Title: Understanding the North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance Introduction: In North Carolina, it is vital for both lessors and lessees to understand their rights and obligations when a leased property undergoes damage covered by insurance. This article aims to provide a detailed description of the North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance. We will explore the key aspects, significance, and different types of notices that may fall under this category. Keywords: North Carolina, Notice to Lessee, Lessor, Intention, Restore, Damaged Premises, Covered by Insurance 1. What is a North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance? The North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance is a legal document that communicates the lessor's intention to restore a leased property following damage covered by the property owner's insurance policy. The notice emphasizes the lessor's intent to carry out necessary repairs or restoration work and provides key information for the lessee. 2. Key Components of a North Carolina Notice to Lessee: — Statement of Intent: The notice should explicitly state the lessor's intention to restore the damaged premises. — Nature of Damage: Include a detailed description of the type and extent of damage incurred by the premises. — Insurance Coverage: Specify that the property is covered by insurance and will be restored using those funds. — Repair Timeline: Provide an estimated timeline within which the restoration work will be conducted. — Lessee's Responsibilities: Clarify any obligations or cooperation required from the lessee during the restoration process. — Means of Communication: Include contact information or instructions for the lessee to reach out with any concerns or queries. 3. Significance of the Notice: The North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance serves several purposes: — It provides formal communication from the lessor to the lessee, ensuring transparency and clarity about property restoration plans. — It informs the lessee about the timeline for repairs, allowing them to plan accordingly. — It helps establish a record of the lessor's compliance with applicable legal requirements and insurance obligations. — It outlines the rights and responsibilities of both parties, reducing the chances of misunderstandings or disputes. 4. Types of North Carolina Notices to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance: There aren't specific "types" of notices falling under this category. However, the content may vary depending on the nature of the damage, insurance coverage, and the restoration process agreed upon between the lessor and lessee. Some scenarios that may require such notices include: — Damage due to natural disasters (e.g., hurricanes, floods, or storms) — Structural damage caused by accidents or unforeseen events — Reconstruction or renovation projects affecting leased premises Conclusion: Understanding the North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance is essential for both lessors and lessees. This notice ensures effective communication, sets expectations, and provides legal compliance during property restoration. By comprehending its purpose and components, all parties involved can work together to minimize disruption and expedite the restoration process.

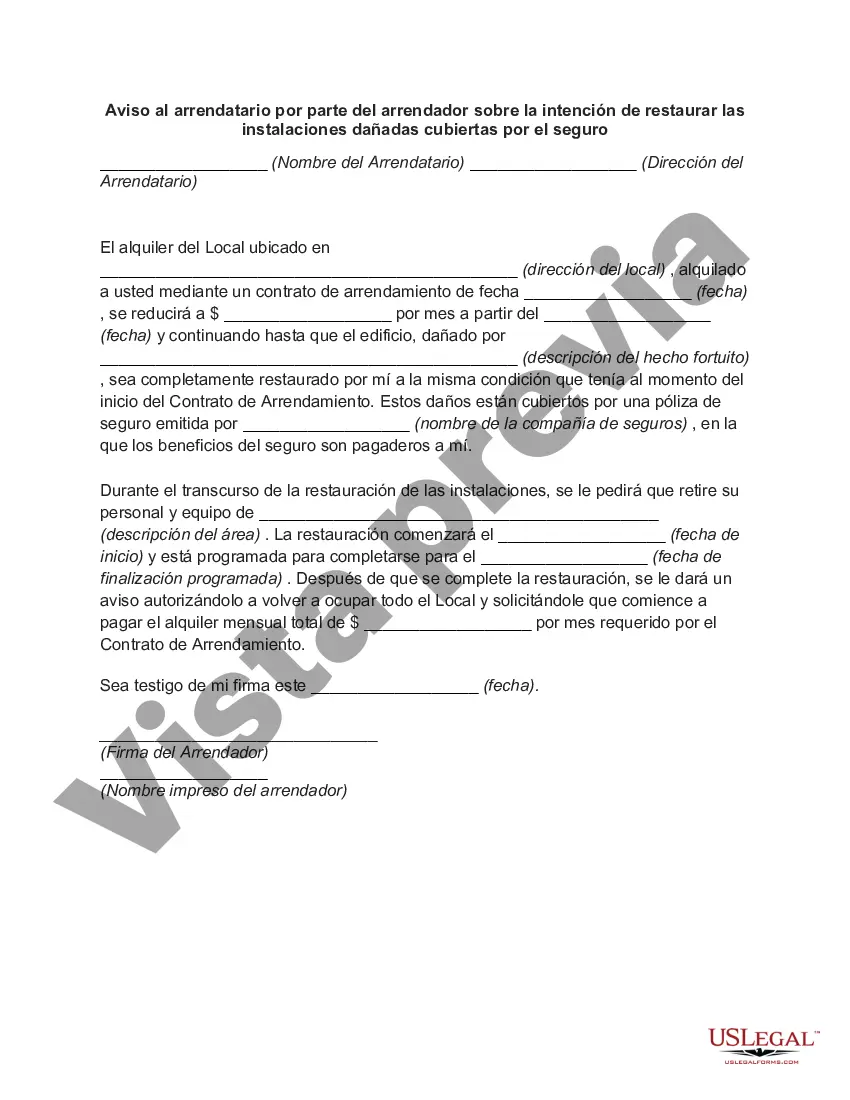

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Aviso al arrendatario por parte del arrendador sobre la intención de restaurar las instalaciones dañadas cubiertas por el seguro - Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance

Description

How to fill out North Carolina Aviso Al Arrendatario Por Parte Del Arrendador Sobre La Intención De Restaurar Las Instalaciones Dañadas Cubiertas Por El Seguro?

It is possible to devote hours on the web trying to find the authorized document design that suits the state and federal requirements you need. US Legal Forms gives a large number of authorized types which are examined by specialists. It is simple to obtain or print the North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance from my assistance.

If you have a US Legal Forms bank account, you may log in and then click the Download option. Afterward, you may comprehensive, modify, print, or signal the North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance. Each authorized document design you get is your own property eternally. To acquire another duplicate associated with a obtained develop, go to the My Forms tab and then click the related option.

Should you use the US Legal Forms site the very first time, adhere to the easy guidelines under:

- First, be sure that you have chosen the proper document design for the state/city of your choosing. See the develop information to ensure you have picked the correct develop. If available, take advantage of the Review option to search throughout the document design at the same time.

- If you wish to get another version in the develop, take advantage of the Search area to discover the design that meets your needs and requirements.

- When you have identified the design you need, just click Acquire now to continue.

- Choose the prices program you need, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your credit card or PayPal bank account to fund the authorized develop.

- Choose the structure in the document and obtain it in your system.

- Make changes in your document if needed. It is possible to comprehensive, modify and signal and print North Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance.

Download and print a large number of document templates making use of the US Legal Forms website, that offers the biggest assortment of authorized types. Use expert and condition-certain templates to take on your small business or individual requires.