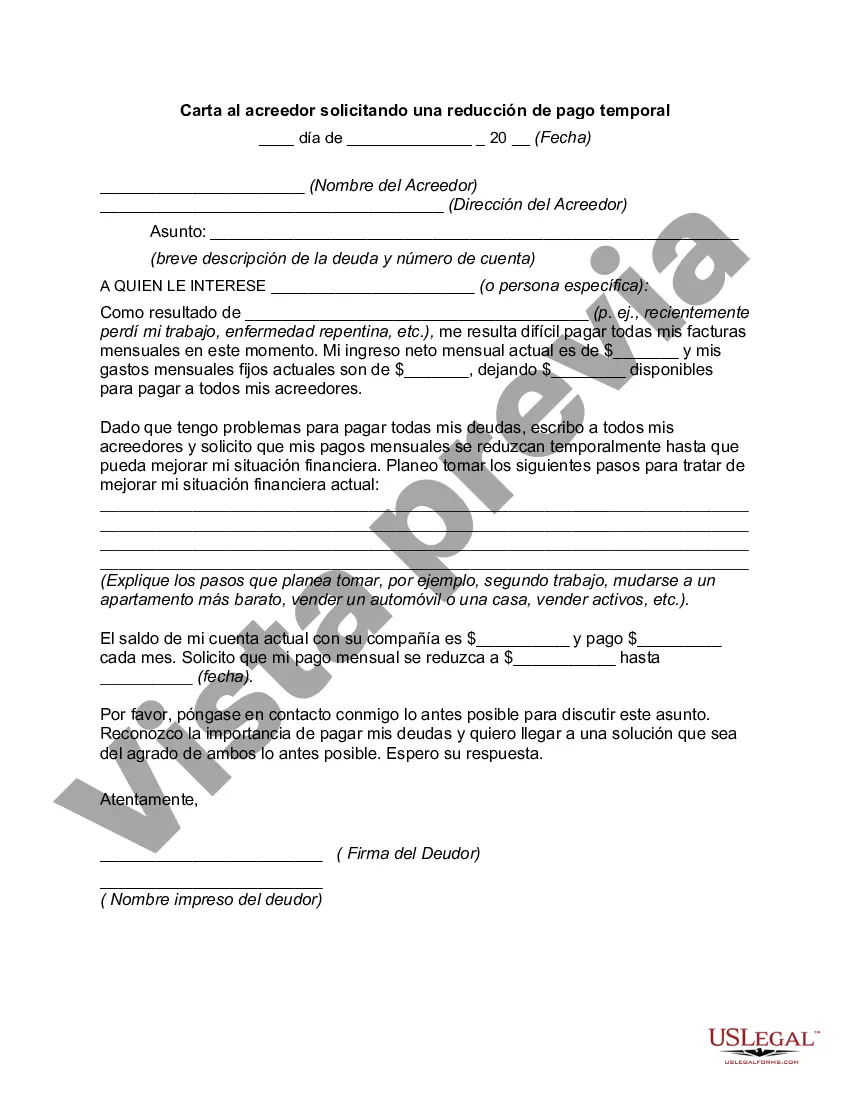

Title: North Carolina Letter to Creditor Requesting a Temporary Payment Reduction Description: A North Carolina Letter to Creditor Requesting a Temporary Payment Reduction is a comprehensive document used by individuals residing in North Carolina to request a temporary decrease in their debt repayment obligations due to financial hardships. This letter is an effective tool for negotiating with creditors, providing a detailed explanation of the debtor's current financial situation and a formal request for a reduced payment amount during a specific period. Keywords: North Carolina, letter, creditor, requesting, temporary, payment reduction, debt repayment obligations, financial hardships, negotiating, detailed explanation, formal request, reduced payment amount. Types of North Carolina Letter to Creditor Requesting a Temporary Payment Reduction: 1. North Carolina Mortgage Letter to Creditor Requesting a Temporary Payment Reduction: This specific type of letter is tailored for individuals facing financial difficulties in repaying their mortgage obligations. It addresses mortgage lenders and highlights the need for a temporary reduction in mortgage repayments to maintain financial stability. 2. North Carolina Auto Loan Letter to Creditor Requesting a Temporary Payment Reduction: This variant focuses on individuals requesting a temporary payment reduction for their auto loan obligations due to unexpected financial burdens. It addresses the auto loan creditor and formally requests a temporary decrease in monthly payments. 3. North Carolina Student Loan Letter to Creditor Requesting a Temporary Payment Reduction: Specifically designed for borrowers facing financial difficulties in repaying their student loans, this letter targets student loan creditors. It emphasizes the need for a temporary payment reduction to alleviate immediate financial stress and help borrowers stay current on their obligations. 4. North Carolina Credit Card Letter to Creditor Requesting a Temporary Payment Reduction: This type of letter aims to assist individuals experiencing financial hardships in managing credit card debt obligations. It addresses credit card companies or banks, providing a compelling case for a temporary reduction in monthly payments to prevent default and maintain financial stability. 5. North Carolina Personal Loan Letter to Creditor Requesting a Temporary Payment Reduction: Tailored for individuals struggling to meet repayment obligations for personal loans, this letter targets personal loan creditors. It presents a detailed explanation of the borrower's current financial hardship and formalizes a request for a temporary decrease in monthly payments to avoid defaulting on the loan. Remember, regardless of the specific type, it is crucial to provide accurate information and a compelling case for a temporary payment reduction, demonstrating the debtor's commitment to fulfilling their obligations while also addressing their current financial difficulties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Carta al acreedor solicitando una reducción de pago temporal - Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out North Carolina Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

US Legal Forms - among the largest libraries of authorized types in the United States - offers a variety of authorized papers web templates you can obtain or produce. Using the web site, you may get 1000s of types for organization and personal functions, sorted by types, says, or keywords.You will find the most up-to-date variations of types such as the North Carolina Letter to Creditor Requesting a Temporary Payment Reduction within minutes.

If you already have a monthly subscription, log in and obtain North Carolina Letter to Creditor Requesting a Temporary Payment Reduction through the US Legal Forms collection. The Obtain option can look on each develop you perspective. You get access to all formerly saved types inside the My Forms tab of your account.

In order to use US Legal Forms initially, here are basic guidelines to get you started off:

- Make sure you have chosen the best develop for your area/state. Click the Preview option to examine the form`s content material. Look at the develop outline to actually have chosen the appropriate develop.

- When the develop does not satisfy your demands, make use of the Lookup field towards the top of the monitor to discover the one who does.

- When you are content with the form, verify your selection by clicking on the Acquire now option. Then, select the pricing program you like and provide your credentials to register to have an account.

- Method the financial transaction. Utilize your bank card or PayPal account to perform the financial transaction.

- Select the format and obtain the form on your product.

- Make changes. Fill up, revise and produce and indication the saved North Carolina Letter to Creditor Requesting a Temporary Payment Reduction.

Every single design you included in your money does not have an expiry time and is your own for a long time. So, if you would like obtain or produce an additional version, just proceed to the My Forms segment and click on about the develop you need.

Get access to the North Carolina Letter to Creditor Requesting a Temporary Payment Reduction with US Legal Forms, by far the most substantial collection of authorized papers web templates. Use 1000s of skilled and express-specific web templates that meet up with your organization or personal requires and demands.