Are you currently in a location that you need documents for potential business or specific purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the North Dakota Receipt for Payment Made on Real Estate Promissory Note, which can be completed to comply with state and federal regulations.

Utilize US Legal Forms, a comprehensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally designed legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Dakota Receipt for Payment Made on Real Estate Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for your correct area/county.

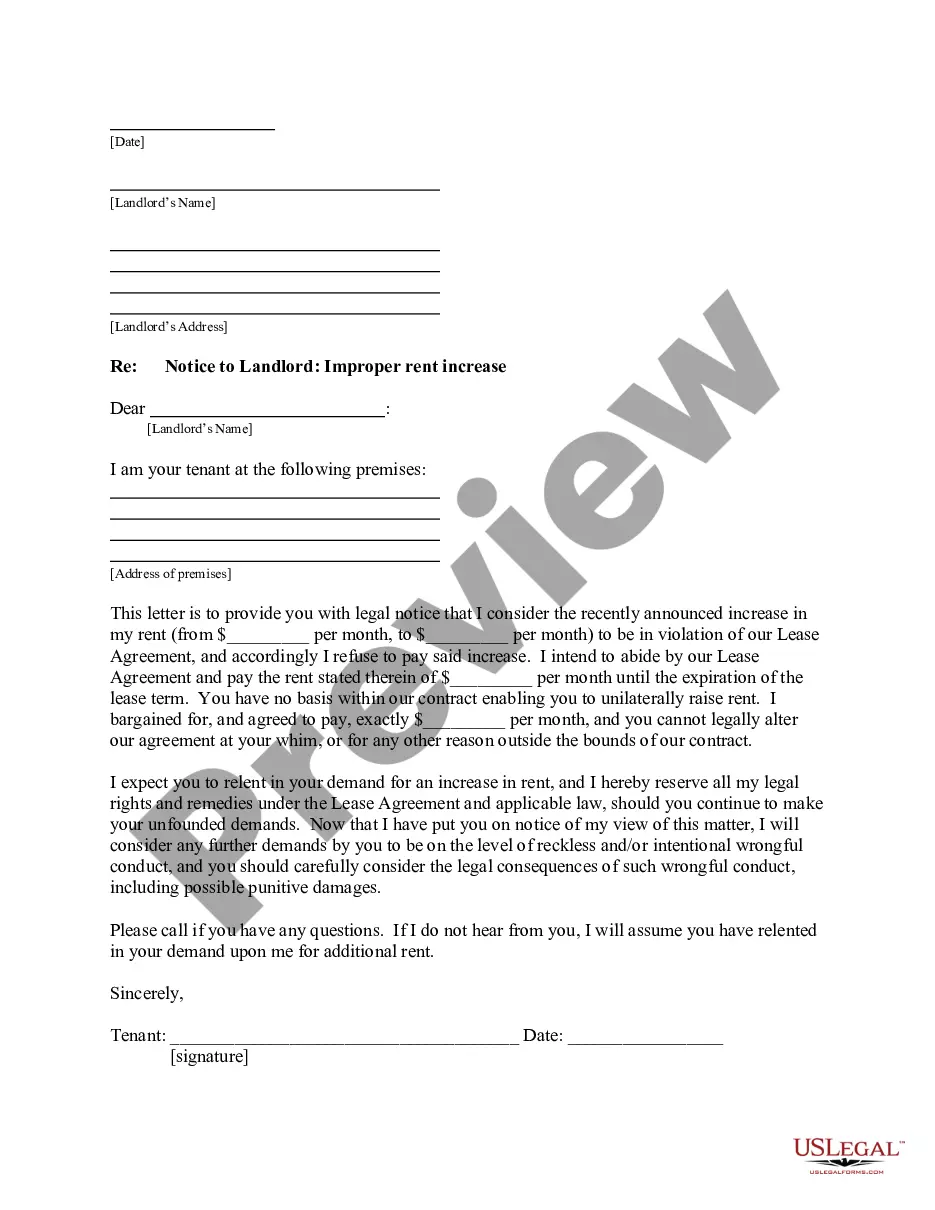

- Utilize the Preview button to review the form.

- Read the information to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, just click Get now.

- Choose the pricing plan you desire, complete the necessary details to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You can obtain another copy of the North Dakota Receipt for Payment Made on Real Estate Promissory Note at any time.

- Simply select the desired form to download or print the document template.

trust funds are: earnest money deposits, down payments,1 NOTE: The North Dakota Real Estate Commission has taken the position that ...25 pages

? trust funds are: earnest money deposits, down payments,1 NOTE: The North Dakota Real Estate Commission has taken the position that ... The seller remains the legal owner of the property until the contract is paid. Contract for deed sales are usually made when a mortgage loan cannot be obtained, ...41 pages

The seller remains the legal owner of the property until the contract is paid. Contract for deed sales are usually made when a mortgage loan cannot be obtained, ...GRAND FORKS, a North Dakota municipal corporation whose principal office andproperty tax incentive that will be in the form of a payment in lieu of ... It proves that ownership of a particular piece of property has changedSince the bill of sale states that you have already been paid, ... A: If we do not receive a complete application and you have missed four monthly payments or there is reason to believe the property is vacant or abandoned, we ... The seller will retain legal title to the real estate identified in the Minnesota Contract for Deed until the entire purchase price has been paid ? at which ... UNITED STATES BANKRUPTCY COURT. DISTRICT OF NORTH DAKOTA. In Re: Bankruptcy No.Justin Vasvick paid $210,105.82 for the Property,. What is a Bill of Sale? · Proof of purchase · Proof of payment · As-is Bill of Sale · Proof of sale · Sales slip · Sales receipt ... Deed of Architectural Facade Easement for the property at 420 EastWHEREAS, Assignor executed that certain Residual Receipts Note dated ... 1922 · ?Law reports, digests, etcHis interest was evidenced by a mortgage on real estate in a foreign juris- receipt for moneys paid by him on the purdiction . chase price .

Can you provide help when I need it? What are the benefits of becoming a real estate agent? What is real estate brokerage? What can I learn to use an online real estate broker? What can I do while online with an online real estate agent? How do I get registered? How do I become an agent? What is home services? What is an agent network? What is brokerage? How do I become an agent? How much do agents make? Buyer's guide to buying a home: what you need to know If you are looking for a place to live for yourself, your loved ones, and the kids, you are probably in the market for a home.