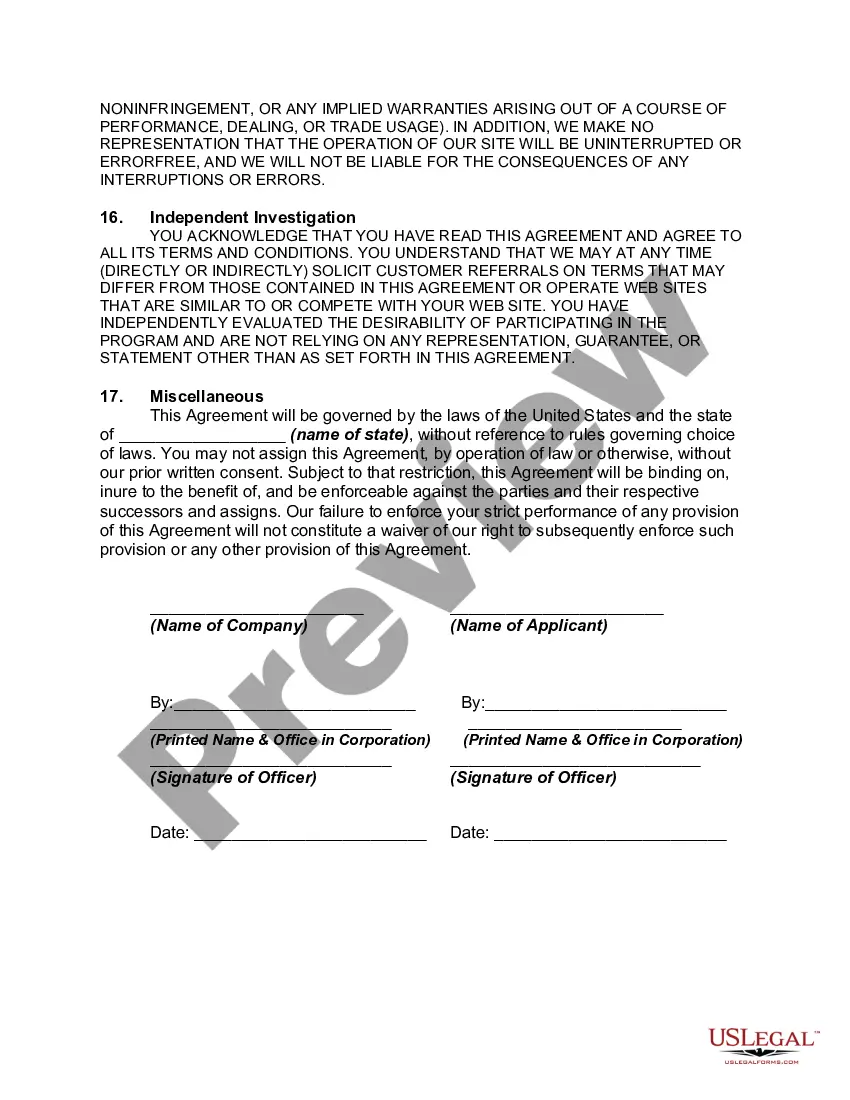

North Dakota Non-Exclusive Online Affiliate Program Agreement

Description

How to fill out Non-Exclusive Online Affiliate Program Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent iterations of forms such as the North Dakota Non-Exclusive Online Affiliate Program Agreement in seconds.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your choice by selecting the Purchase now button. Then, choose your preferred payment plan and provide your details to register for an account.

- If you already have a subscription, Log In to download the North Dakota Non-Exclusive Online Affiliate Program Agreement from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms through the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure to select the correct form for the city/state.

- Click the Review button to check the form’s details.

Form popularity

FAQ

Yes, independent contractors can participate as affiliates under the North Dakota Non-Exclusive Online Affiliate Program Agreement. These contractors can leverage their skills and networks to market products effectively and earn commissions. This flexibility allows independent contractors to diversify their income streams through affiliate marketing.

While making $10,000 a month with affiliate marketing is possible, it requires a solid strategy and consistent effort. The North Dakota Non-Exclusive Online Affiliate Program Agreement provides a framework that can help you structure your affiliate activities effectively. Success in this field depends on your ability to drive traffic, convert leads, and nurture relationships with your audience.

Yes, individuals can become affiliates under the North Dakota Non-Exclusive Online Affiliate Program Agreement. This program allows individuals to earn commissions by promoting products and driving sales. With the right strategy and effort, anyone can leverage affiliate marketing to create a profitable income stream.

An affiliate arrangement is a mutual agreement between an affiliate and a business to collaborate on marketing efforts. This arrangement, as described in the North Dakota Non-Exclusive Online Affiliate Program Agreement, defines how affiliates will promote products and receive compensation. A clear affiliate arrangement helps align both parties for mutual success.

The contract for affiliate marketing outlines the terms and conditions between an affiliate and a business. Within the scope of the North Dakota Non-Exclusive Online Affiliate Program Agreement, this contract details commission structures, payment terms, and expectations for both parties. Understanding this contract is crucial for protecting your rights and ensuring smooth operations.

An independent affiliate is an individual or business that promotes products or services independently, typically under an affiliate marketing agreement. With the North Dakota Non-Exclusive Online Affiliate Program Agreement, these affiliates can earn commissions on sales generated through their efforts. They operate without the direct supervision of a company, giving them flexibility in how they market.

In North Dakota, the withholding tax for non-resident partners is typically based on the share of income received from the partnership. Under the North Dakota Non-Exclusive Online Affiliate Program Agreement, non-resident partners may need to file certain forms to ensure compliance with state tax laws. It's essential for affiliates to understand their tax obligations to avoid any penalties.

In North Dakota, capital gains tax rates fluctuate based on your taxable income and specific circumstances surrounding the sale of assets. The state generally taxes capital gains as ordinary income, so effective tax planning is essential. Engaging in an agreement like the North Dakota Non-Exclusive Online Affiliate Program Agreement may have implications on your capital gains tax, making it important to stay informed.

North Dakota offers a Pass-Through Entity (PTE) election, allowing certain business entities to pass income directly to their owners for tax purposes. This can provide a tax advantage, depending on your business structure. If you are considering the North Dakota Non-Exclusive Online Affiliate Program Agreement, this election can influence your overall tax strategy.

In North Dakota, business owners can choose various forms of partnerships, including general partnerships and limited partnerships. The choice of partnership form impacts taxation and liability, so it's crucial to select the right one for your business goals. If you are exploring opportunities like the North Dakota Non-Exclusive Online Affiliate Program Agreement, understanding partnership structures will guide your decisions.