North Dakota Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

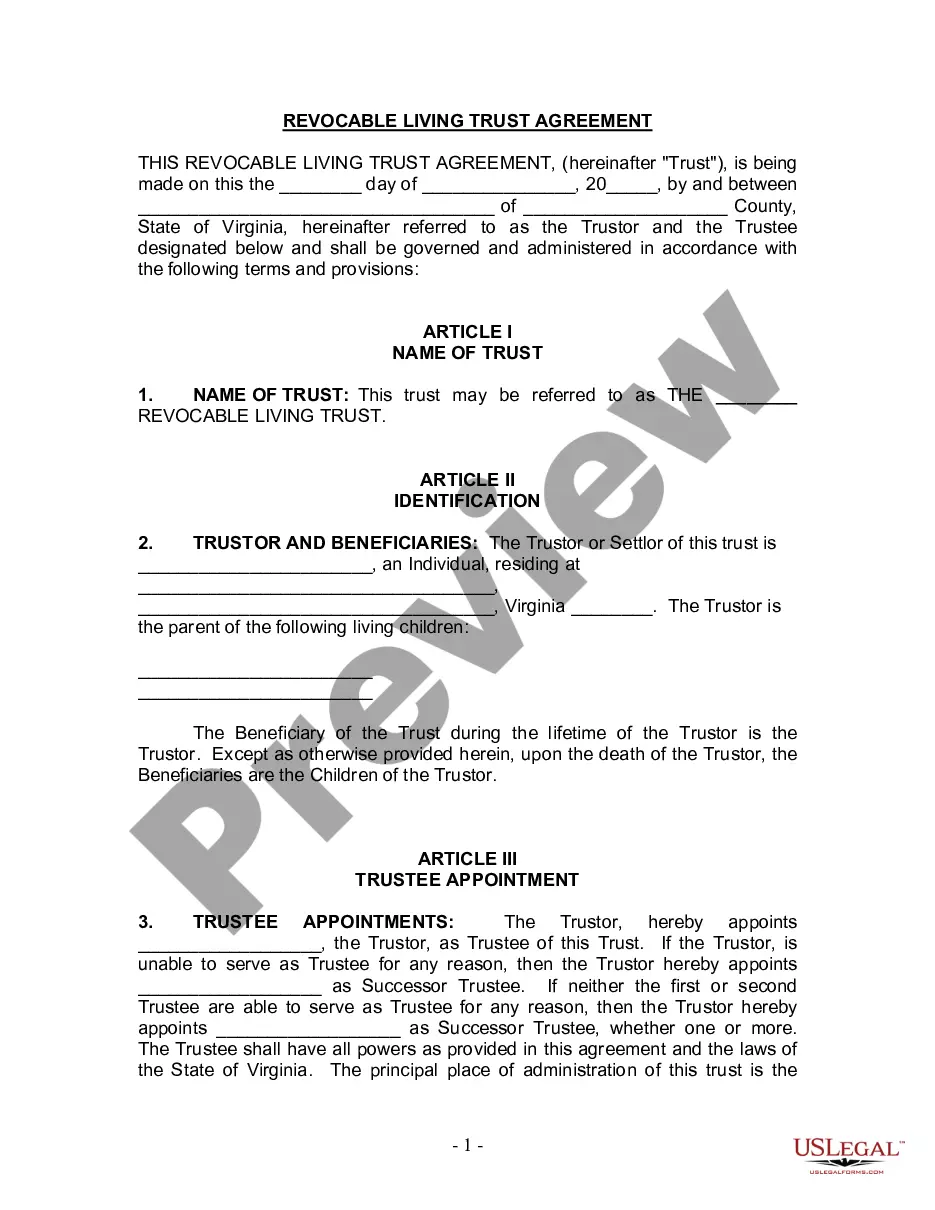

Finding the appropriate valid document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you identify the legal form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct document for your city/state. You can review the form using the Review button and read the form details to confirm it is the right one for you.

- This service provides thousands of templates, including the North Dakota Agreement Acquiring Share of Retiring Law Partner, suitable for both business and personal purposes.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the North Dakota Agreement Acquiring Share of Retiring Law Partner.

- Use your account to browse through the legal forms you may have purchased previously.

- Visit the My documents tab of your account to get another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

The withholding for a non-resident partner in North Dakota is typically determined based on the partner’s share of income. Following the guidelines provided by North Dakota’s tax code, partnerships, including those under a North Dakota Agreement Acquiring Share of Retiring Law Partner, must ensure accurate withholding rates. It's crucial to comply with these rules to avoid penalties. Consulting with a tax expert will provide clarity and support.