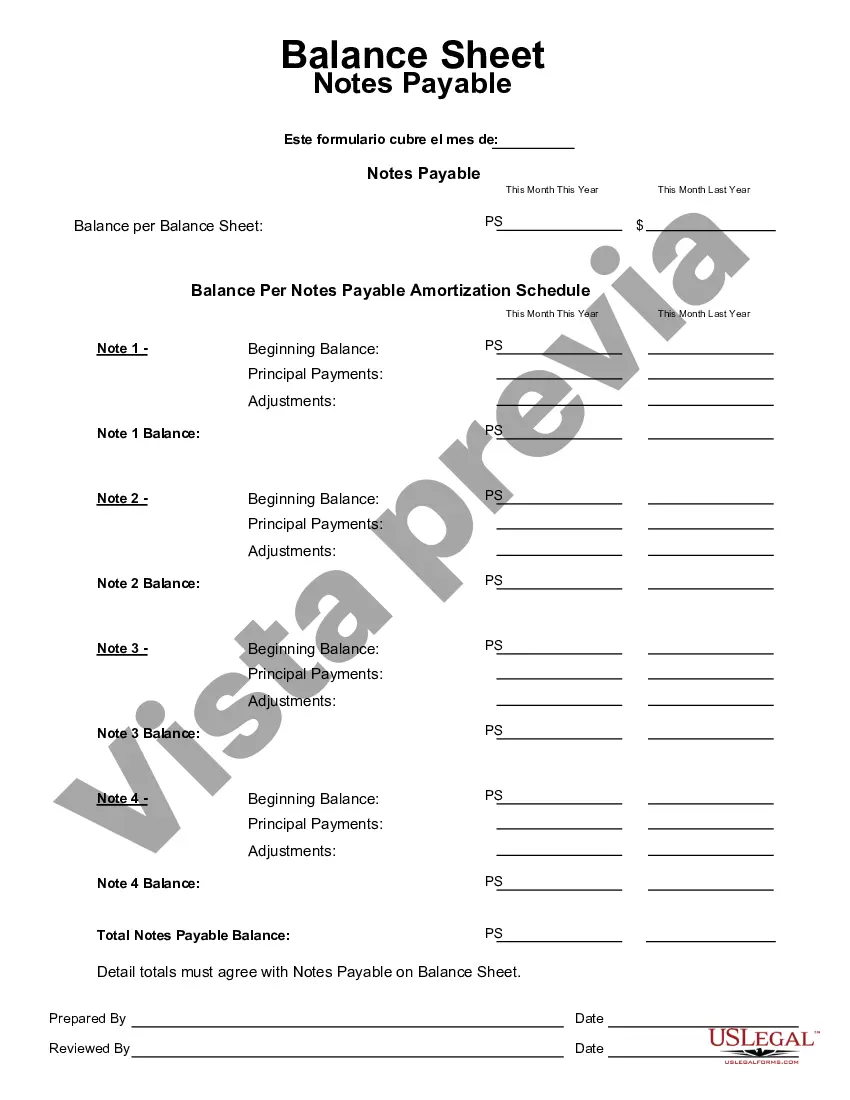

North Dakota Balance Sheet Notes Payable is a financial document that outlines the liabilities owed by a company or organization in North Dakota. This specific section of the balance sheet provides detailed information regarding the debts incurred by the entity and the terms of their repayment. Notes Payable encompass different types of financial obligations, which may vary based on their source and duration, as explained below. 1. Long-term Notes Payable: These are liabilities with a maturity period exceeding one year. Examples include bonds, mortgages, or loans with extended repayment terms. Long-term Notes Payable commonly involve larger sums of money and generally have lower interest rates to incentivize borrowing for long-term ventures. 2. Short-term Notes Payable: These are liabilities that come due within a year. They often represent immediate financial obligations, such as accrued expenses, current portion of long-term debts, or short-term loans. Short-term Notes Payable typically hold higher interest rates due to the shorter timeframe involved. 3. Promissory Notes: These are legal documents stating the borrower's promise to repay a specific amount within a specified period. Promissory notes can be utilized for various purposes, including personal loans, business investments, or financing arrangements. They provide a written record of the debt's terms, interest rate, and repayment schedule. 4. Credit Lines or Revolving Credit: This type of Notes Payable represents a pre-approved borrowing limit provided by a financial institution, enabling businesses to access funds when needed. Credit lines often have variable interest rates and flexible repayment terms, allowing companies to manage short-term liquidity needs efficiently. 5. Trade Payables: These are obligations resulting from purchases made by a company on credit terms from suppliers or vendors. Trade payables typically include accounts payable, outstanding invoices, or accrued expenses. They represent short-term liabilities that arise from regular business operations. In summary, North Dakota Balance Sheet Notes Payable is a crucial financial record delineating the various types of debts an entity bears. Companies in North Dakota can have different Notes Payable, including long-term and short-term obligations, promissory notes, credit lines, and trade payables. By accurately tracking and managing these liabilities, businesses can maintain a clear overview of their financial obligations and effectively plan for future growth and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Balance Notas por Pagar - Balance Sheet Notes Payable

Description

How to fill out North Dakota Balance Notas Por Pagar?

Have you been within a situation where you need to have documents for possibly organization or person uses just about every day time? There are plenty of legal papers layouts available on the net, but discovering types you can trust isn`t simple. US Legal Forms provides thousands of form layouts, much like the North Dakota Balance Sheet Notes Payable, which are published to fulfill federal and state demands.

In case you are presently informed about US Legal Forms website and have a free account, just log in. Next, you can acquire the North Dakota Balance Sheet Notes Payable template.

If you do not provide an accounts and would like to start using US Legal Forms, follow these steps:

- Discover the form you will need and ensure it is for your correct area/county.

- Take advantage of the Preview switch to examine the form.

- Look at the description to actually have selected the proper form.

- In case the form isn`t what you`re searching for, utilize the Lookup field to discover the form that meets your needs and demands.

- Once you discover the correct form, click on Buy now.

- Select the costs plan you would like, complete the necessary info to generate your account, and buy your order with your PayPal or credit card.

- Select a practical document format and acquire your backup.

Find each of the papers layouts you may have bought in the My Forms food list. You can aquire a further backup of North Dakota Balance Sheet Notes Payable any time, if possible. Just click on the necessary form to acquire or print the papers template.

Use US Legal Forms, probably the most substantial variety of legal varieties, to save some time and avoid mistakes. The services provides expertly made legal papers layouts that can be used for an array of uses. Create a free account on US Legal Forms and start producing your lifestyle a little easier.