North Carolina Authorization of Consumer Report: A Detailed Description The North Carolina Authorization of Consumer Report refers to a legal document that allows businesses and employers to obtain and review an individual's consumer report or background check while ensuring compliance with state and federal laws. This document provides essential authorization from the consumer, granting permission for the potential employer or business to access and evaluate their credit history, criminal records, employment history, and other related information to assess their suitability for various purposes. Keywords: North Carolina, Authorization of Consumer Report, legal document, businesses, employers, consumer report, background check, compliance, state laws, federal laws, authorization, permission, credit history, criminal records, employment history, suitability. Types of North Carolina Authorization of Consumer Reports: 1. Employment Authorization: This type of authorization is used by employers in North Carolina to conduct consumer reports on job applicants or existing employees as part of the hiring process, promotions, or job-related decisions. The report may include credit checks, criminal records, education verification, and previous employment history. 2. Tenant Screening Authorization: Landlords and property management companies in North Carolina often require tenants to provide authorization for a consumer report. This helps evaluate potential tenants' creditworthiness, criminal history, eviction records, and previous rental history to ensure the safety and financial integrity of their property. 3. Financial Services Authorization: Financial institutions, such as lenders and banks, may request an individual's authorization to access their consumer report before approving loans, mortgages, or credit applications. This type of authorization allows them to review the potential borrower's credit score, payment history, outstanding debts, and other financial aspects to assess their risk level and eligibility for financial services. 4. Insurance Coverage Authorization: Insurance companies in North Carolina may seek authorization from consumers to obtain a consumer report to determine their insurance premiums, eligibility for coverage, or assess claim risks. This report can include credit checks, driving records, previous insurance claims, and other factors relevant to the insurance application or coverage renewal process. 5. Voluntary Consumer Report Authorization: In certain cases, individuals may provide a voluntary authorization to allow businesses or organizations to access their consumer report. This could be for personal reasons such as applying for memberships, subscriptions, or other custom services that require an assessment of the individual's background, credit, or other relevant information. In summary, the North Carolina Authorization of Consumer Report is a crucial legal document that provides individuals' consent for businesses, employers, landlords, and other entities to access and evaluate their consumer reports or background checks. With various types of authorizations available, it allows different sectors to make informed decisions while complying with state and federal regulations.

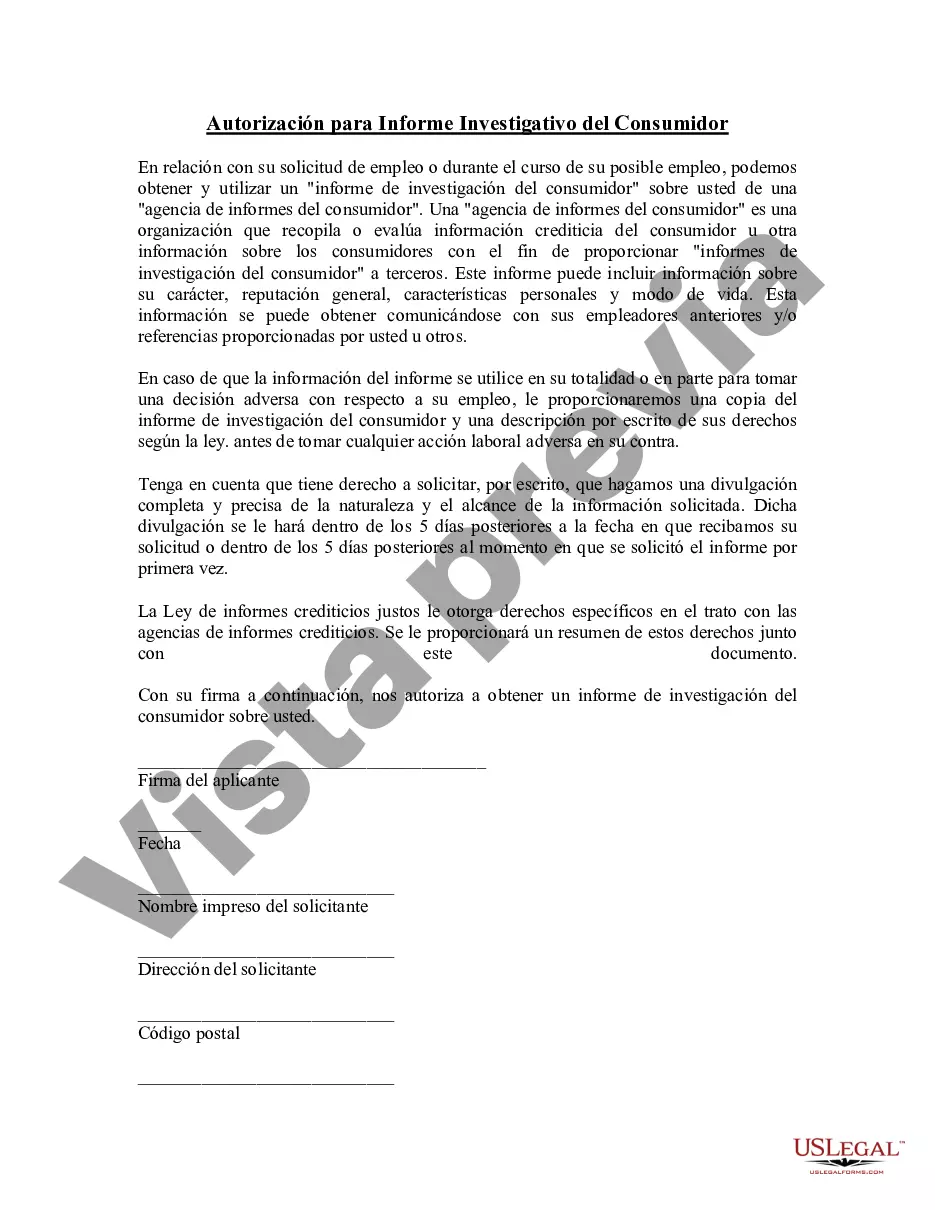

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Autorización de Informe del Consumidor - Authorization of Consumer Report

Description

How to fill out North Carolina Autorización De Informe Del Consumidor?

If you wish to total, down load, or printing authorized record layouts, use US Legal Forms, the greatest collection of authorized forms, that can be found on the Internet. Utilize the site`s simple and handy search to get the files you want. Various layouts for company and individual functions are categorized by categories and says, or key phrases. Use US Legal Forms to get the North Carolina Authorization of Consumer Report with a handful of click throughs.

In case you are currently a US Legal Forms customer, log in in your profile and then click the Obtain key to find the North Carolina Authorization of Consumer Report. You can also entry forms you formerly acquired in the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for the appropriate area/nation.

- Step 2. Utilize the Preview option to check out the form`s articles. Don`t forget to read through the outline.

- Step 3. In case you are unhappy using the form, make use of the Research industry on top of the display screen to locate other types of your authorized form template.

- Step 4. After you have located the shape you want, click the Purchase now key. Opt for the rates prepare you prefer and add your accreditations to sign up to have an profile.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Choose the formatting of your authorized form and down load it on your own system.

- Step 7. Total, revise and printing or signal the North Carolina Authorization of Consumer Report.

Every authorized record template you buy is yours permanently. You may have acces to each form you acquired in your acccount. Select the My Forms segment and select a form to printing or down load once more.

Remain competitive and down load, and printing the North Carolina Authorization of Consumer Report with US Legal Forms. There are thousands of expert and condition-distinct forms you may use for the company or individual requirements.