An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

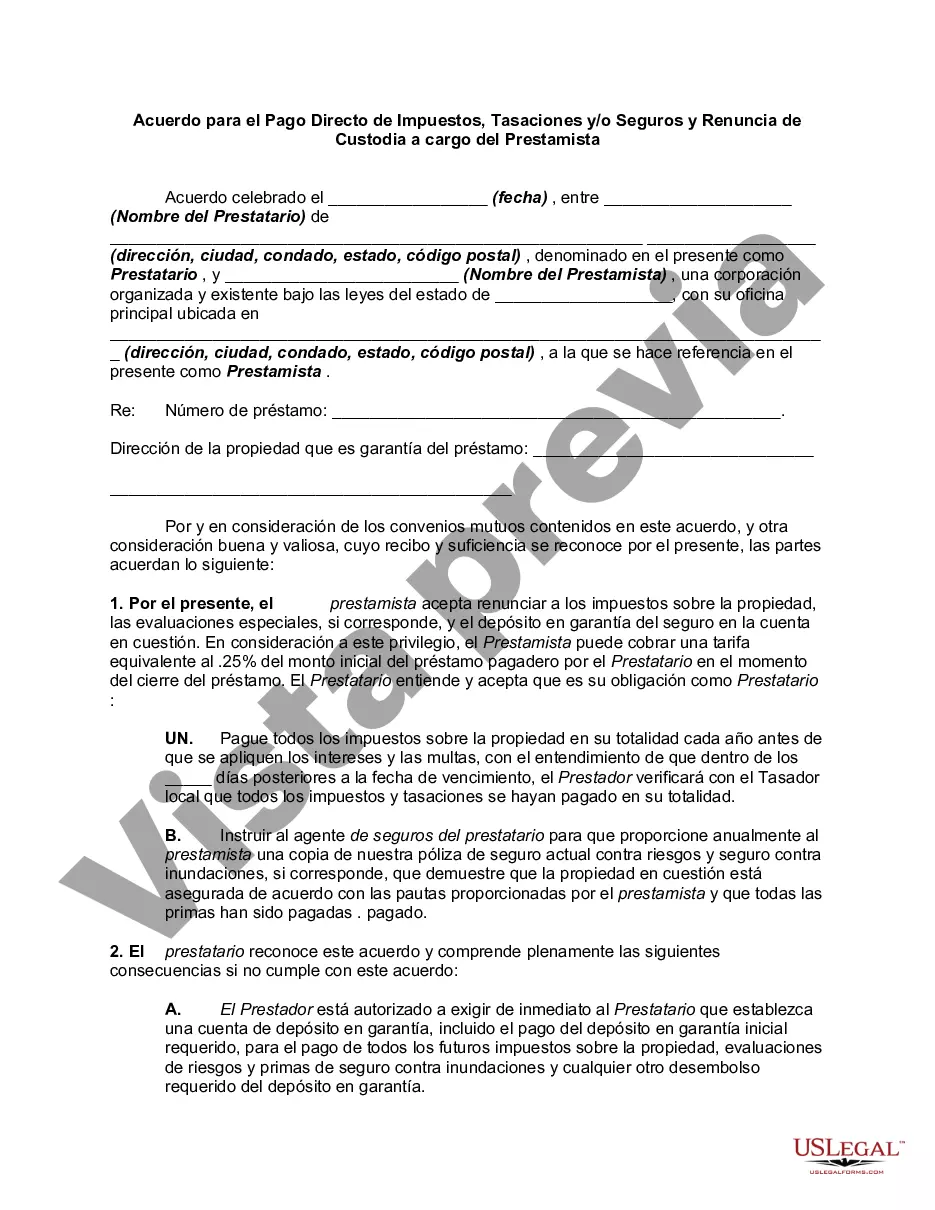

The North Dakota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that sets out the terms and conditions for the borrower to directly pay their property taxes, assessments, and/or insurance premiums instead of having the lender hold them in an escrow account. This agreement is commonly used in real estate transactions, particularly when the borrower prefers to manage their own tax and insurance payments. By opting for this agreement, the borrower takes on the responsibility of ensuring timely payment of these expenses. The North Dakota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender allows the borrower the flexibility to handle their tax and insurance obligations directly, while also waiving the requirement for an escrow account. This means that the borrower is solely responsible for making these payments on time and in full. By avoiding escrow, borrowers have more control over their finances and can potentially earn interest on the funds that would have been held in an escrow account. However, it is crucial for borrowers to carefully budget and plan for these expenses to avoid any late payments or lapses in coverage. It's important to note that there may be variations of this agreement depending on the specific terms and circumstances of the loan. For instance, there could be separate agreements for the direct payment of property taxes, assessments, and insurance, or a combined agreement encompassing all three responsibilities. Overall, the North Dakota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers borrowers the option to handle their tax and insurance obligations independently, granting them more control over their financial matters.The North Dakota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that sets out the terms and conditions for the borrower to directly pay their property taxes, assessments, and/or insurance premiums instead of having the lender hold them in an escrow account. This agreement is commonly used in real estate transactions, particularly when the borrower prefers to manage their own tax and insurance payments. By opting for this agreement, the borrower takes on the responsibility of ensuring timely payment of these expenses. The North Dakota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender allows the borrower the flexibility to handle their tax and insurance obligations directly, while also waiving the requirement for an escrow account. This means that the borrower is solely responsible for making these payments on time and in full. By avoiding escrow, borrowers have more control over their finances and can potentially earn interest on the funds that would have been held in an escrow account. However, it is crucial for borrowers to carefully budget and plan for these expenses to avoid any late payments or lapses in coverage. It's important to note that there may be variations of this agreement depending on the specific terms and circumstances of the loan. For instance, there could be separate agreements for the direct payment of property taxes, assessments, and insurance, or a combined agreement encompassing all three responsibilities. Overall, the North Dakota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers borrowers the option to handle their tax and insurance obligations independently, granting them more control over their financial matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.