North Carolina Payroll Deduction — Special Services is a program designed to assist employees in conveniently managing various expenses through automated deductions from their paychecks. This service offers various benefits and options to North Carolina state employees, making it easier for them to handle specific financial obligations seamlessly. One type of North Carolina Payroll Deduction — Special Service is the Employee Benefits Deduction. This category includes deductions for health insurance premiums, retirement contributions, and other employee benefits offered by the state. Through this service, employees can have these payments automatically deducted from their paychecks, ensuring timely contributions without the hassle of manual payments. Another type of special service is the Education Assistance Deduction. North Carolina state employees can take advantage of payroll deductions to contribute towards their or their dependents' education expenses. This deduction can be used for tuition payments, textbook purchases, student loan repayments, or other eligible educational costs, allowing employees to efficiently plan and manage their educational finances. Furthermore, the North Carolina Payroll Deduction — Special Services extends to charitable donations. Employees can opt to have regular deductions from their paychecks allocated to qualified charitable organizations or initiatives of their choice. This service supports employees in giving back to their community and contributing towards social causes effortlessly. Additionally, the North Carolina Payroll Deduction — Special Services covers deductions for other specific purposes. This may include deductions for certain voluntary insurance programs, such as life insurance, disability insurance, or long-term care insurance. Employees can utilize this service to facilitate hassle-free premium payments and ensure continuous coverage. Overall, North Carolina Payroll Deduction — Special Services provides employees with a range of convenient options to manage their finances, streamline payments, and contribute towards various aspects of their lives, including benefits, education, charity, and insurance coverage. By automating these deductions, employees can focus on their work and personal lives, knowing that their financial obligations are being handled efficiently.

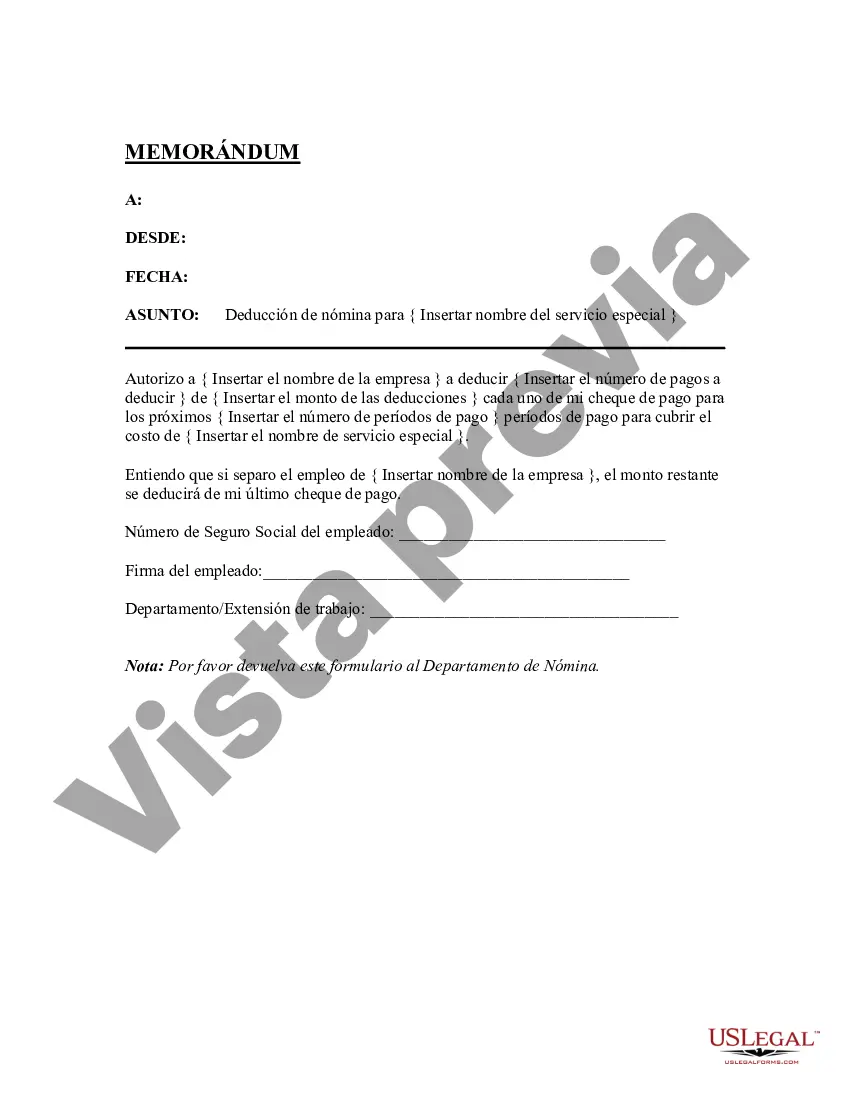

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out North Carolina Deducción De Nómina - Servicios Especiales?

Finding the right authorized record format can be a struggle. Obviously, there are tons of themes available on the net, but how will you get the authorized develop you want? Make use of the US Legal Forms website. The support delivers 1000s of themes, like the North Carolina Payroll Deduction - Special Services, that can be used for company and private requirements. All the forms are examined by professionals and meet up with federal and state specifications.

If you are previously listed, log in to your accounts and then click the Obtain key to get the North Carolina Payroll Deduction - Special Services. Make use of accounts to look from the authorized forms you may have bought previously. Proceed to the My Forms tab of the accounts and get yet another copy from the record you want.

If you are a new customer of US Legal Forms, allow me to share easy instructions for you to comply with:

- Initially, be sure you have selected the appropriate develop for your personal city/area. You are able to check out the shape utilizing the Preview key and look at the shape description to make sure this is the right one for you.

- In the event the develop fails to meet up with your preferences, take advantage of the Seach area to discover the proper develop.

- Once you are certain the shape is suitable, go through the Get now key to get the develop.

- Choose the rates strategy you need and enter in the needed information and facts. Create your accounts and pay money for the transaction with your PayPal accounts or charge card.

- Choose the data file format and obtain the authorized record format to your product.

- Complete, modify and printing and indicator the attained North Carolina Payroll Deduction - Special Services.

US Legal Forms is the most significant catalogue of authorized forms that you will find a variety of record themes. Make use of the service to obtain skillfully-manufactured papers that comply with state specifications.