When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

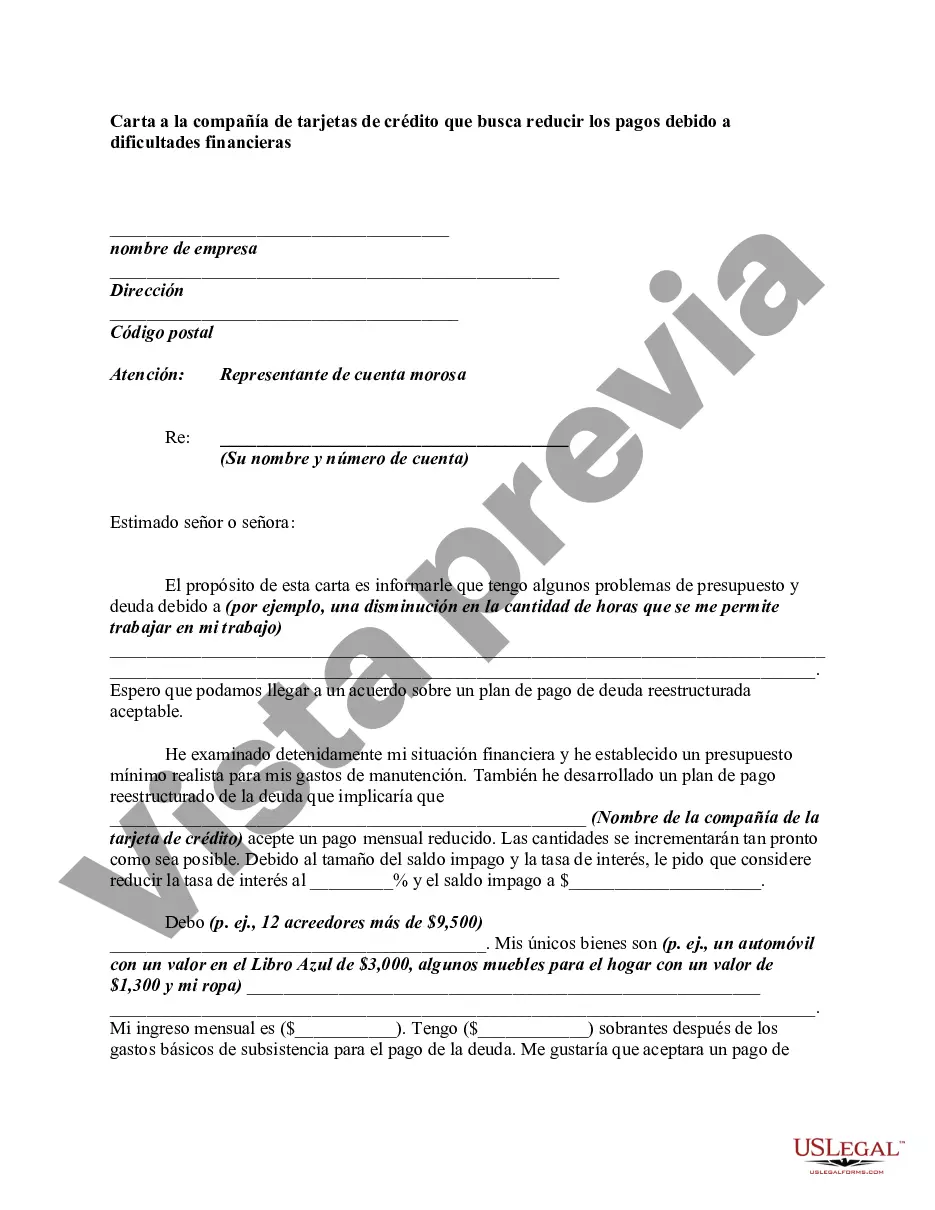

Subject: Request to Lower Monthly Payments Due to Financial Difficulties — North Dakota Dear [Credit Card Company], I hope this letter finds you in good health. I am writing to discuss my current financial situation and request your assistance in lowering the monthly payments on my credit card account due to circumstances beyond my control. As a resident of North Dakota, I am facing certain challenges that have impacted my ability to meet my financial obligations. North Dakota, known as the Peace Garden State, is an agricultural hub and home to a diverse range of industries. Unfortunately, in recent months, our state has experienced economic downturns affecting several key sectors, such as energy, agriculture, and manufacturing. The resulting job losses, reduced hours, and decreased income have put a significant strain on many residents, including myself. As a diligent cardholder, I have been making regular payments on my credit card account. However, due to the unforeseen financial difficulties I am currently facing, I find it increasingly challenging to meet the previously agreed-upon monthly payment amount. It is essential for me to find a solution that would allow me to continue making regular payments while managing my financial responsibilities sustainably. I understand that your organization has encountered numerous similar requests in recent times, given the ongoing economic situation. Acknowledging the importance of maintaining a good credit score and a healthy financial standing, I kindly request your consideration in granting me a temporary decrease in my monthly payments. This reduction would alleviate the burden of my current financial hardships, enabling me to honor my commitment to your organization. I am committed to honoring my financial obligations and assure you that this request is not intended to shirk responsibility. Instead, it is a proactive step taken to address my financial situation responsibly, considering the prevailing economic challenges in North Dakota and their impact on individuals and households. To provide you with a clearer picture of my financial circumstances, I have enclosed the necessary documentation, including recent pay stubs, bank statements, and a detailed breakdown of my monthly expenses. These documents will demonstrate my earnest efforts to manage my finances effectively while striving to meet my obligations. In light of the uncertain economic future in North Dakota, I would greatly appreciate your cooperation in this matter. If approved, a lower monthly payment amount would ease the burden on my finances, allowing me to continue making timely payments and ultimately maintain a positive relationship with your esteemed organization. I kindly request your prompt attention to this matter and would appreciate a written confirmation regarding the potential approval of my request. Please feel free to contact me at [your contact number] or [your email address] to discuss any additional details or documentation required. Thank you for your understanding and consideration. I hope that together, we can find a mutually agreeable solution that will alleviate my financial burden while ensuring the integrity of our business relationship. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Date]Subject: Request to Lower Monthly Payments Due to Financial Difficulties — North Dakota Dear [Credit Card Company], I hope this letter finds you in good health. I am writing to discuss my current financial situation and request your assistance in lowering the monthly payments on my credit card account due to circumstances beyond my control. As a resident of North Dakota, I am facing certain challenges that have impacted my ability to meet my financial obligations. North Dakota, known as the Peace Garden State, is an agricultural hub and home to a diverse range of industries. Unfortunately, in recent months, our state has experienced economic downturns affecting several key sectors, such as energy, agriculture, and manufacturing. The resulting job losses, reduced hours, and decreased income have put a significant strain on many residents, including myself. As a diligent cardholder, I have been making regular payments on my credit card account. However, due to the unforeseen financial difficulties I am currently facing, I find it increasingly challenging to meet the previously agreed-upon monthly payment amount. It is essential for me to find a solution that would allow me to continue making regular payments while managing my financial responsibilities sustainably. I understand that your organization has encountered numerous similar requests in recent times, given the ongoing economic situation. Acknowledging the importance of maintaining a good credit score and a healthy financial standing, I kindly request your consideration in granting me a temporary decrease in my monthly payments. This reduction would alleviate the burden of my current financial hardships, enabling me to honor my commitment to your organization. I am committed to honoring my financial obligations and assure you that this request is not intended to shirk responsibility. Instead, it is a proactive step taken to address my financial situation responsibly, considering the prevailing economic challenges in North Dakota and their impact on individuals and households. To provide you with a clearer picture of my financial circumstances, I have enclosed the necessary documentation, including recent pay stubs, bank statements, and a detailed breakdown of my monthly expenses. These documents will demonstrate my earnest efforts to manage my finances effectively while striving to meet my obligations. In light of the uncertain economic future in North Dakota, I would greatly appreciate your cooperation in this matter. If approved, a lower monthly payment amount would ease the burden on my finances, allowing me to continue making timely payments and ultimately maintain a positive relationship with your esteemed organization. I kindly request your prompt attention to this matter and would appreciate a written confirmation regarding the potential approval of my request. Please feel free to contact me at [your contact number] or [your email address] to discuss any additional details or documentation required. Thank you for your understanding and consideration. I hope that together, we can find a mutually agreeable solution that will alleviate my financial burden while ensuring the integrity of our business relationship. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Date]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.