North Dakota Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor pertains to the distinction between an employee, a self-employed individual, and an independent contractor in the state of North Dakota. This instruction provides guidance to a jury on how to determine the employment status of an individual and has relevance to cases involving employment disputes, workers' compensation claims, and taxation matters. Keywords: North Dakota, jury instruction, employee, self-employed, independent contractor, employment status, employment dispute, workers' compensation, taxation. In employment law cases, it is essential to differentiate between employees, self-employed individuals, and independent contractors as their rights, obligations, and legal protections differ significantly. North Dakota Jury Instruction — 1.9.4.1 assists jurors in understanding the criteria for classifying an individual's employment status within these three categories. There are different types of employment relationships addressed within North Dakota Jury Instruction — 1.9.4.1. The first type is an employee, defined as an individual who works under the control and direction of an employer, receives wages or salary, and is subject to the employer's right to control the details and methods of their work. The second type is a self-employed individual. This category typically includes individuals who operate their own businesses, control their work arrangements, and have the freedom to determine the projects they undertake and the clients they work for. They often provide services to various entities and are responsible for their own taxes, social security contributions, and benefits. Lastly, North Dakota Jury Instruction — 1.9.4.1 addresses independent contractors. Independent contractors are individuals who enter into agreements to provide specific services for clients or businesses. Unlike employees, independent contractors typically have more control and independence in their work, including the ability to set their own hours, use their tools, and determine how to complete the contracted tasks. Determining the correct employment status of an individual is crucial because it affects various legal aspects such as workers' compensation eligibility, tax withholding requirements, insurance coverage, and the existence of an employer-employee relationship. Cases involving misclassification of workers as independent contractors when they should be deemed employees can result in legal disputes, unpaid benefits, and potential violations of labor laws. North Dakota Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor provides jurors with guidelines to help them assess the specific facts and circumstances of an individual's work arrangement. By analyzing factors such as the level of control exerted by the employer, the degree of financial investment by the worker, the provision of employee benefits, the intent of the parties, and the degree of skill required, the jury can make an informed decision on the individual's proper classification. In conclusion, North Dakota Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor is a critical legal instruction that assists jurors in determining whether an individual should be classified as an employee, self-employed, or an independent contractor. This instruction provides clarity on the different types of employment relationships and their respective implications for worker rights, obligations, and legal protections.

North Dakota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

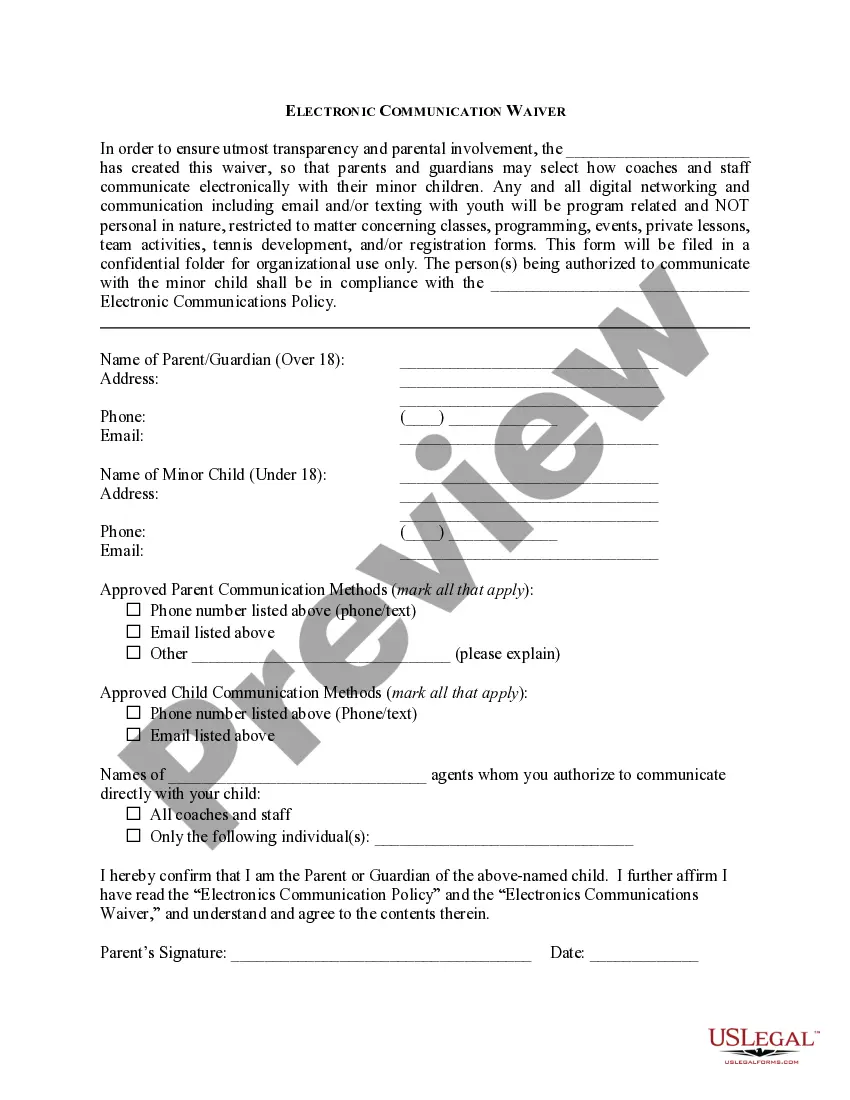

How to fill out North Dakota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

US Legal Forms - one of the largest libraries of legitimate varieties in the USA - delivers an array of legitimate papers templates you are able to download or produce. Making use of the web site, you will get a huge number of varieties for enterprise and person purposes, sorted by groups, says, or keywords and phrases.You can get the most recent types of varieties like the North Dakota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor within minutes.

If you already have a subscription, log in and download North Dakota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor through the US Legal Forms library. The Obtain key can look on every develop you look at. You get access to all earlier delivered electronically varieties inside the My Forms tab of your own account.

If you would like use US Legal Forms initially, allow me to share basic guidelines to get you started off:

- Be sure to have chosen the proper develop for your city/region. Click the Preview key to check the form`s content. See the develop outline to actually have selected the proper develop.

- When the develop doesn`t fit your demands, use the Lookup discipline towards the top of the display screen to find the one who does.

- When you are pleased with the form, verify your choice by visiting the Buy now key. Then, opt for the costs prepare you favor and supply your credentials to sign up for the account.

- Procedure the financial transaction. Make use of your charge card or PayPal account to accomplish the financial transaction.

- Pick the file format and download the form on your gadget.

- Make modifications. Complete, revise and produce and indicator the delivered electronically North Dakota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor.

Every design you put into your bank account does not have an expiry particular date and is also your own property forever. So, if you wish to download or produce an additional duplicate, just visit the My Forms area and then click around the develop you want.

Obtain access to the North Dakota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor with US Legal Forms, by far the most comprehensive library of legitimate papers templates. Use a huge number of skilled and state-specific templates that fulfill your company or person requirements and demands.