North Dakota Sample Letter for Agreement to Compromise Debt

Description

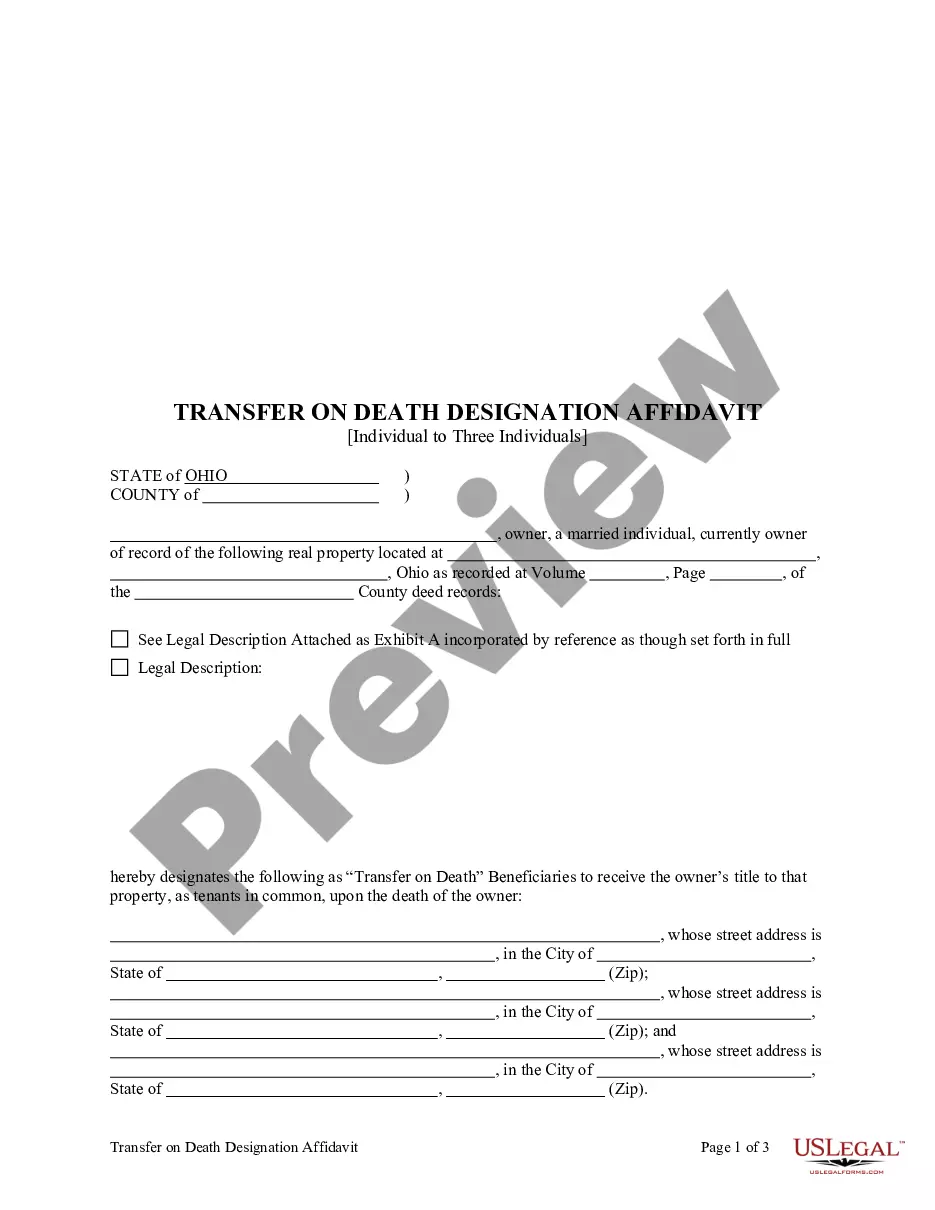

How to fill out Sample Letter For Agreement To Compromise Debt?

You can invest hours online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the North Dakota Sample Letter for Agreement to Compromise Debt from my service.

If available, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the North Dakota Sample Letter for Agreement to Compromise Debt.

- Every legal document template you acquire is yours permanently.

- To obtain another version of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the location/city of your preference.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

When writing a letter to get out of debt, clearly state your current financial situation and propose a plan for repayment or settlement. Be honest about your circumstances and express your commitment to resolving the debt. Including a request for negotiation can show your willingness to find a workable solution. Using a North Dakota Sample Letter for Agreement to Compromise Debt can help you format your proposal effectively.

To write a letter requesting proof of debt, start with your information and the creditor’s details. Politely request a verification that includes the original documentation supporting the debt. Be clear about your intent and provide a deadline for their response. You may find value in using a North Dakota Sample Letter for Agreement to Compromise Debt to guide your writing.

You can ask for verification of debt by sending a formal letter to your creditor. Clearly state your request for a detailed validation of the debt, including the original creditor’s name and amount owed. It is advisable to be concise and specific in your request. Referencing a North Dakota Sample Letter for Agreement to Compromise Debt could enhance your request and make it more effective.

To write a proof of debt letter, start by clearly identifying the debtor and the amount owed. Include relevant details, such as the account number and any agreements made. It's essential to maintain a professional tone, and provide a request for validation or detailed breakdown of the debt. Utilizing a North Dakota Sample Letter for Agreement to Compromise Debt can help you structure your letter appropriately.

A debt agreement can be a wise decision if you face financial difficulties but want to avoid bankruptcy. It allows you to negotiate reduced payments that can help you regain your financial footing. Using resources like the North Dakota Sample Letter for Agreement to Compromise Debt can facilitate this process, helping ensure a smoother negotiation with creditors.

Generally, offering between 30% and 50% of your total debt is a good starting point for negotiating a settlement. However, the accepted percentage may vary based on the creditor's policies and your financial situation. By utilizing the North Dakota Sample Letter for Agreement to Compromise Debt, you can structure your offer effectively, increasing the chances of acceptance.

To write a debt agreement, start by identifying the parties involved and specifying the amount of the debt. Include the payment terms and any conditions required for the settlement. For a clearer perspective, use the North Dakota Sample Letter for Agreement to Compromise Debt, which will guide you in drafting a well-organized and legally sound document.

The 777 rule suggests that consumers should aim to settle a debt for around 30% to 50% of what they owe. This rule implies that the higher your settlement offer is, the more likely creditors will accept it. Understanding this rule can help you when negotiating your own debt settlements, like those noted in the North Dakota Sample Letter for Agreement to Compromise Debt.

Writing a debt settlement agreement involves outlining the terms of the settlement clearly. Begin by stating both parties' names, the total debt amount, and the agreed settlement amount. To ensure you're on the right track, refer to the North Dakota Sample Letter for Agreement to Compromise Debt, which provides a structured format that can help streamline the process.

To fill out a debt validation letter, start by including your name, address, and the date at the top. Next, add the creditors' name and address, then clearly state your request for validation of the debt. You can use the North Dakota Sample Letter for Agreement to Compromise Debt as a guide to ensure you include all necessary details and maintain a professional tone.