any time, if possible. Just go through the required form to acquire or print out the papers format.

Use US Legal Forms, probably the most comprehensive assortment of legal forms, to save time and steer clear of faults. The service gives appropriately made legal papers layouts which you can use for a variety of uses. Create your account on US Legal Forms and begin producing your way of life a little easier.