The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

In North Dakota, a Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows debtors to provide detailed information about their financial situation to creditors in an effort to negotiate debt settlement or forgiveness. This affidavit is a crucial step towards resolving past due debts amicably and avoiding potential legal actions. The North Dakota Debtor's Affidavit of Financial Status typically includes several key sections addressing the debtor's assets and liabilities. These sections are designed to provide a comprehensive overview of the debtor's financial standing, allowing creditors to assess their ability to repay the debt. Here are the main sections typically found in this affidavit: 1. Personal Information: This section requires the debtor to provide their full name, contact details, Social Security number, and any other relevant identification information. 2. Financial History: Debtors must disclose their current employment status, including employer details, job title, and income. It also requires information about any other sources of income, such as rental properties, investments, or government benefits. 3. Assets: Debtors are required to provide a detailed list of their assets, including real estate properties, vehicles, bank accounts, investments, and valuable personal belongings. It is important to include accurate valuations for each asset. 4. Liabilities: This section requires debtors to list all their outstanding debts, including credit card balances, loans, mortgages, and any other liabilities. Each debt should be accompanied by the current balance owed and the name of the creditor. 5. Monthly Expenses: Detailed information about the debtor's monthly expenses, such as rent/mortgage payments, utilities, transportation costs, groceries, healthcare, and other necessary living expenses should be included in this section. 6. Financial Hardship Explanation: In this section, debtors have the opportunity to explain the circumstances that led to their financial hardship. It is crucial to provide an honest and detailed account to help creditors understand the reasons behind the past due debt. By completing the North Dakota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities, debtors demonstrate their willingness to cooperate and negotiate a fair resolution. It allows creditors to make informed decisions regarding potential debt restructuring, settlement, or forgiveness. It's important to note that while the content described above is generally relevant for this affidavit, it is essential for debtors to consult legal professionals or qualified advisors for specific guidance tailored to their individual circumstances. Additionally, different creditors or debt collection agencies may have their own variations of this affidavit, so debtors should use the appropriate document provided by the relevant party.In North Dakota, a Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows debtors to provide detailed information about their financial situation to creditors in an effort to negotiate debt settlement or forgiveness. This affidavit is a crucial step towards resolving past due debts amicably and avoiding potential legal actions. The North Dakota Debtor's Affidavit of Financial Status typically includes several key sections addressing the debtor's assets and liabilities. These sections are designed to provide a comprehensive overview of the debtor's financial standing, allowing creditors to assess their ability to repay the debt. Here are the main sections typically found in this affidavit: 1. Personal Information: This section requires the debtor to provide their full name, contact details, Social Security number, and any other relevant identification information. 2. Financial History: Debtors must disclose their current employment status, including employer details, job title, and income. It also requires information about any other sources of income, such as rental properties, investments, or government benefits. 3. Assets: Debtors are required to provide a detailed list of their assets, including real estate properties, vehicles, bank accounts, investments, and valuable personal belongings. It is important to include accurate valuations for each asset. 4. Liabilities: This section requires debtors to list all their outstanding debts, including credit card balances, loans, mortgages, and any other liabilities. Each debt should be accompanied by the current balance owed and the name of the creditor. 5. Monthly Expenses: Detailed information about the debtor's monthly expenses, such as rent/mortgage payments, utilities, transportation costs, groceries, healthcare, and other necessary living expenses should be included in this section. 6. Financial Hardship Explanation: In this section, debtors have the opportunity to explain the circumstances that led to their financial hardship. It is crucial to provide an honest and detailed account to help creditors understand the reasons behind the past due debt. By completing the North Dakota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities, debtors demonstrate their willingness to cooperate and negotiate a fair resolution. It allows creditors to make informed decisions regarding potential debt restructuring, settlement, or forgiveness. It's important to note that while the content described above is generally relevant for this affidavit, it is essential for debtors to consult legal professionals or qualified advisors for specific guidance tailored to their individual circumstances. Additionally, different creditors or debt collection agencies may have their own variations of this affidavit, so debtors should use the appropriate document provided by the relevant party.

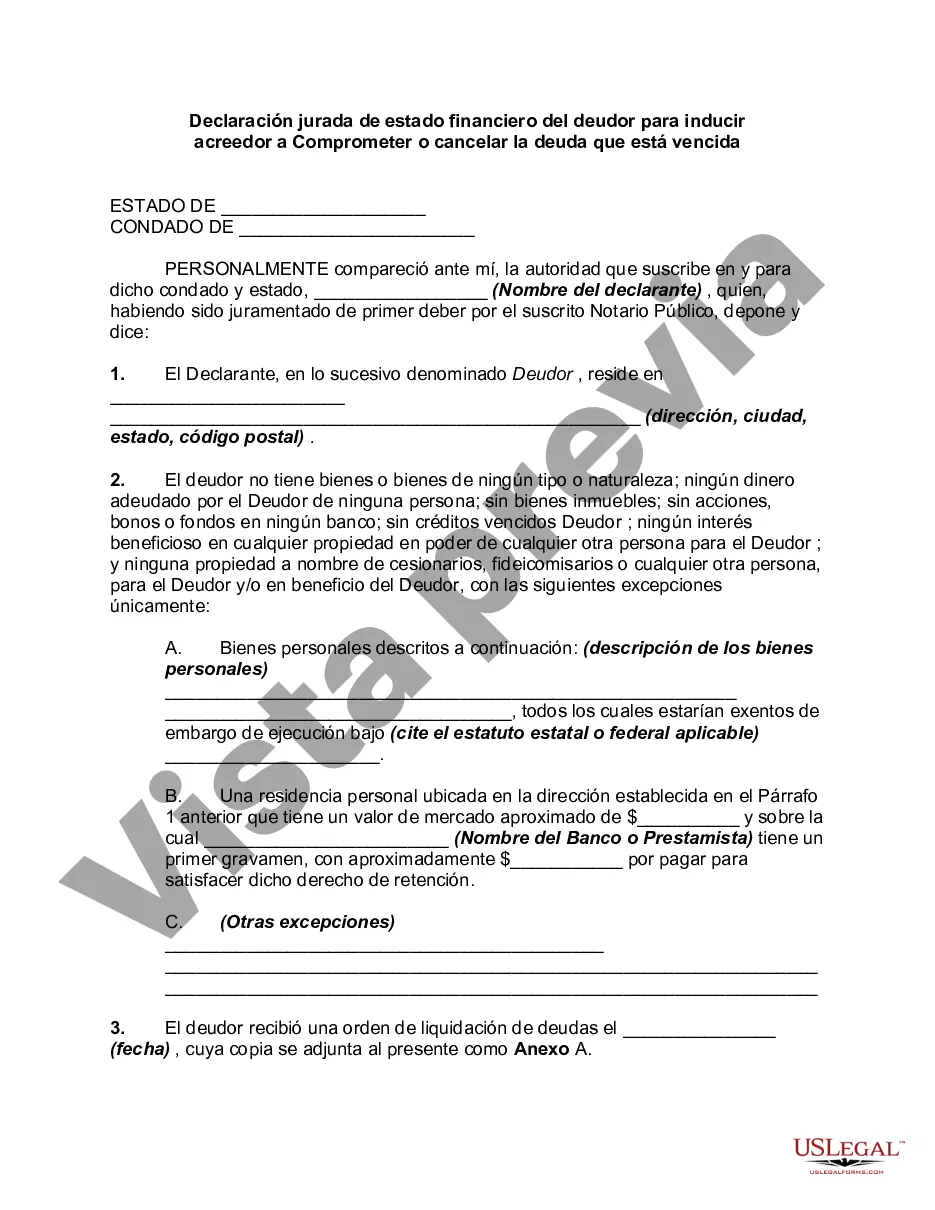

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.