North Carolina Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Agreement To Establish Committee To Wind Up Partnership?

Have you ever found yourself in a scenario where you require documents for either professional or personal purposes almost every day.

There are numerous legal document templates available on the internet, but finding ones you can trust is challenging.

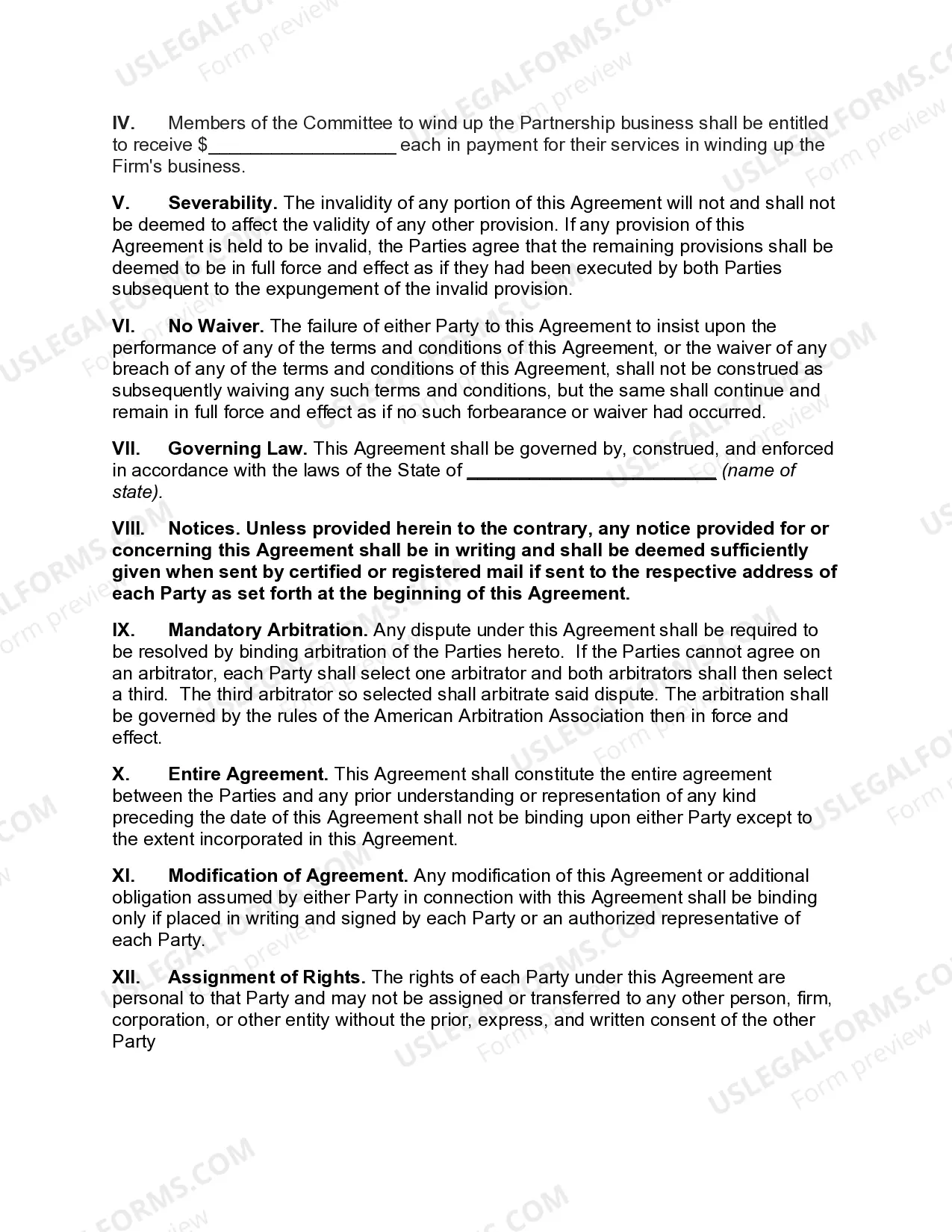

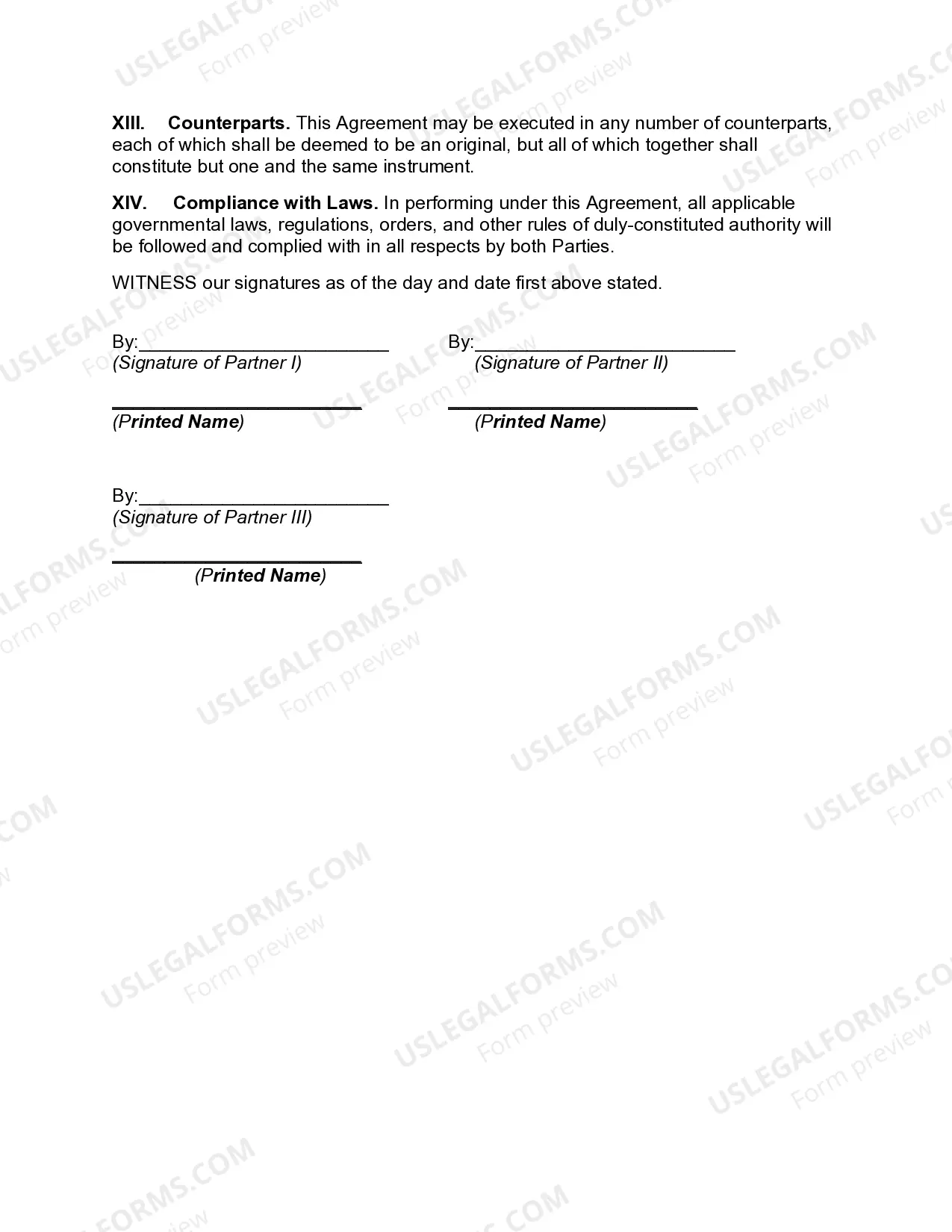

US Legal Forms provides a vast array of form templates, such as the North Carolina Agreement to Establish Committee to Wind up Partnership, designed to comply with federal and state regulations.

When you locate the correct form, click Acquire now.

Select the subscription plan you want, fill in the necessary details to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- After that, you can download the North Carolina Agreement to Establish Committee to Wind up Partnership template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct city/area.

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right document.

- If the form isn't what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Partnership Agreements and the Exit of One PartnerA partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

A partnership firm may be discontinued or dissolved in any of the following ways.Dissolution by Agreement. The easiest and the most hassle-free method to dissolve a partnership firm is by mutual consent or an agreement.Dissolution by Notice.Dissolution due to contingencies.Compulsory Dissolution.Dissolution by Court.

27. No majority of the partners can expel any partner, unless a power to do so has been conferred by express agreement between the partners.

Only partners who have not wrongfully caused dissolution or have not wrongfully dissociated may participate in winding up the partnership's affairs. State partnership statutes set the procedure to be used to wind up partnership business.

As provided under Section 40 of the Act, winding up of a partnership firm may be processed only with the consent of all the partners or in accordance with a contract between them. The partners may, by consent or by entering into an agreement, dissolve the firm and proceed for winding up of a partnership firm.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

In California, a general partnership is an association of two or more persons, acting as co-owners of a business for profit. Any partner in a partnership is free to dissociate, or leave the partnership, at any time.

A partnership can be dissolved when:An agreement between yourself and all other partners have been reached;One partner gives written notice to the other partners;The life of the partnership, according to the partnership agreement, has expired;Any partner dies or becomes bankrupt;More items...?22-Jan-2021