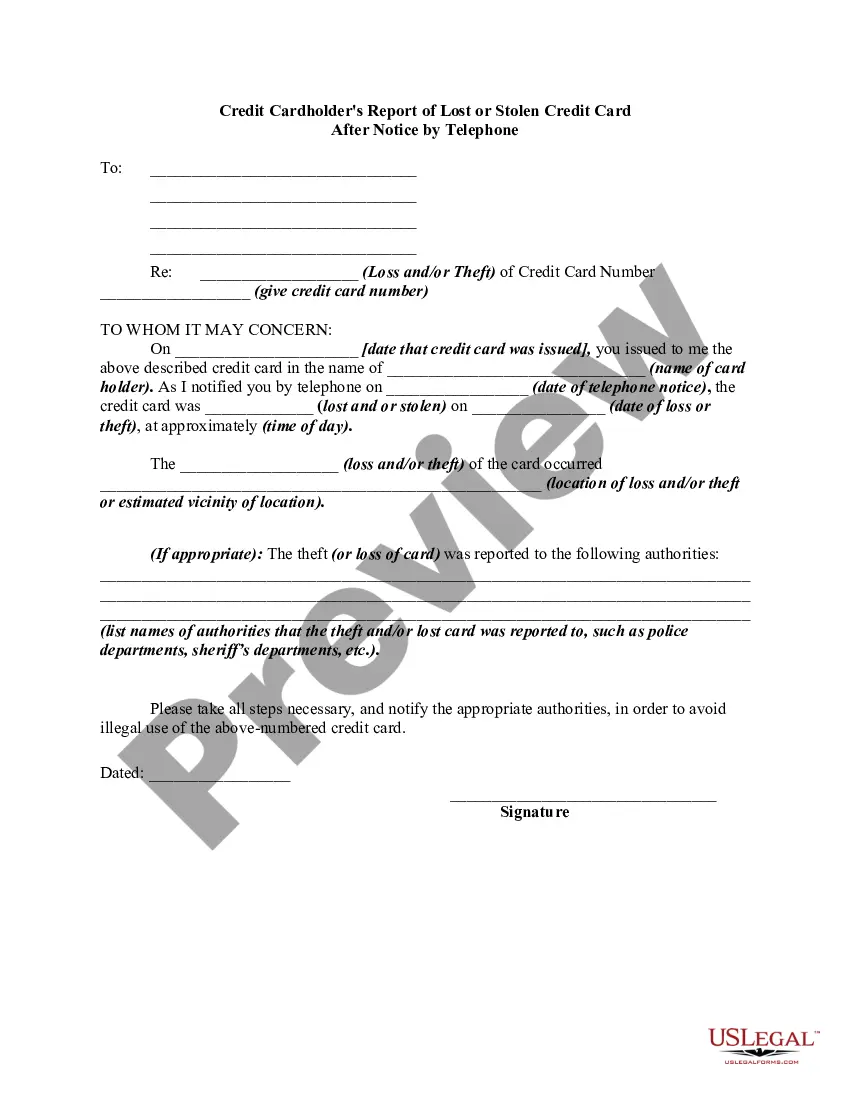

Title: North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone — A Comprehensive Guide Introduction: The North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is a crucial process that allows credit cardholders in North Dakota to promptly take action and mitigate any potential fraud or unauthorized transactions. This report ensures that individuals can report their lost or stolen credit cards conveniently over the phone, providing an efficient means of communication with credit card issuers. In this article, we will delve into the details of the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, including various types and key aspects. Types of North Dakota Credit Cardholder's Reports: 1. Standard North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone: — Traditional reporting procedure for credit cardholders in North Dakota. — Initiated by contacting the designated credit card issuer's hotline or customer service number. — Involves providing necessary information to verify the cardholder's identity and report the loss or theft. 2. Emergency North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone: — A specialized report for situations requiring immediate attention due to potential fraudulent activity or unauthorized transactions. — Allows cardholders to reach out to the credit card issuer's emergency hotline or dedicated customer support helpline for expedited assistance. — Typically involves enhanced security checks and rapid actions to mitigate risks and protect the cardholder's finances. Key Elements of the North Dakota Credit Cardholder's Report: 1. Telephone Notice: — The primary mode of reporting a lost or stolen credit card is via telephone. — Cardholders are required to call the credit card issuer's designated hotline or customer service number promptly. — Quick notification ensures the card issuer can take immediate action to protect against unauthorized usage. 2. Identity Verification: — Upon calling, cardholders will need to provide personal information to verify their identity. — Information may include name, address, social security number, and any other identification details requested by the credit card issuer. 3. Lost or Stolen Card Details: — Cardholders must provide specific details regarding the lost or stolen credit card. — This includes the credit card number, expiration date, and any other relevant information to help identify the account. 4. Reporting Timeframe: — The Credit Cardholder's Report must be made as soon as the cardholder becomes aware of the loss or theft. — Timely reporting helps limit potential liability for unauthorized transactions. 5. Follow-up Actions: — After reporting, cardholders should follow any instructions provided by the credit card issuer. — This may involve filing a written report, signing affidavits, or cooperating with further investigations to eliminate fraudulent activity. Conclusion: Timely reporting of a lost or stolen credit card through the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is vital for protecting the financial security of cardholders. By promptly contacting the credit card issuer and providing the required details, individuals can reduce the risk of unauthorized transactions and fraudulent activity. Remember, immediate action and adherence to the credit card issuer's instructions are crucial to rectify the situation and safeguard against financial losses.

North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

How to fill out North Dakota Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

You may invest hours on the web attempting to find the authorized document template that suits the state and federal requirements you want. US Legal Forms offers a huge number of authorized kinds which are examined by experts. It is possible to acquire or produce the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone from our services.

If you currently have a US Legal Forms accounts, it is possible to log in and click on the Obtain option. After that, it is possible to total, revise, produce, or indication the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone. Each and every authorized document template you purchase is your own property eternally. To have an additional copy of the acquired kind, go to the My Forms tab and click on the related option.

If you work with the US Legal Forms web site for the first time, adhere to the easy guidelines listed below:

- Initially, ensure that you have chosen the proper document template to the county/area that you pick. See the kind information to ensure you have chosen the right kind. If available, use the Review option to appear with the document template also.

- If you would like get an additional variation of the kind, use the Research field to discover the template that meets your needs and requirements.

- After you have located the template you want, click Acquire now to proceed.

- Select the prices strategy you want, type your credentials, and register for an account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal accounts to pay for the authorized kind.

- Select the formatting of the document and acquire it for your product.

- Make modifications for your document if necessary. You may total, revise and indication and produce North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone.

Obtain and produce a huge number of document layouts using the US Legal Forms site, that offers the most important assortment of authorized kinds. Use specialist and express-particular layouts to handle your small business or person requires.