A North Dakota Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a loan agreement between two individuals. This note serves as evidence of the borrower's promise to repay the loan in specified installments and according to agreed-upon terms. In North Dakota, there are no specific variations or types of simple promissory notes for personal loans. However, here are some keywords and important information related to this topic: 1. Key Features: A North Dakota Simple Promissory Note for Personal Loan typically includes information such as the names and contact details of both the lender and borrower, the loan amount, the interest rate (if applicable), the repayment schedule, and any late payment penalties. 2. Loan Amount and Terms: North Dakota personal loans can vary in terms of the loan amount. It can be a small loan between family members or friends, or even a larger loan with more formal arrangements. The terms can also be flexible and customized to the needs and preferences of both parties involved. 3. Interest Rate: While not mandatory for personal loans, the promissory note can include an agreed-upon interest rate. This rate should comply with North Dakota's usury laws, which set a maximum limit on the interest that can be charged on loans. 4. Repayment Schedule: The promissory note should clearly lay out the repayment schedule, indicating the frequency of payments (e.g., monthly, quarterly) and the due dates. The note should also specify the payment method (e.g., bank transfer, cash), and if any grace period is allowed before late fees are applied. 5. Security or Collateral: Depending on the circumstances, the promissory note may include provisions related to collateral or security for the loan. This ensures that the lender has the right to claim certain assets as repayment if the borrower defaults on the loan. 6. Governing Law: It is essential to specify that the North Dakota law governs the promissory note and any legal disputes regarding the loan agreement. This provision ensures that both parties understand the jurisdiction under which any disagreements would be resolved. Remember, it is crucial to consult a legal professional for assistance in drafting or understanding the complexities involved in a North Dakota Simple Promissory Note for Personal Loan.

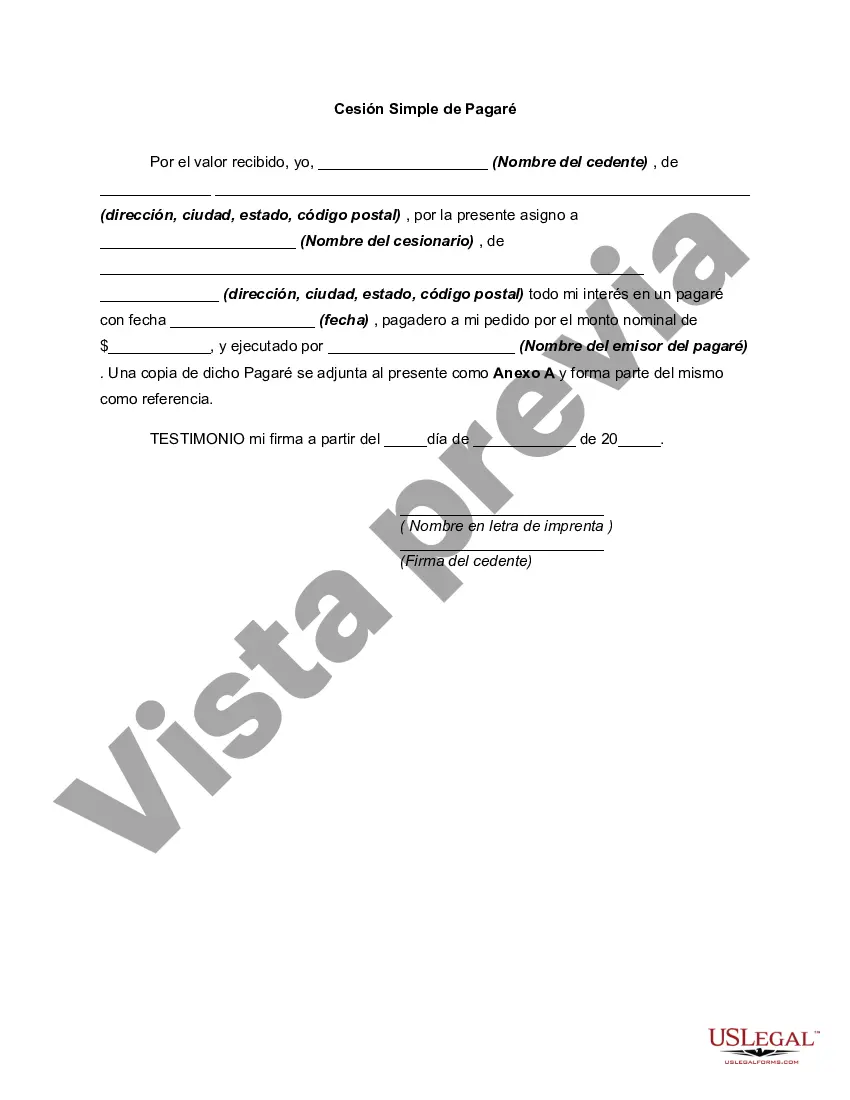

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out North Dakota Pagaré Simple Para Préstamo Personal?

If you have to comprehensive, acquire, or print legitimate document templates, use US Legal Forms, the largest assortment of legitimate varieties, which can be found online. Take advantage of the site`s simple and convenient look for to obtain the paperwork you need. Numerous templates for business and person uses are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the North Dakota Simple Promissory Note for Personal Loan within a handful of mouse clicks.

When you are currently a US Legal Forms client, log in to the profile and then click the Down load button to find the North Dakota Simple Promissory Note for Personal Loan. Also you can accessibility varieties you previously delivered electronically in the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the form to the right area/nation.

- Step 2. Use the Review method to check out the form`s articles. Never forget to read the explanation.

- Step 3. When you are not happy using the form, use the Research discipline towards the top of the display screen to locate other models from the legitimate form format.

- Step 4. After you have found the form you need, click on the Get now button. Select the prices strategy you like and add your credentials to sign up to have an profile.

- Step 5. Approach the purchase. You may use your charge card or PayPal profile to perform the purchase.

- Step 6. Find the formatting from the legitimate form and acquire it on your own gadget.

- Step 7. Total, change and print or indicator the North Dakota Simple Promissory Note for Personal Loan.

Each legitimate document format you acquire is your own property for a long time. You possess acces to each form you delivered electronically within your acccount. Go through the My Forms section and pick a form to print or acquire once again.

Compete and acquire, and print the North Dakota Simple Promissory Note for Personal Loan with US Legal Forms. There are millions of skilled and state-distinct varieties you can utilize for the business or person demands.