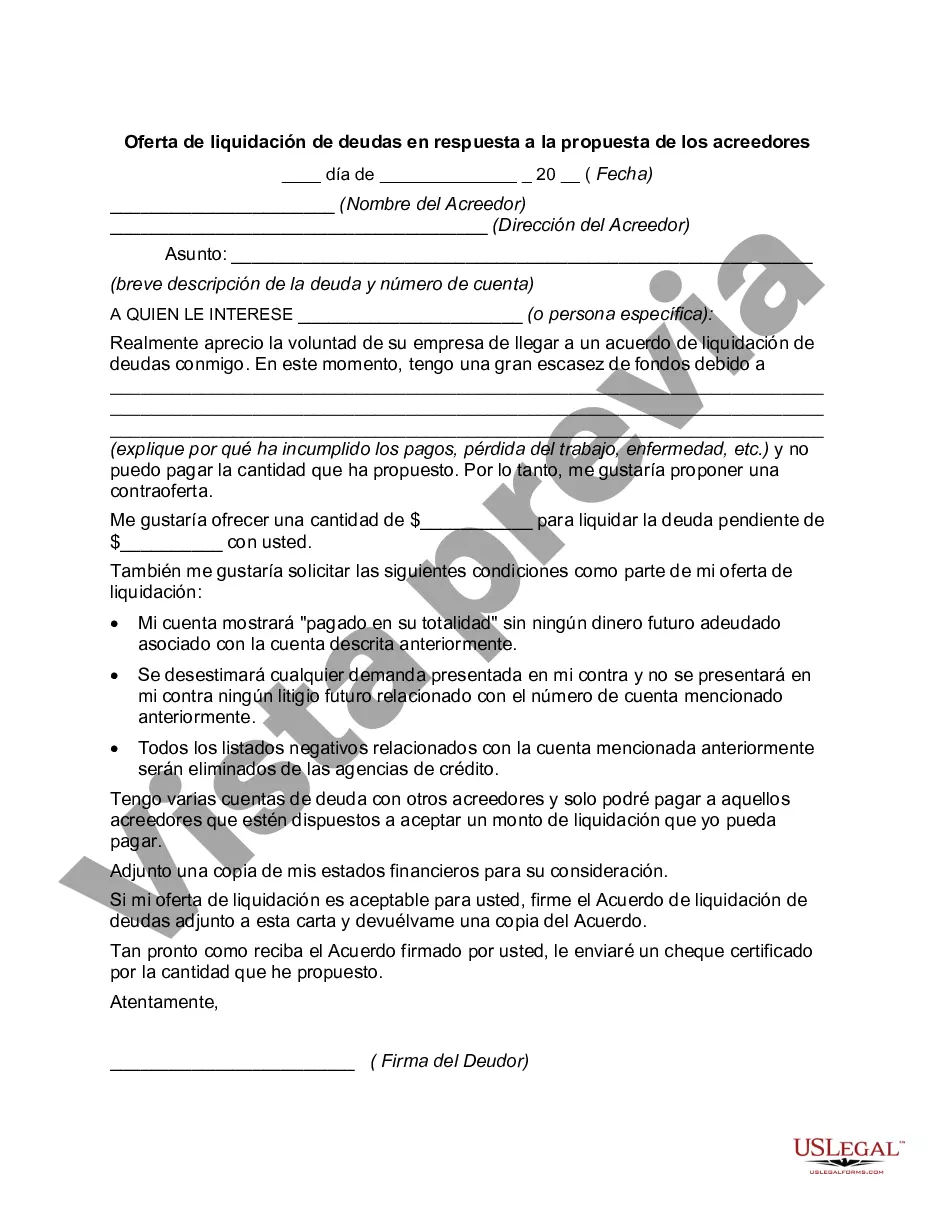

North Dakota Debt Settlement Offer in Response to Creditor's Proposal is a process where individuals or businesses in North Dakota negotiate with creditors to settle their outstanding debts for a reduced amount. This offer is made in response to a proposal put forth by the creditor regarding a repayment plan or possible forgiveness of a portion of the debt. The North Dakota Debt Settlement Offer in Response to Creditor's Proposal can vary depending on the circumstances and the type of debt involved. Some different types of debt settlement offers in North Dakota may include: 1. Credit Card Debt Settlement Offer: This is a common type of debt settlement where individuals negotiate with credit card companies to settle their outstanding balances for a reduced amount. 2. Medical Debt Settlement Offer: People facing overwhelming medical bills can negotiate with healthcare providers or collection agencies to settle their medical debts for a lower sum. 3. Personal Loan Debt Settlement Offer: Those with personal loans in North Dakota can work with creditors to negotiate a settlement offer for a reduced amount to resolve their debt. 4. Student Loan Debt Settlement Offer: While it may be challenging to settle student loan debt, individuals can explore negotiation options with lenders or loan services to reach a manageable settlement. 5. Business Debt Settlement Offer: Businesses struggling with outstanding debts can enter into negotiations with creditors to settle their debts, often resulting in reduced payment amounts or extended repayment terms. When responding to a creditor's proposal, the North Dakota Debt Settlement Offer typically includes specific details such as the proposed settlement amount, a timeline for repayment, and any terms or conditions agreed upon by both parties. It is crucial for debtors to carefully assess their financial situation and engage in open and honest discussions with creditors to reach a mutually beneficial resolution. It's important to note that debt settlement offers may impact an individual's credit score and financial history. Therefore, individuals in North Dakota should consider consulting with a financial professional or a reputable debt settlement company to navigate the process effectively and understand any potential consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out North Dakota Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

If you wish to comprehensive, download, or print out authorized file web templates, use US Legal Forms, the largest variety of authorized kinds, that can be found on the Internet. Utilize the site`s simple and convenient lookup to find the files you will need. Different web templates for organization and individual purposes are categorized by types and suggests, or keywords. Use US Legal Forms to find the North Dakota Debt Settlement Offer in Response to Creditor's Proposal in just a number of clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and then click the Obtain option to have the North Dakota Debt Settlement Offer in Response to Creditor's Proposal. You may also accessibility kinds you earlier downloaded within the My Forms tab of the bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape for that proper city/land.

- Step 2. Make use of the Review solution to examine the form`s content material. Do not overlook to read the description.

- Step 3. In case you are unsatisfied using the develop, utilize the Search area at the top of the monitor to discover other versions in the authorized develop template.

- Step 4. After you have discovered the shape you will need, select the Get now option. Choose the pricing plan you prefer and add your credentials to sign up for the bank account.

- Step 5. Approach the purchase. You may use your bank card or PayPal bank account to complete the purchase.

- Step 6. Pick the structure in the authorized develop and download it on your own gadget.

- Step 7. Full, change and print out or indication the North Dakota Debt Settlement Offer in Response to Creditor's Proposal.

Each and every authorized file template you buy is your own property permanently. You have acces to each and every develop you downloaded inside your acccount. Select the My Forms segment and decide on a develop to print out or download again.

Contend and download, and print out the North Dakota Debt Settlement Offer in Response to Creditor's Proposal with US Legal Forms. There are millions of specialist and express-particular kinds you can use for the organization or individual demands.