This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Different Types of North Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary Introduction: North Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary plays a crucial role in the transfer of property and assets from a trust to the rightful beneficiaries. This legal document ensures that all obligations between the trustee and beneficiary are properly fulfilled, granting a smooth transition of assets. In North Dakota, there are various types of releases that can be utilized depending on the particular circumstances. In this article, we will delve into the details of these releases, highlighting their significance and providing a comprehensive understanding. 1. Full Release by Trustee to Beneficiary and Receipt from Beneficiary: A Full Release by Trustee to Beneficiary and Receipt from Beneficiary is a comprehensive document that signifies the complete transfer of assets or property from the trust to the beneficiary. It releases the trustee from any further liability or responsibility related to the trust, confirming that all terms and conditions of the trust have been met. 2. Partial Release by Trustee to Beneficiary and Receipt from Beneficiary: A Partial Release by Trustee to Beneficiary and Receipt from Beneficiary is utilized when only a portion of the trust's assets is being transferred to the beneficiary. This type of release outlines the specific details of what assets are being released, the reason for their partial transfer, and any remaining obligations or responsibilities that the trustee may still have. 3. Conditional Release by Trustee to Beneficiary and Receipt from Beneficiary: In certain situations, a Conditional Release by Trustee to Beneficiary and Receipt from Beneficiary is necessary. This type of release establishes specific conditions that must be met by the beneficiary before the trustee can fully transfer the assets. These conditions may include the completion of certain tasks or meeting predefined milestones outlined within the trust agreement. 4. Revocable Release by Trustee to Beneficiary and Receipt from Beneficiary: A Revocable Release by Trustee to Beneficiary and Receipt from Beneficiary allows the trustee to later rescind or modify the release. This type of release is often used when there is potential uncertainty or changing circumstances regarding the transfer of assets. It provides flexibility for the trustee while still acknowledging the transfer process. Conclusion: Understanding the different types of North Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary is crucial to ensure a smooth and legally compliant transfer of assets from a trust to the beneficiary. Each type of release serves a specific purpose and provides clarity and protection for both parties involved. It is recommended to consult with a legal professional specializing in estate planning or trust administration to ensure that the appropriate release is chosen based on the unique circumstances of the trust and beneficiary relationship.Title: Understanding the Different Types of North Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary Introduction: North Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary plays a crucial role in the transfer of property and assets from a trust to the rightful beneficiaries. This legal document ensures that all obligations between the trustee and beneficiary are properly fulfilled, granting a smooth transition of assets. In North Dakota, there are various types of releases that can be utilized depending on the particular circumstances. In this article, we will delve into the details of these releases, highlighting their significance and providing a comprehensive understanding. 1. Full Release by Trustee to Beneficiary and Receipt from Beneficiary: A Full Release by Trustee to Beneficiary and Receipt from Beneficiary is a comprehensive document that signifies the complete transfer of assets or property from the trust to the beneficiary. It releases the trustee from any further liability or responsibility related to the trust, confirming that all terms and conditions of the trust have been met. 2. Partial Release by Trustee to Beneficiary and Receipt from Beneficiary: A Partial Release by Trustee to Beneficiary and Receipt from Beneficiary is utilized when only a portion of the trust's assets is being transferred to the beneficiary. This type of release outlines the specific details of what assets are being released, the reason for their partial transfer, and any remaining obligations or responsibilities that the trustee may still have. 3. Conditional Release by Trustee to Beneficiary and Receipt from Beneficiary: In certain situations, a Conditional Release by Trustee to Beneficiary and Receipt from Beneficiary is necessary. This type of release establishes specific conditions that must be met by the beneficiary before the trustee can fully transfer the assets. These conditions may include the completion of certain tasks or meeting predefined milestones outlined within the trust agreement. 4. Revocable Release by Trustee to Beneficiary and Receipt from Beneficiary: A Revocable Release by Trustee to Beneficiary and Receipt from Beneficiary allows the trustee to later rescind or modify the release. This type of release is often used when there is potential uncertainty or changing circumstances regarding the transfer of assets. It provides flexibility for the trustee while still acknowledging the transfer process. Conclusion: Understanding the different types of North Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary is crucial to ensure a smooth and legally compliant transfer of assets from a trust to the beneficiary. Each type of release serves a specific purpose and provides clarity and protection for both parties involved. It is recommended to consult with a legal professional specializing in estate planning or trust administration to ensure that the appropriate release is chosen based on the unique circumstances of the trust and beneficiary relationship.

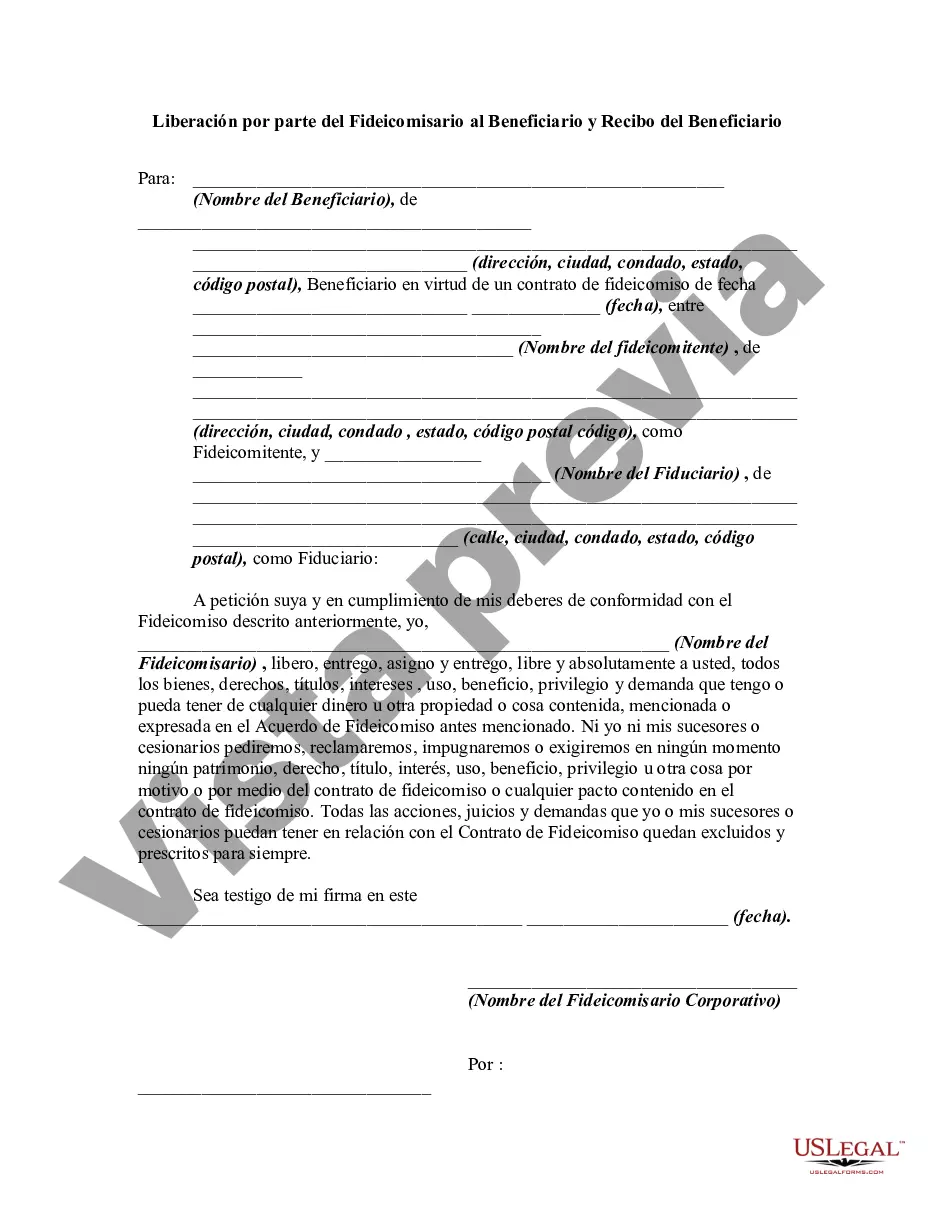

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.