North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software: A Comprehensive Overview Keywords: North Dakota, revenue sharing agreement, income, licensing, custom modification, software. Introduction: In North Dakota, revenue sharing agreements play a vital role in income generation from the licensing and custom modification of software. These agreements define the terms and conditions by which parties can collaborate and share the revenue derived from software licensing and customization. Here, we provide a detailed description of what the North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software entails and outline any potential variations within this agreement. Description of the North Dakota Revenue Sharing Agreement: The North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software is a contractual arrangement between parties involved in activities related to software licensing and customization. The agreement governs the sharing of revenue generated from these activities in North Dakota. Key aspects of the agreement include: 1. Licensing Arrangements: The agreement outlines the terms and conditions for licensing software to third parties. It specifies the revenue sharing percentages or ratios between the involved parties, such as the software developers, distributors, and other relevant stakeholders. 2. Custom Modification Services: Additionally, the agreement covers revenue sharing related to custom modification services provided for software. It defines the revenue allocation between parties involved in the modification process, including developers, consultants, and clients. 3. Intellectual Property Rights: The agreement addresses the ownership and protection of intellectual property rights associated with the licensed software and custom modifications. It clarifies the rights, responsibilities, and limitations of the involved parties concerning intellectual property. 4. Revenue Calculation and Distribution: The document details how the revenue generated from licensing and custom modification will be calculated. It may include provisions for periodic financial reporting and auditing to ensure accurate revenue sharing. Clear guidelines are established for the distribution of revenue among the parties involved. 5. Non-Disclosure and Confidentiality: To maintain a secure and confidential environment, the agreement may include clauses stipulating non-disclosure and confidentiality obligations. This ensures that any sensitive information pertaining to the software, licensing arrangements, or custom modification procedures remains protected. Different Types of Revenue Sharing Agreements: While the North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software serves as a broad framework, various specific types or variations of this agreement can exist. Some potential variations include: 1. Percentage-based Revenue Sharing: This type of agreement determines revenue shares based on fixed or variable percentages. Parties involved agree upon a specific percentage allocation formula to distribute revenue generated from software licensing and customization activities. 2. Flat Fee Revenue Sharing: In this variation, parties may opt for a fixed fee structure, where revenue is shared based on set monetary amounts rather than percentages. This approach offers simplicity and predictability in revenue distribution. 3. Role-Based Revenue Sharing: Certain agreements may allocate revenue based on the roles and responsibilities of each party. For example, software developers may receive a higher share due to their primary role in creating and maintaining the software, while distributors may receive a smaller portion for their marketing and distribution efforts. Conclusion: The North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software provides a structured framework to distribute revenue generated through software licensing and customization. This agreement defines the rights, obligations, and revenue sharing methodologies among the involved parties. While variations may exist based on different revenue allocation models, the primary goal is to ensure a fair and transparent sharing of income in accordance with agreed-upon terms and conditions.

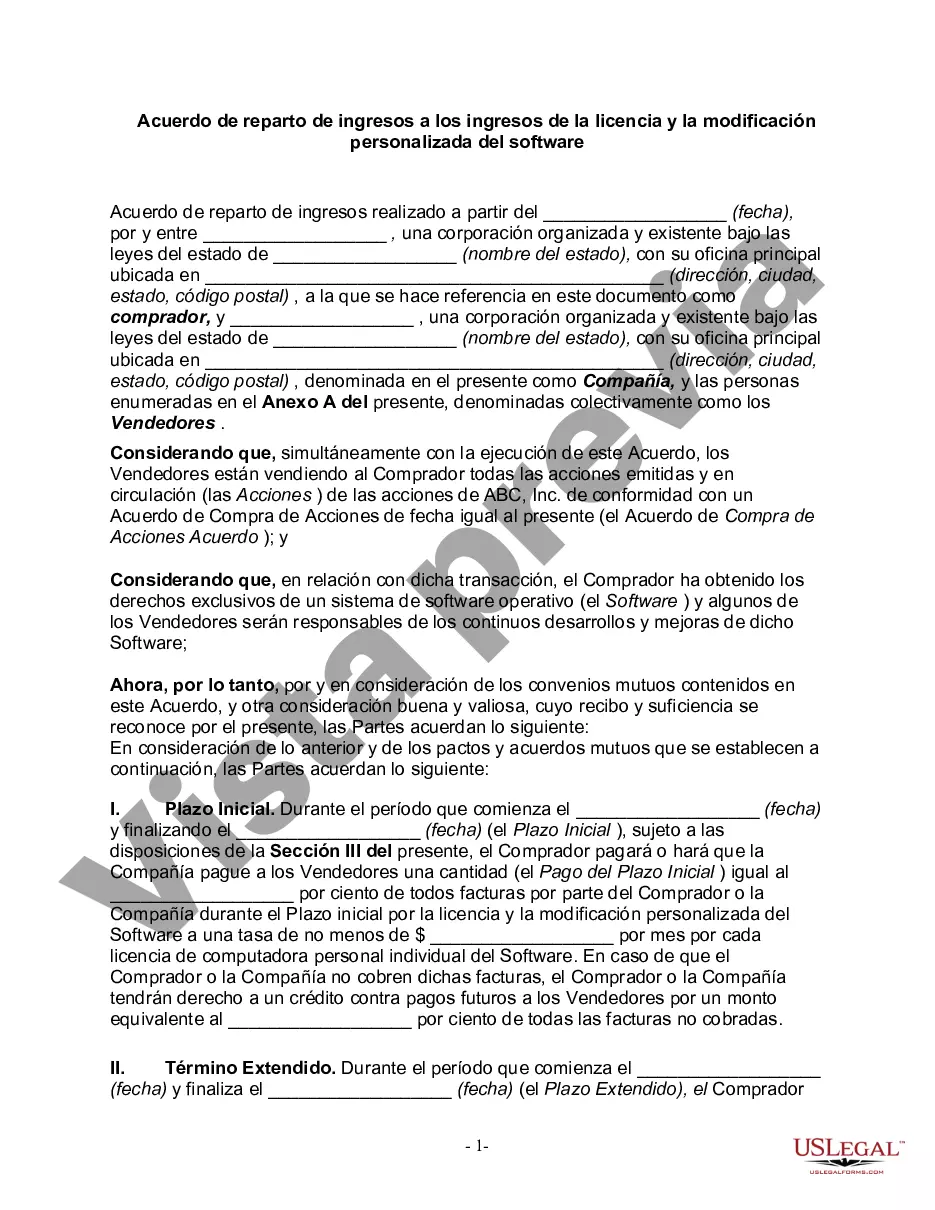

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out North Dakota Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

US Legal Forms - one of many greatest libraries of legal varieties in the United States - provides an array of legal record templates it is possible to obtain or print out. Utilizing the web site, you will get 1000s of varieties for company and individual reasons, categorized by types, says, or search phrases.You will discover the most up-to-date variations of varieties much like the North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software within minutes.

If you already have a subscription, log in and obtain North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software from your US Legal Forms catalogue. The Down load switch will show up on each and every form you see. You have accessibility to all formerly downloaded varieties within the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, listed here are straightforward recommendations to obtain began:

- Be sure to have selected the best form for the metropolis/county. Click the Preview switch to review the form`s information. Look at the form explanation to ensure that you have selected the proper form.

- If the form doesn`t match your needs, utilize the Research discipline near the top of the screen to obtain the one that does.

- In case you are content with the form, validate your selection by clicking the Get now switch. Then, pick the rates program you want and supply your qualifications to register on an profile.

- Approach the purchase. Use your charge card or PayPal profile to finish the purchase.

- Choose the formatting and obtain the form on your own system.

- Make alterations. Fill out, change and print out and indication the downloaded North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

Each and every design you put into your account lacks an expiry day which is your own eternally. So, if you would like obtain or print out another backup, just go to the My Forms segment and click around the form you will need.

Get access to the North Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software with US Legal Forms, the most comprehensive catalogue of legal record templates. Use 1000s of skilled and express-specific templates that meet your company or individual requirements and needs.