The North Dakota Short Sale Affidavit of Buyer is a legal document that serves as a detailed declaration of the buyer's intent to purchase a property participating in a short sale in North Dakota. This affidavit is a crucial part of the short sale process, and it provides important information for both the buyer and the lender. Key information included in the North Dakota Short Sale Affidavit of Buyer may consist of: 1. Buyer's Information: The buyer is required to provide their full name, contact information, and address. 2. Property Details: The affidavit demands the accurate address and legal description of the property being purchased. 3. Short Sale Participation: The buyer affirms their understanding that the property is subject to a short sale transaction and acknowledges its implications. 4. Financing Information: The affidavit requires the buyer to disclose the financing sources they plan to utilize for the purchase, such as obtaining a traditional mortgage or using personal funds. 5. Buyer's Representation: If the buyer is represented by a real estate agent or attorney, their details and contact information need to be included. 6. Buyer's Intent: The affidavit mandates the buyer to declare their earnest intention to purchase the property promptly and proceed with the transaction diligently. 7. Disclosures: The buyer acknowledges receiving any required property disclosures, including information about known defects, repairs, or potential liabilities. Different types of North Dakota Short Sale Affidavits of Buyer may include: 1. Individual Buyer Affidavit: This type of affidavit is used when an individual buyer is purchasing the property independently, without involving any corporate entities. 2. Corporate Buyer Affidavit: When a corporate entity is involved in the purchase of a short sale property, a separate affidavit is required, outlining the details of the corporation, its representatives, and confirming its authority to engage in the transaction. 3. Co-Buyer Affidavit: In cases where multiple buyers are involved in the purchase, a co-buyer affidavit is utilized to ensure all parties acknowledge their responsibilities, liabilities, and intentions collectively. 4. Investor Affidavit: If the buyer intends to purchase the property as an investment, an investor affidavit may be required to declare their intent to either rent, resell, or hold the property for its long-term value. Utilizing the North Dakota Short Sale Affidavit of Buyer is crucial in ensuring a transparent and legally compliant short sale transaction in North Dakota. It provides a standardized framework for buyers to assert their commitment, disclose relevant information, and protects both the buyer and the lender involved in the process.

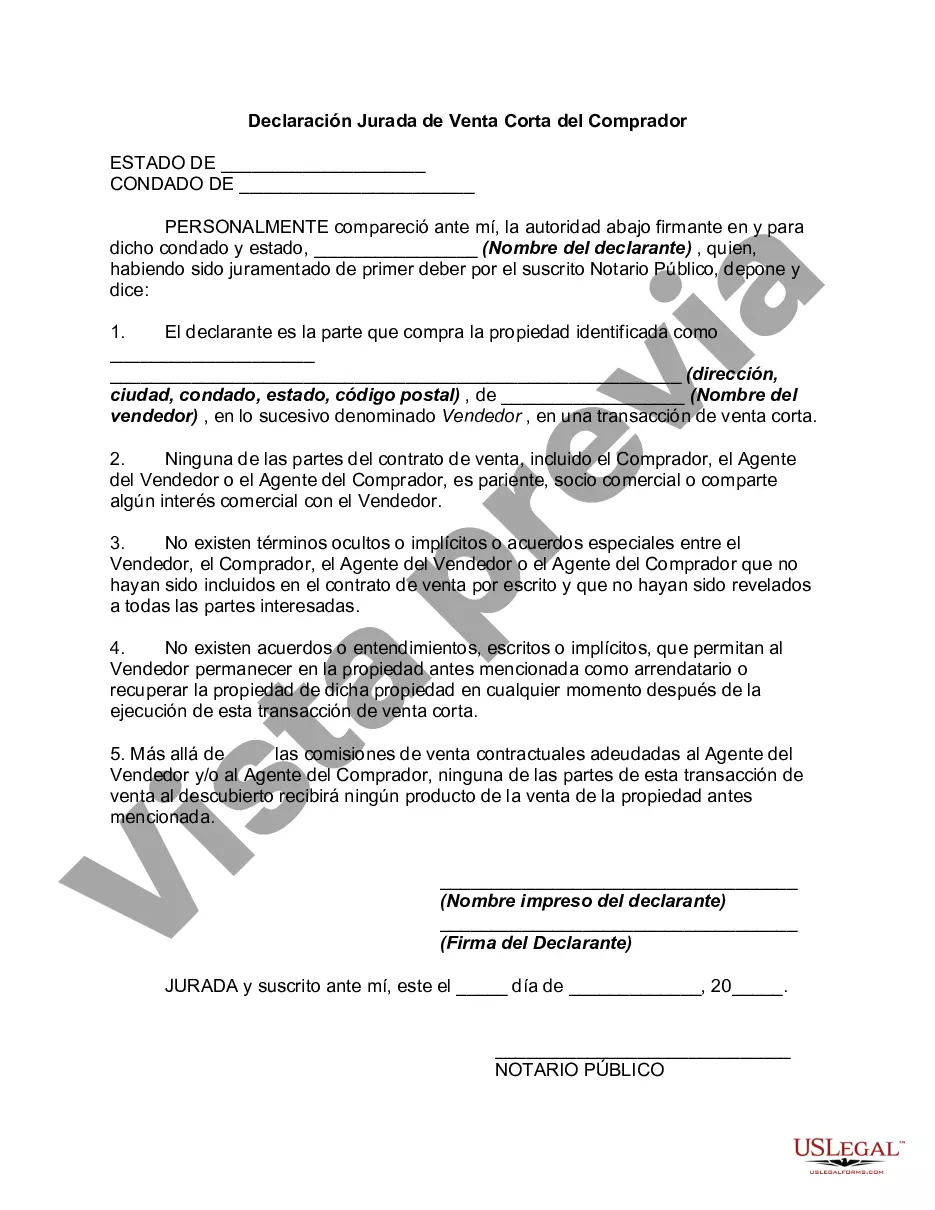

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out North Dakota Declaración Jurada De Venta Corta Del Comprador?

Choosing the right authorized file design can be a battle. Of course, there are a variety of web templates available online, but how would you discover the authorized type you want? Use the US Legal Forms internet site. The support provides a huge number of web templates, like the North Dakota Short Sale Affidavit of Buyer, which you can use for company and personal requires. All of the varieties are checked by experts and fulfill state and federal demands.

If you are currently signed up, log in for your profile and click the Download switch to find the North Dakota Short Sale Affidavit of Buyer. Use your profile to search throughout the authorized varieties you may have acquired earlier. Go to the My Forms tab of your profile and acquire another version of the file you want.

If you are a brand new end user of US Legal Forms, listed below are easy instructions that you can adhere to:

- Very first, make certain you have selected the right type for your personal city/region. It is possible to check out the shape making use of the Preview switch and read the shape description to make certain this is basically the best for you.

- In case the type fails to fulfill your needs, utilize the Seach discipline to obtain the proper type.

- Once you are positive that the shape is suitable, select the Get now switch to find the type.

- Select the costs program you desire and type in the necessary information. Create your profile and pay for an order using your PayPal profile or bank card.

- Select the document format and obtain the authorized file design for your system.

- Complete, edit and printing and indication the received North Dakota Short Sale Affidavit of Buyer.

US Legal Forms is definitely the greatest collection of authorized varieties in which you will find different file web templates. Use the service to obtain skillfully-made files that adhere to status demands.