North Dakota Balance Sheet Notes Payable

Description

How to fill out Balance Sheet Notes Payable?

Have you encountered a circumstance where you require documents for potential organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of form templates, such as the North Dakota Balance Sheet Notes Payable, which are designed to meet federal and state requirements.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the North Dakota Balance Sheet Notes Payable template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific area/county.

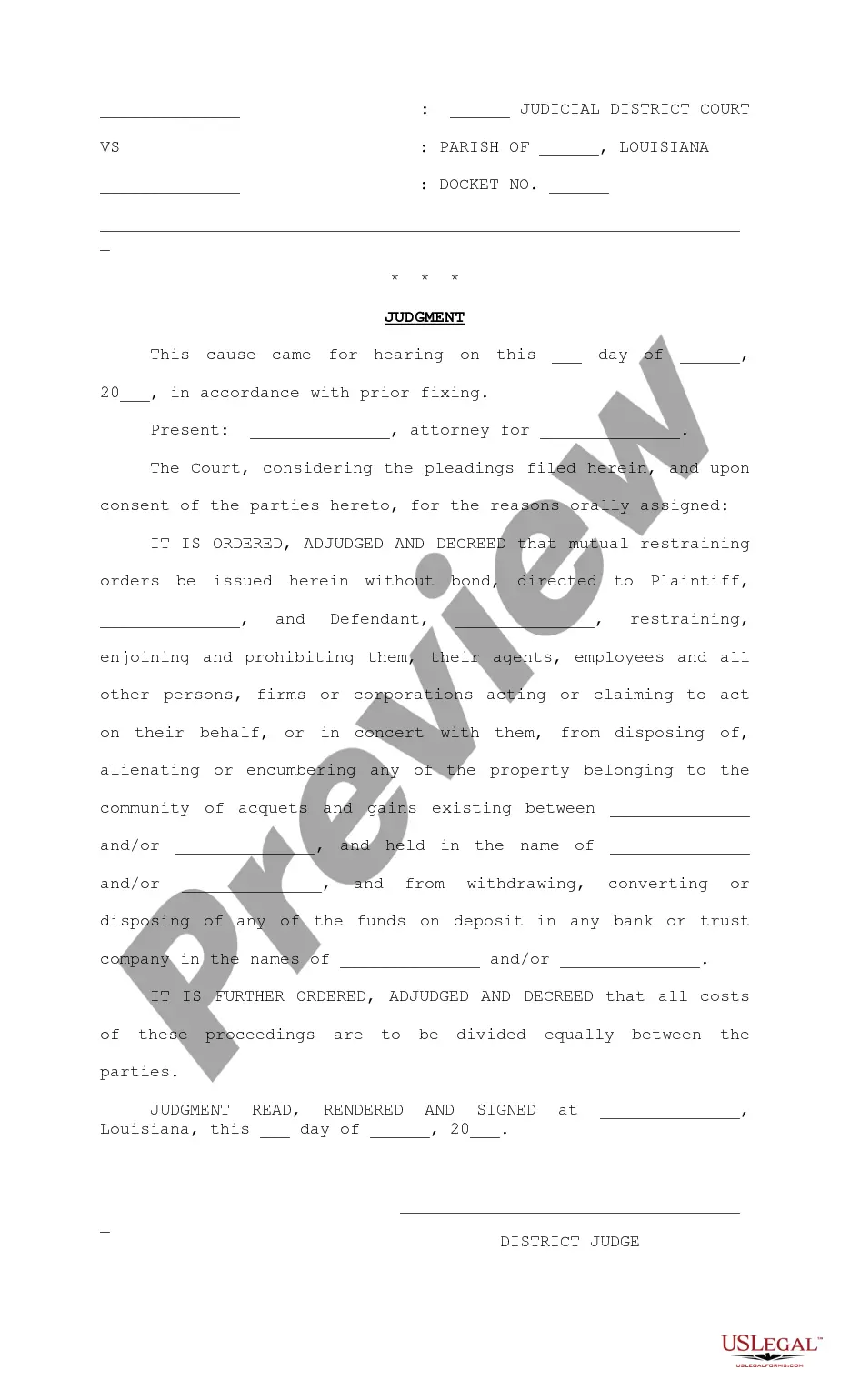

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

On the left side of the balance sheet, companies list their assets. On the right side, they list their liabilities and shareholders' equity.

How to Prepare a Basic Balance SheetDetermine the Reporting Date and Period.Identify Your Assets.Identify Your Liabilities.Calculate Shareholders' Equity.Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.10-Sept-2019

Remember the left side of your balance sheet (assets) must equal the right side (liabilities + owners' equity).

Liabilities are on the right side of the accounting equation. Liability account balances should be on the right side of the accounts. Thus liability accounts such as Accounts Payable, Notes Payable, Wages Payable, and Interest Payable should have credit balances.

Accounts payable is listed on a company's balance sheet. Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet.

LiabilitiesLiabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of what the company owes. With liabilities, this is obviousyou owe loans to a bank, or repayment of bonds to holders of debt.

All balance sheets follow the same format: when two columns are used, assets are on the left, liabilities are on the right, and net worth is beneath liabilities. When one column is used, assets are listed first, followed by liabilities and net worth.

In finance and accounting, accounts payable can serve as either a credit or a debit. Because accounts payable is a liability account, it should have a credit balance. The credit balance indicates the amount that a company owes to its vendors.

Notes to accounts generally represent the issue of shares, buyback programs, convertible shares, arrears, etc.

A standard company balance sheet has two sides: assets on the left, and financing on the rightwhich itself has two parts; liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity.