This office lease form is a more detailed, more complicated subordination provision stating that subordination is conditioned on the landlord providing the tenant with a satisfactory non-disturbance agreement.

North Carolina Detailed Subordination Provision

Description

How to fill out Detailed Subordination Provision?

Have you been within a position in which you need to have documents for either enterprise or person functions nearly every time? There are plenty of authorized papers themes available on the net, but getting versions you can depend on is not effortless. US Legal Forms gives a large number of type themes, such as the North Carolina Detailed Subordination Provision, that are published in order to meet state and federal needs.

If you are previously informed about US Legal Forms web site and possess an account, just log in. Afterward, you can acquire the North Carolina Detailed Subordination Provision web template.

If you do not come with an bank account and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for your proper area/county.

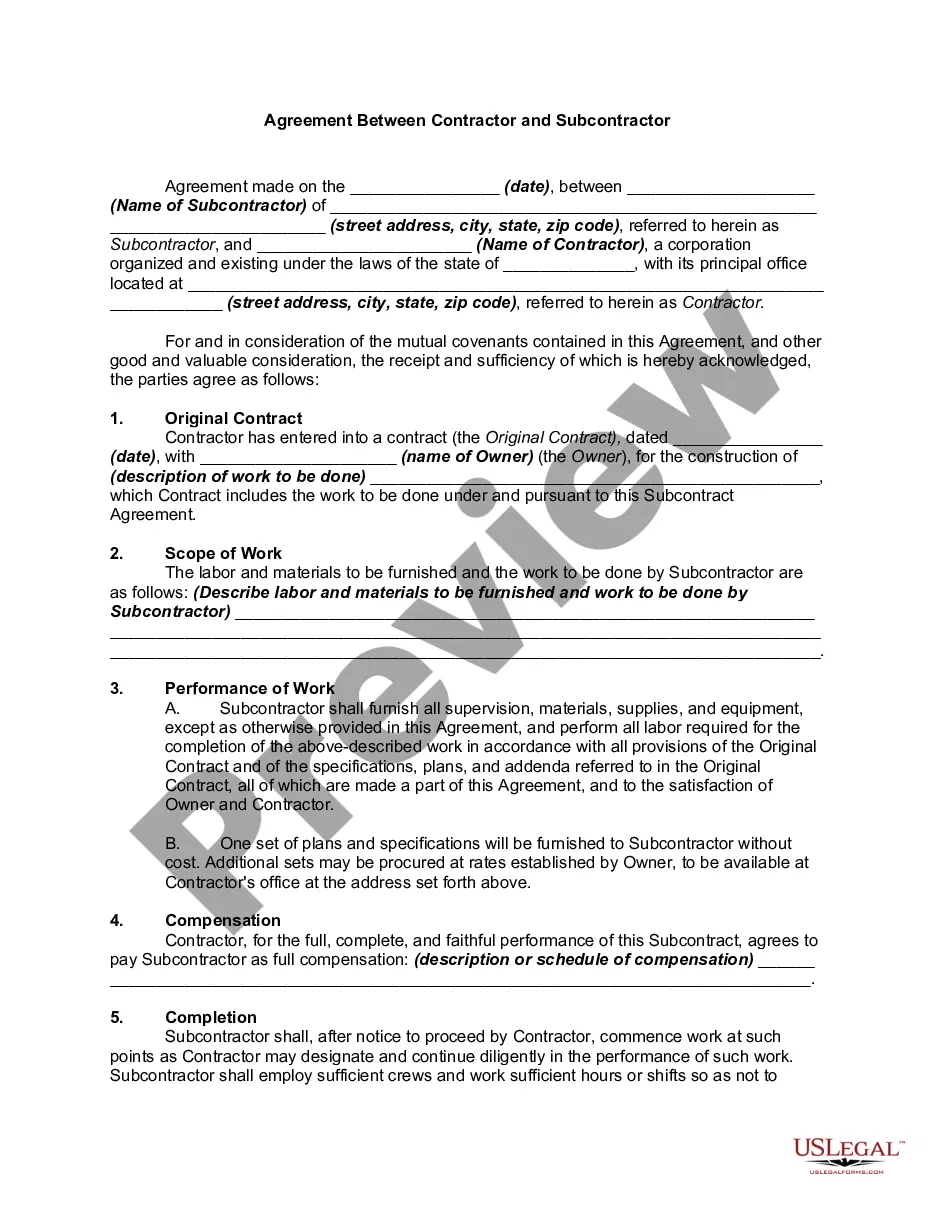

- Use the Review button to review the form.

- See the explanation to ensure that you have selected the right type.

- If the type is not what you are seeking, utilize the Research industry to find the type that meets your needs and needs.

- Once you find the proper type, simply click Purchase now.

- Pick the prices program you need, complete the necessary information and facts to create your money, and purchase the transaction using your PayPal or charge card.

- Decide on a handy file formatting and acquire your backup.

Find each of the papers themes you may have bought in the My Forms food selection. You can obtain a additional backup of North Carolina Detailed Subordination Provision at any time, if required. Just click on the essential type to acquire or print out the papers web template.

Use US Legal Forms, the most comprehensive collection of authorized kinds, to save lots of efforts and avoid errors. The support gives appropriately manufactured authorized papers themes which can be used for an array of functions. Create an account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

A Subordination Agreement focuses on creditor priorities and security claims, providing legal certainty to creditors when assessing repayment risk. If a credit event (or default) occurs, a subordination agreement provides a senior lender superior repayment rights than the subordinated lender.

Subordination Agreement: An agreement by the holder of an encumbrance against real property to permit that claim to take an inferior position to other encumbrances against the property.

A subordination agreement adjusts the priority of mortgages. It moves a refinance loan up to the front of the line. A "subordination agreement" is a contract to prioritize one debt over another for repayment. The agreement establishes that one party's claim is superior to another party's interest.

Subordination is the process whereby one party is allowed to have a higher priority in potentially competing claims. Thus, the title insurance company and/or bank want to be ahead of any other potential claimant who has provided labor and/or materials.

A (In a typical subordination agreement, the senior lien holder agrees to subordinate or lower its lien position in favor of the junior lien. This agreement must be signed by both lien holders and recorded.)

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future. Subordination is the act of yielding priority.

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

So, if a seller sells the property, the lender would call that seller's loan due and payable and the buyer would have to obtain their own, brand new loan. A subordination clause is where a first and second mortgage will switch places. In other words, the first becomes a second, a second becomes a first.