Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

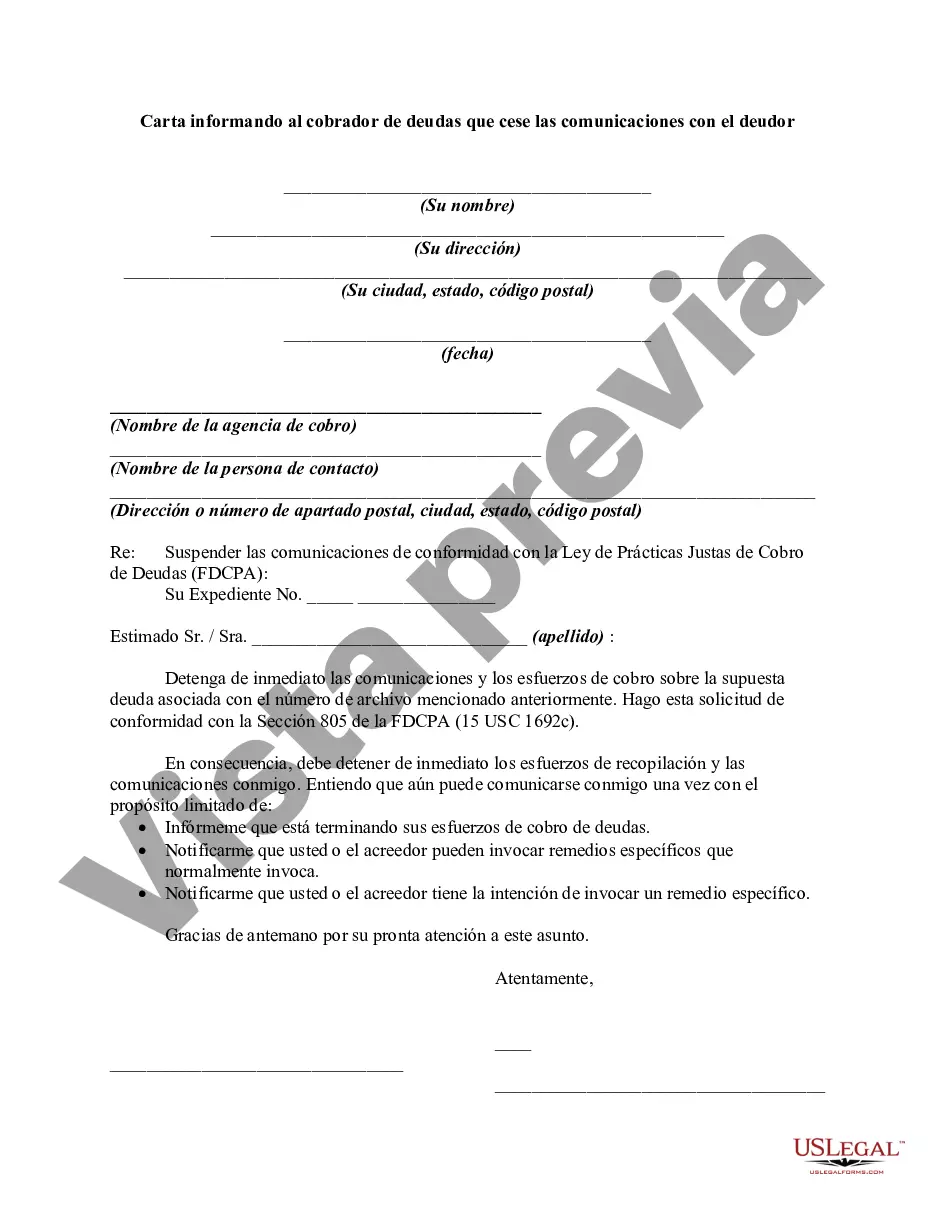

A North Dakota Letter Informing a Debt Collector to Cease Communications with the Debtor is a written communication sent to a debt collector requesting that they stop contacting the debtor regarding an outstanding debt. This letter is protected by the Fair Debt Collection Practices Act (FD CPA) and allows the debtor to assert their rights and preferences related to communication. Keywords: North Dakota, Letter Informing, Debt Collector, Cease Communications, Debtor, Fair Debt Collection Practices Act, FD CPA, outstanding debt, rights, preferences, communication. There are no specific variations of a North Dakota Letter Informing a Debt Collector to Cease Communications with the Debtor as the process and requirements are standardized across the state. However, the content and language used in the letter may vary depending on individual circumstances and personal preferences. When crafting such a letter, it is important to include the following key components: 1. Heading: Begin the letter with your name, address, and contact information, followed by the date. 2. Debt Collector's Information: Address the letter to the specific debt collector or collection agency who has been contacting you. Include their name, address, and any reference numbers they may have provided. 3. Reference to the Fair Debt Collection Practices Act (FD CPA): Clearly state in the body of the letter that your request to cease communication is made under the FD CPA, which provides protection to debtors from abusive or harassing debt collection practices. 4. Request for Cease Communications: Clearly state your request for the debt collector to stop contacting you in any form, including phone calls, letters, emails, or any other means of communication. This request should be unequivocal and express your desire to preserve your privacy and peace of mind. 5. Reminder of Rights: reiterate your rights under the FD CPA, including the right to dispute the debt or request verification of the debt, without the threat of continued communication from the debt collector. 6. Delivery Confirmation: Conclude the letter by stating that you require written confirmation that the debt collector has received your request and will comply with it. Provide a mailing address where they can send a written acknowledgment. 7. Certified Mail: When sending the letter, it is advisable to use certified mail with return receipt requested. This way, you will have proof of the debt collector's receipt of your request. 8. Retain Copies: Make copies of the signed letter, along with the certified mail receipt and any other relevant documentation for your records. It helps to maintain a paper trail in case any dispute arises in the future. Remember to keep your letter concise, polite, and professional. Avoid personal attacks or accusations but enforce your rights and preferences firmly. If you wish to seek legal advice or guidance, consult with an attorney experienced in debt collection laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.