A North Carolina Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after a Specified Time is a legal arrangement where an individual (the trust or) transfers their assets to a trust, relinquishing ownership and control over those assets. The trust is established with the purpose of providing future financial security for the trust or while ensuring a regular stream of income during a specified period. This type of trust offers certain advantages to the trust or. Firstly, by creating an irrevocable trust, the trust or can protect their assets from potential creditors, lawsuits, or other legal claims. Additionally, the trust or can also establish a steady income source for themselves at a later point in time. There are different types of North Carolina Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, including: 1. Fixed Term Trust: This type of trust specifies a predetermined time frame in which income would be payable to the trust or. For example, a trust or might set up a trust where income is payable to them every month for the next 20 years. Once the specified time period ends, the trust assets are distributed according to the trust agreement. 2. Retirement Income Trust: This trust primarily focuses on providing income for the trust or during their retirement years. It allows the trust or to accumulate assets during their working years and then receive regular income post-retirement. The trust document outlines the terms and conditions for income distribution as well as provisions for potential beneficiaries if the trust or passes away. 3. Life Insurance Trust: In this type of trust, the trust or transfers life insurance policies to the trust. The income from the policies becomes payable to the trust or after a specified time, usually triggered by retirement. This type of trust ensures financial security for the trust or during their golden years while also providing potential tax benefits. 4. Education Trust: This type of trust is created specifically to fund educational expenses, such as college tuition, for the trust or their designated beneficiaries. Income from the trust becomes payable to the trust or after a specified time, allowing them to cover education-related costs. This trust type ensures that the trust or has the financial means to support educational goals later in life. In conclusion, a North Carolina Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after a Specified Time offers various forms of financial security and income streams to the trust or. Whether it is a fixed-term trust, retirement income trust, life insurance trust, or education trust, these legal arrangements provide the opportunity for the trust or to maintain control over their assets while receiving a steady income in the future.

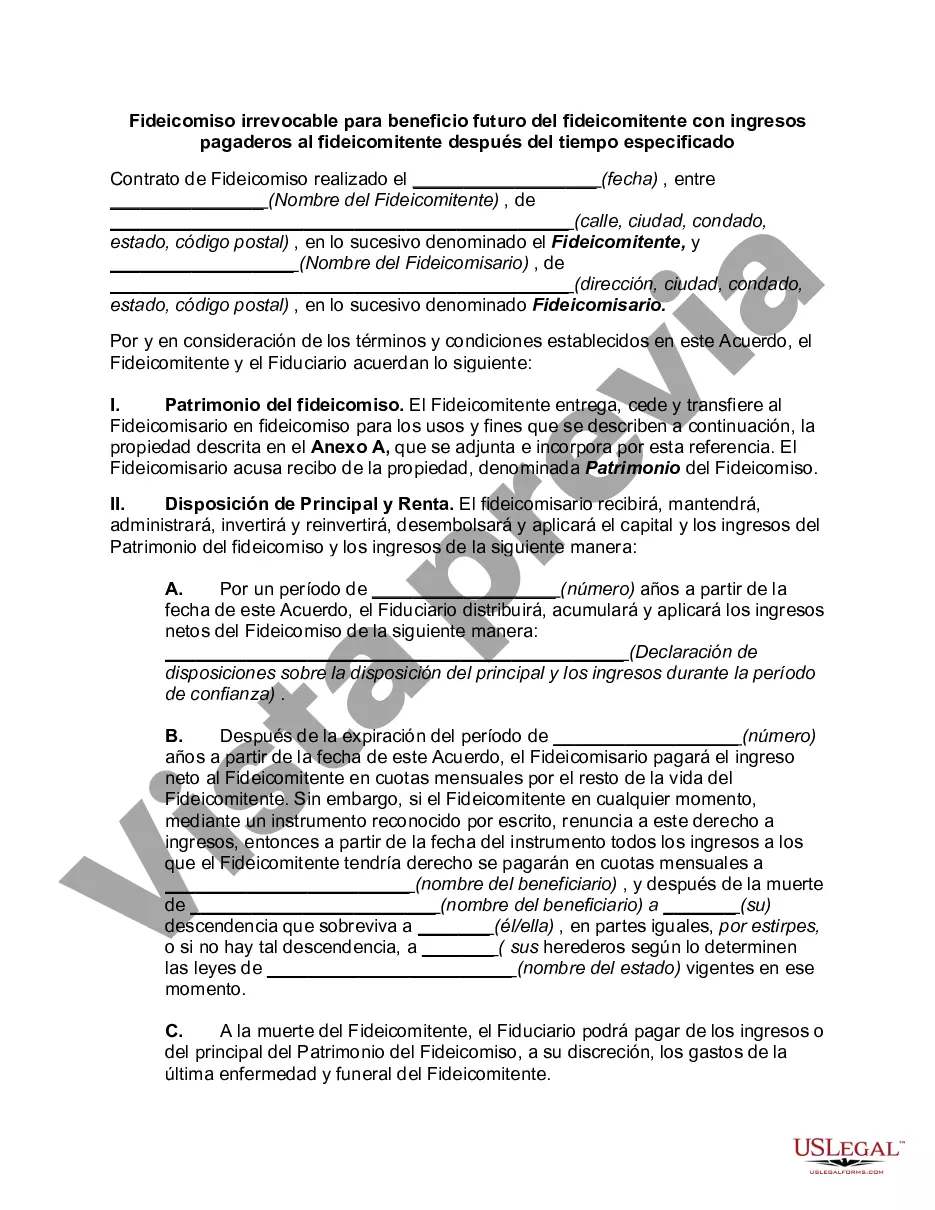

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out North Carolina Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

It is possible to invest several hours on the Internet searching for the authorized record design which fits the state and federal specifications you need. US Legal Forms provides a huge number of authorized types that are analyzed by experts. You can actually down load or printing the North Carolina Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time from the support.

If you already possess a US Legal Forms accounts, you may log in and click on the Obtain key. Afterward, you may complete, edit, printing, or signal the North Carolina Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. Each and every authorized record design you get is the one you have eternally. To get one more copy of the purchased develop, proceed to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms site the very first time, follow the simple recommendations under:

- Initially, make certain you have chosen the best record design for that county/town of your choosing. See the develop information to make sure you have selected the correct develop. If available, use the Review key to look through the record design at the same time.

- In order to locate one more version of the develop, use the Search field to discover the design that meets your requirements and specifications.

- After you have located the design you would like, simply click Acquire now to carry on.

- Select the rates strategy you would like, type in your qualifications, and register for an account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal accounts to cover the authorized develop.

- Select the formatting of the record and down load it to your system.

- Make modifications to your record if necessary. It is possible to complete, edit and signal and printing North Carolina Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Obtain and printing a huge number of record web templates utilizing the US Legal Forms web site, which offers the biggest selection of authorized types. Use expert and condition-certain web templates to deal with your organization or person requirements.