North Dakota Reorganization of Partnership by Modification of Partnership Agreement is a legal process that allows partners within a partnership to alter the terms and conditions of their existing partnership agreement. This modification can be made to reorganize the partnership structure, align with changing business needs, or address evolving partnership dynamics. It enables partners to make necessary adjustments without dissolving the partnership and forming a new one. Keywords: North Dakota, reorganization of partnership, modification of partnership agreement, partnership structure, business needs, partnership dynamics. There are several types of North Dakota Reorganization of Partnership by Modification of Partnership Agreement that partners can consider, depending on their specific circumstances: 1. Economic realignment: This type of reorganization involves adjusting the financial or capital contributions of partners within the partnership, reallocating profit-sharing ratios, or modifying the distribution of assets and liabilities. It may be implemented to reflect changes in partners' investment levels, financial performance, or to accommodate new investment opportunities. 2. Governance restructuring: Partnerships might undergo governance restructuring to change decision-making processes, managerial responsibilities, or voting rights. This modification can help in balancing decision-making power, assigning specialized roles, or accommodating the entry of new partners with specific skills or expertise. 3. Ownership transfer: In this type of reorganization, partners may decide to transfer or redistribute their ownership interests within the partnership. This typically occurs when a partner wishes to exit the partnership and sell their interests to another partner or external party. The modification helps facilitate a smooth transition of ownership and ensures partners' interests are properly accounted for. 4. Admission or withdrawal of partners: A partnership can be modified to add new partners, either by admitting existing members' associates or by bringing in entirely new partners. Conversely, partners can also use this reorganization method to remove or retire partners who no longer wish to be part of the partnership. 5. Restructuring for tax benefits: Partners may consider modifying the partnership agreement to take advantage of tax benefits or comply better with changing tax regulations. This may involve altering the partnership's legal or ownership structure, ensuring maximum tax efficiency and minimizing potential liabilities. Ultimately, the North Dakota Reorganization of Partnership by Modification of Partnership Agreement provides partners with a legal framework to adapt their partnership to changing circumstances, enabling smooth business operations, and ensuring the partnership's longevity and success.

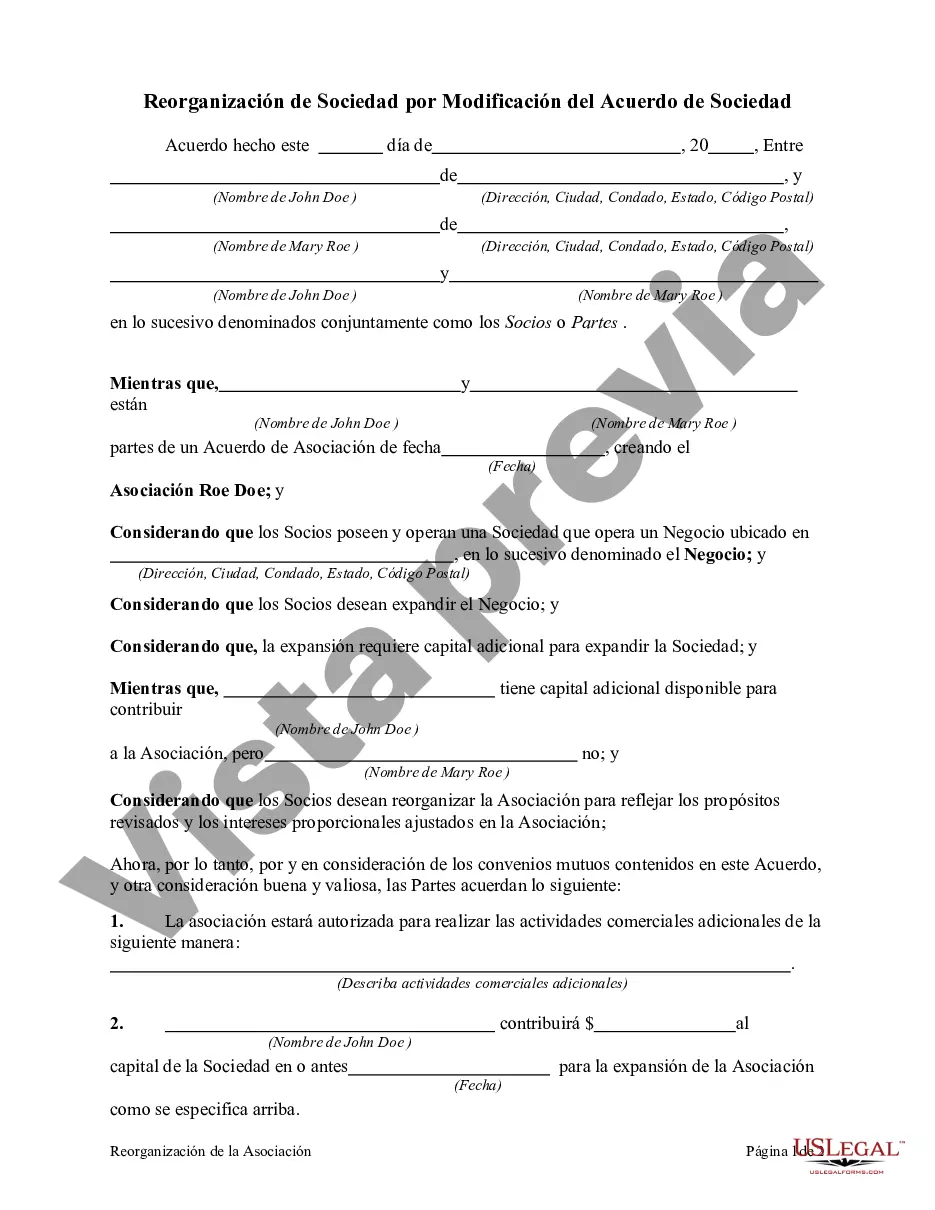

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Reorganización de Sociedad por Modificación del Acuerdo de Sociedad - Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out North Dakota Reorganización De Sociedad Por Modificación Del Acuerdo De Sociedad?

If you have to complete, acquire, or produce legal record layouts, use US Legal Forms, the largest assortment of legal kinds, which can be found online. Use the site`s easy and convenient lookup to obtain the papers you will need. Various layouts for business and personal functions are sorted by categories and states, or key phrases. Use US Legal Forms to obtain the North Dakota Reorganization of Partnership by Modification of Partnership Agreement within a handful of mouse clicks.

When you are previously a US Legal Forms client, log in to your profile and click the Down load option to get the North Dakota Reorganization of Partnership by Modification of Partnership Agreement. You may also entry kinds you formerly saved in the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate area/nation.

- Step 2. Take advantage of the Preview option to look through the form`s content material. Don`t forget to learn the description.

- Step 3. When you are unhappy using the type, utilize the Look for industry towards the top of the monitor to locate other versions of the legal type format.

- Step 4. After you have identified the form you will need, go through the Get now option. Pick the rates plan you prefer and include your qualifications to sign up for the profile.

- Step 5. Procedure the deal. You should use your charge card or PayPal profile to complete the deal.

- Step 6. Find the structure of the legal type and acquire it in your system.

- Step 7. Complete, change and produce or indicator the North Dakota Reorganization of Partnership by Modification of Partnership Agreement.

Each legal record format you purchase is yours eternally. You possess acces to each type you saved with your acccount. Click the My Forms portion and choose a type to produce or acquire again.

Remain competitive and acquire, and produce the North Dakota Reorganization of Partnership by Modification of Partnership Agreement with US Legal Forms. There are thousands of skilled and condition-distinct kinds you can utilize for your personal business or personal needs.