A North Dakota Simple Promissory Note for Tuition Fee is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a certain amount of money borrowed to cover tuition fees. This type of promissory note is used in North Dakota as a formal agreement between the lender (usually an educational institution or private lender) and the borrower (often a student or their parent/guardian). The North Dakota Simple Promissory Note for Tuition Fee typically includes essential information such as the names and contact information of both parties, the agreed-upon amount borrowed, the repayment terms (including interest rates, if applicable), and the repayment schedule. It serves as evidence of the borrower's promise to repay the loan and provides legal protection to both parties involved. Different types of North Dakota Simple Promissory Notes for Tuition Fee may exist, depending on specific circumstances and parties involved. Some common variations include: 1. Fixed Interest Rate Promissory Note: This type of promissory note specifies a predetermined interest rate that remains constant throughout the loan repayment period. It ensures that the interest to be paid remains the same, allowing borrowers to make accurate budget plans. 2. Variable Interest Rate Promissory Note: In contrast to the fixed interest rate, this type of promissory note includes an interest rate that fluctuates over time. The rate is often tied to an index, such as the prime rate or LIBOR (London Interbank Offered Rate), and may change periodically according to market conditions. 3. Unsecured Promissory Note: An unsecured promissory note is not backed by collateral, meaning that the lender relies solely on the borrower's creditworthiness. In case of default, the lender may pursue legal action to recover the borrowed amount but does not have a specific asset to claim. 4. Secured Promissory Note: This type of promissory note is secured by collateral, such as a property or valuable asset owned by the borrower. In the event of default, the lender has the right to claim and sell the collateral to recover the outstanding debt. It is important for both lenders and borrowers in North Dakota to carefully review and understand the terms and conditions outlined in a Simple Promissory Note for Tuition Fee before entering into an agreement. Seeking legal advice and conducting thorough research can help ensure that the promissory note is fair and protects the rights of all parties involved.

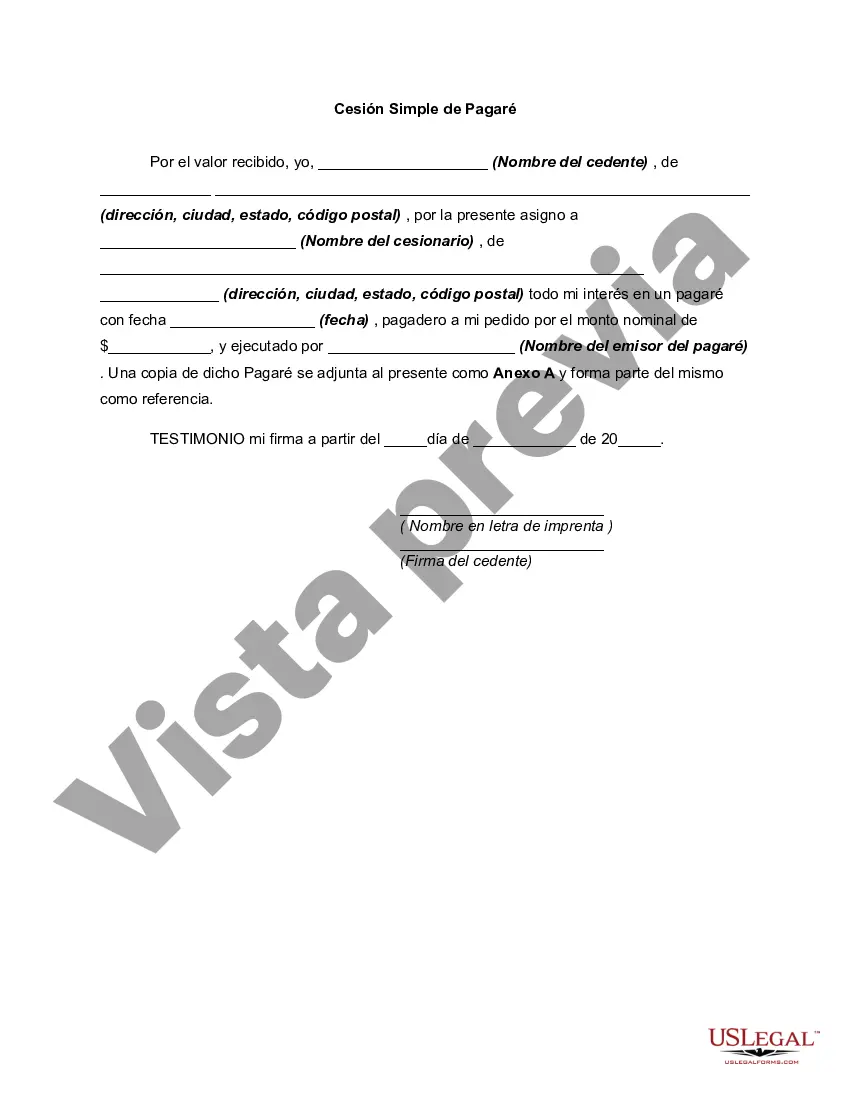

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out North Dakota Pagaré Simple De Matrícula?

If you want to total, down load, or print out lawful document layouts, use US Legal Forms, the biggest assortment of lawful forms, that can be found on the web. Take advantage of the site`s simple and easy convenient look for to discover the documents you will need. Numerous layouts for company and specific purposes are sorted by categories and claims, or keywords. Use US Legal Forms to discover the North Dakota Simple Promissory Note for Tutition Fee with a couple of mouse clicks.

Should you be currently a US Legal Forms client, log in to the profile and then click the Obtain option to obtain the North Dakota Simple Promissory Note for Tutition Fee. Also you can gain access to forms you earlier delivered electronically in the My Forms tab of the profile.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for the appropriate town/nation.

- Step 2. Utilize the Preview choice to look over the form`s content. Do not overlook to read the information.

- Step 3. Should you be unsatisfied with the develop, utilize the Lookup discipline near the top of the display to find other types from the lawful develop design.

- Step 4. When you have found the form you will need, click on the Buy now option. Opt for the prices plan you favor and include your qualifications to register for the profile.

- Step 5. Approach the transaction. You can utilize your charge card or PayPal profile to complete the transaction.

- Step 6. Select the formatting from the lawful develop and down load it on the device.

- Step 7. Comprehensive, edit and print out or indicator the North Dakota Simple Promissory Note for Tutition Fee.

Every lawful document design you purchase is the one you have forever. You may have acces to every single develop you delivered electronically with your acccount. Click on the My Forms section and decide on a develop to print out or down load once more.

Compete and down load, and print out the North Dakota Simple Promissory Note for Tutition Fee with US Legal Forms. There are many professional and status-particular forms you may use for the company or specific requires.