North Dakota Sample Letter for Return of Late Payment and Denial of Discount

Description

How to fill out Sample Letter For Return Of Late Payment And Denial Of Discount?

If you wish to acquire, attain, or generate legal document templates, utilize US Legal Forms, the finest collection of legal forms that can be found online.

Make use of the site’s user-friendly and accessible search tool to locate the documents you need. A selection of templates for business and personal purposes are categorized by genres and categories, or keywords.

Employ US Legal Forms to discover the North Dakota Sample Letter for Return of Late Payment and Denial of Discount in just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded within your account.

Be proactive and acquire, and print the North Dakota Sample Letter for Return of Late Payment and Denial of Discount with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to find the North Dakota Sample Letter for Return of Late Payment and Denial of Discount.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

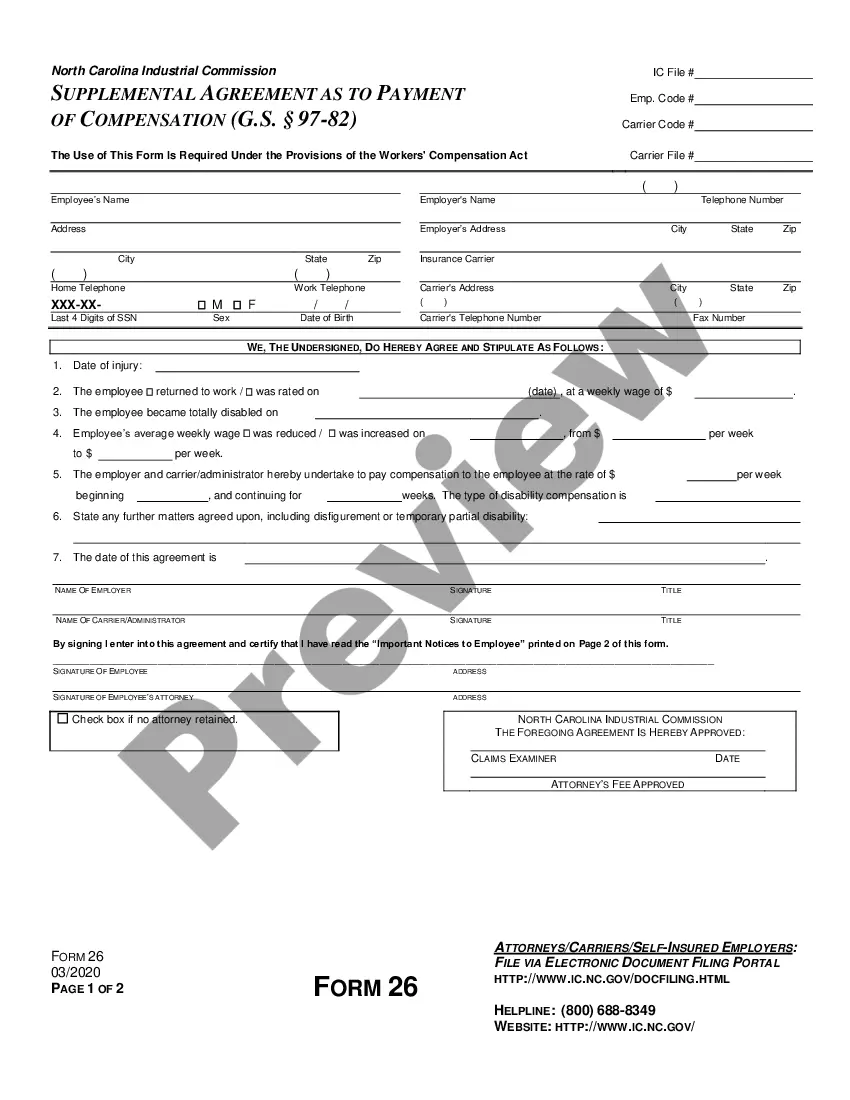

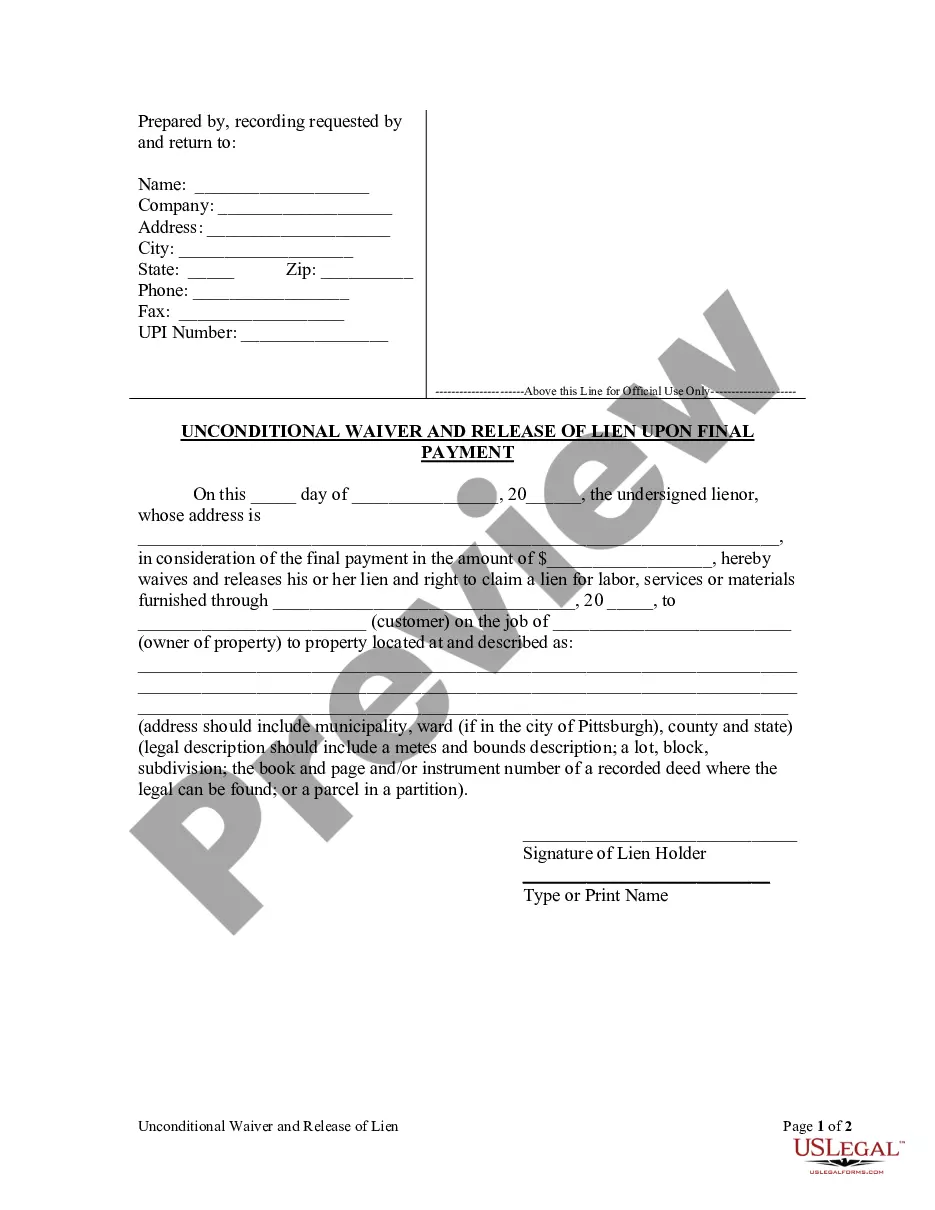

- Step 2. Utilize the Preview feature to review the form’s content. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to locate alternative versions of your legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the North Dakota Sample Letter for Return of Late Payment and Denial of Discount.

Form popularity

FAQ

North Dakota offers a range of benefits for retirees, including tax exemptions on social security income and low property tax rates. This makes the state appealing for individuals looking for a comfortable retirement. If any financial disputes arise, like late payments or discounts, using the North Dakota Sample Letter for Return of Late Payment and Denial of Discount can ensure clarity in your communication.

Yes, North Dakota accepts federal tax extensions, allowing residents extra time to file their state taxes. This can be particularly beneficial if you anticipate late payments. Should you need to communicate about these issues, incorporating the North Dakota Sample Letter for Return of Late Payment and Denial of Discount would be advantageous.

Yes, North Dakota provides specific tax forms for its residents, enhancing the tax filing process. These forms are essential for reporting income, credits, and deductions accurately. For anyone handling tax-related late payments, the North Dakota Sample Letter for Return of Late Payment and Denial of Discount can be an effective tool when addressing these issues.

Currently, there are a few states without an income tax, including Texas, Florida, and South Dakota. This absence of income tax can benefit residents significantly, impacting overall financial management. If you have financial matters in North Dakota, such as dealing with late payments, consider utilizing the North Dakota Sample Letter for Return of Late Payment and Denial of Discount to formalize your communications.

South Dakota is the state that has no state income tax. This feature attracts many individuals and businesses looking for a favorable tax environment. For those drafting letters regarding financial issues like late payments in North Dakota, the North Dakota Sample Letter for Return of Late Payment and Denial of Discount can help navigate state-specific concerns.

resident for tax purposes in North Dakota is an individual who does not reside in the state but earns income from North Dakota sources. This classification includes various scenarios, such as temporary employment or rental income from properties. If you are dealing with late payment situations, utilizing a North Dakota Sample Letter for Return of Late Payment and Denial of Discount can be instrumental in communicating your tax challenges.

Yes, non-residents are required to file an income tax return if they earn income sourced from within North Dakota. This requirement ensures tax obligations are met accurately for the income generated in the state. If you are facing issues with late payments, consider addressing them with a North Dakota Sample Letter for Return of Late Payment and Denial of Discount to clarify your position.

The penalty for late tax filing in North Dakota starts at 5% of the unpaid tax amount for each month that the return is late, capped at 25%. In addition, interest accrues on the unpaid tax from the due date. To avoid these penalties, it could be beneficial to draft a North Dakota Sample Letter for Return of Late Payment and Denial of Discount to express your situation to any impacted parties.

In North Dakota, bonuses are considered supplemental income and are subject to state income tax. The rate may vary based on your overall income level and tax bracket. If you find yourself in a bind with late payments due to bonus income, a North Dakota Sample Letter for Return of Late Payment and Denial of Discount could be a valuable tool in managing communication with creditors.

ND Form 307 is a specific tax form designed to assist individuals in reporting their tax liabilities accurately. This form is crucial for ensuring that your financial responsibilities align with your income and tax rates in North Dakota. If you're facing complications with managing late payments, utilizing a North Dakota Sample Letter for Return of Late Payment and Denial of Discount may provide additional support.