A North Dakota Private Annuity Agreement is a legally binding contract entered into between two parties, wherein one party, usually referred to as the annuitant, transfers property or assets to another party, known as the obliged, in exchange for guaranteed fixed payments over a specified period of time. This arrangement allows individuals or businesses in North Dakota to convert assets, such as real estate, stocks, or a small business, into a stream of income without the immediate tax consequences associated with selling or transferring the assets. The North Dakota Private Annuity Agreement provides several benefits for both parties involved. For the annuitant, it can be a tax-efficient method to defer capital gains tax and potentially reduce estate tax liability. The obliged, on the other hand, may benefit from the potential increase in value of the transferred asset over time, as well as the ability to generate income from it. It is important to note that while Private Annuity Agreements in North Dakota can be advantageous from a tax perspective, they must adhere to strict legal requirements to ensure their validity. Some of the key elements that need to be clearly outlined in the agreement include the duration and amount of payments, the transfer of property or assets, the exact roles and responsibilities of the annuitant and obliged, and any potential contingencies or termination clauses. Although there aren't specific types of North Dakota Private Annuity Agreements, they can be customized based on the unique circumstances and objectives of the parties involved. Some common variations include business annuities, real estate annuities, and family annuities. Business annuities involve transferring ownership of a business in exchange for annuity payments. This can be useful for owners looking to retire or pursue other ventures while still generating income from the business. Real estate annuities involve transferring ownership of real estate properties in exchange for annuity payments. This allows individuals to convert real estate assets into a steady income stream while potentially deferring tax payments. Family annuities, also known as intergenerational annuities, allow for the transfer of assets between family members. This type of annuity can provide estate planning benefits and help in transitioning wealth to the next generation in a tax-efficient manner. In summary, a North Dakota Private Annuity Agreement is a contractual arrangement that enables individuals or businesses to convert assets into a guaranteed stream of income while potentially deferring tax implications. While there aren't specific types of agreements, they can be tailored to different contexts such as business, real estate, or intergenerational transfers. Proper legal guidance is essential to ensure compliance with the relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

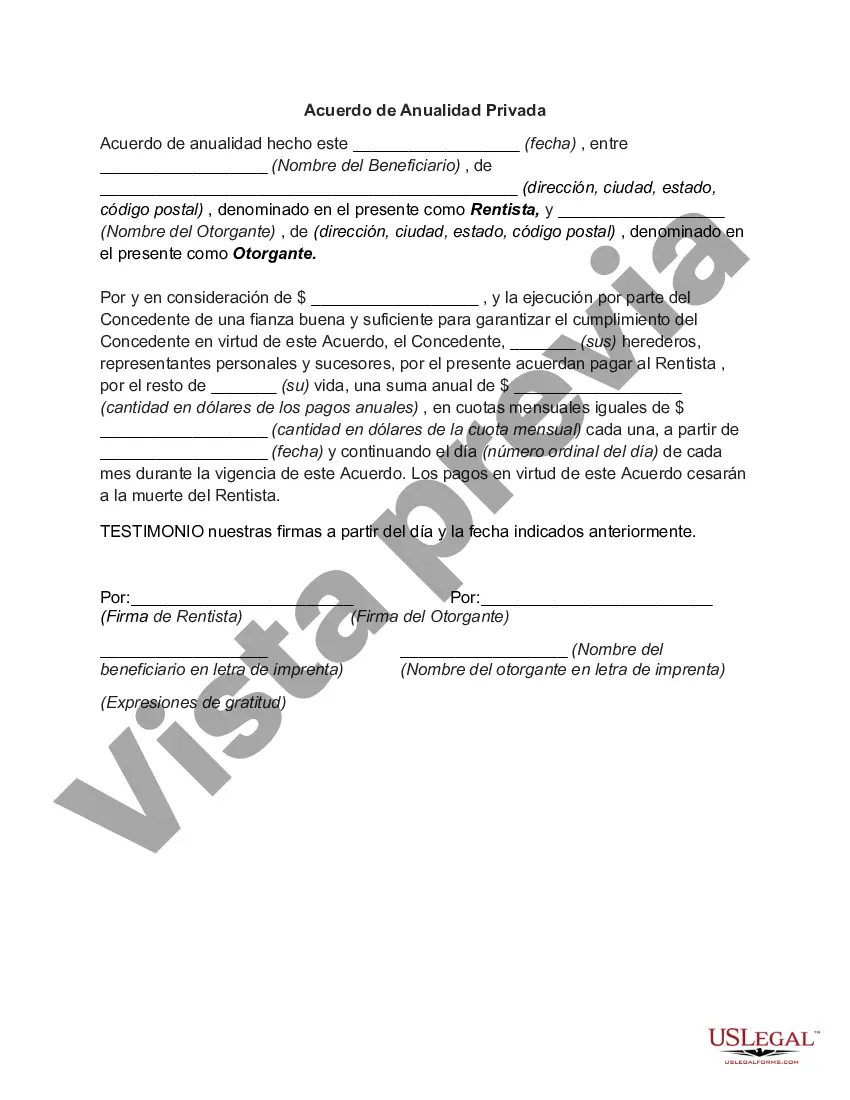

How to fill out North Dakota Acuerdo De Anualidad Privada?

US Legal Forms - one of many largest libraries of legitimate varieties in America - delivers an array of legitimate document layouts you may download or produce. Making use of the internet site, you may get 1000s of varieties for company and personal purposes, sorted by classes, says, or keywords and phrases.You will find the latest variations of varieties like the North Dakota Private Annuity Agreement within minutes.

If you already have a registration, log in and download North Dakota Private Annuity Agreement from the US Legal Forms local library. The Down load key will show up on every single develop you perspective. You gain access to all previously delivered electronically varieties inside the My Forms tab of the account.

In order to use US Legal Forms the first time, allow me to share straightforward directions to obtain began:

- Ensure you have selected the proper develop for your personal area/state. Select the Review key to check the form`s information. Read the develop information to actually have selected the right develop.

- When the develop doesn`t suit your specifications, use the Search field towards the top of the display to get the one which does.

- In case you are content with the form, validate your option by simply clicking the Get now key. Then, pick the pricing program you want and supply your references to sign up on an account.

- Method the financial transaction. Make use of bank card or PayPal account to accomplish the financial transaction.

- Select the format and download the form in your gadget.

- Make changes. Load, change and produce and indicator the delivered electronically North Dakota Private Annuity Agreement.

Every single template you included with your account does not have an expiration particular date and is also the one you have forever. So, if you wish to download or produce yet another backup, just visit the My Forms segment and click on in the develop you want.

Get access to the North Dakota Private Annuity Agreement with US Legal Forms, the most extensive local library of legitimate document layouts. Use 1000s of skilled and express-specific layouts that meet your business or personal requires and specifications.