North Dakota Payroll Deduction — Special Services is a service offered to employees in North Dakota that allows them to have certain financial obligations deducted directly from their paychecks. This convenient payroll deduction system simplifies the process of managing payments for various services and expenses, ultimately ensuring that employees can easily meet their financial commitments. There are several types of North Dakota Payroll Deduction — Special Services that cater to different needs: 1. Health Insurance Deduction: This type of special service enables employees to have their health insurance premiums automatically deducted from their paychecks. By opting for this deduction method, employees can enjoy the convenience of consistent and timely premium payments, without worrying about missed or delayed payments. 2. Retirement Plan Contributions: The payroll deduction system also allows employees to contribute a portion of their earnings towards their retirement plan. With this special service, employees can effortlessly save and invest for their future, without needing to manually transfer funds to their retirement accounts. 3. Childcare Expenses Deduction: For working parents, this type of payroll deduction service helps cover childcare costs. By choosing this option, employees can allocate a specific amount from their paycheck toward childcare expenses, ensuring a seamless and consistent payment process for the services they utilize. 4. Charitable Donations Deduction: Many employees in North Dakota have the opportunity to support charitable causes through payroll deduction. This special service allows individuals to effortlessly donate a predetermined amount from their salary to the charitable organizations or campaigns of their choice. It simplifies the process of giving back to the community and makes charitable contributions more accessible. 5. Insurance Premium Deduction: Employees can also benefit from having various insurance policies' premiums deducted directly from their paychecks. This includes coverage such as life insurance, disability insurance, and other types of voluntary insurance plans. By utilizing this service, employees can efficiently manage their insurance expenses and ensure timely premium payments. North Dakota Payroll Deduction — Special Services provide employees with an array of options to simplify financial obligations directly from their paychecks. Each service is designed to cater to specific needs, thereby ensuring a convenient and streamlined process for both employees and employers. Whether it's health insurance premiums, retirement savings, childcare expenses, charitable donations, or insurance premiums, these special services contribute to a stress-free and organized approach to managing personal finances.

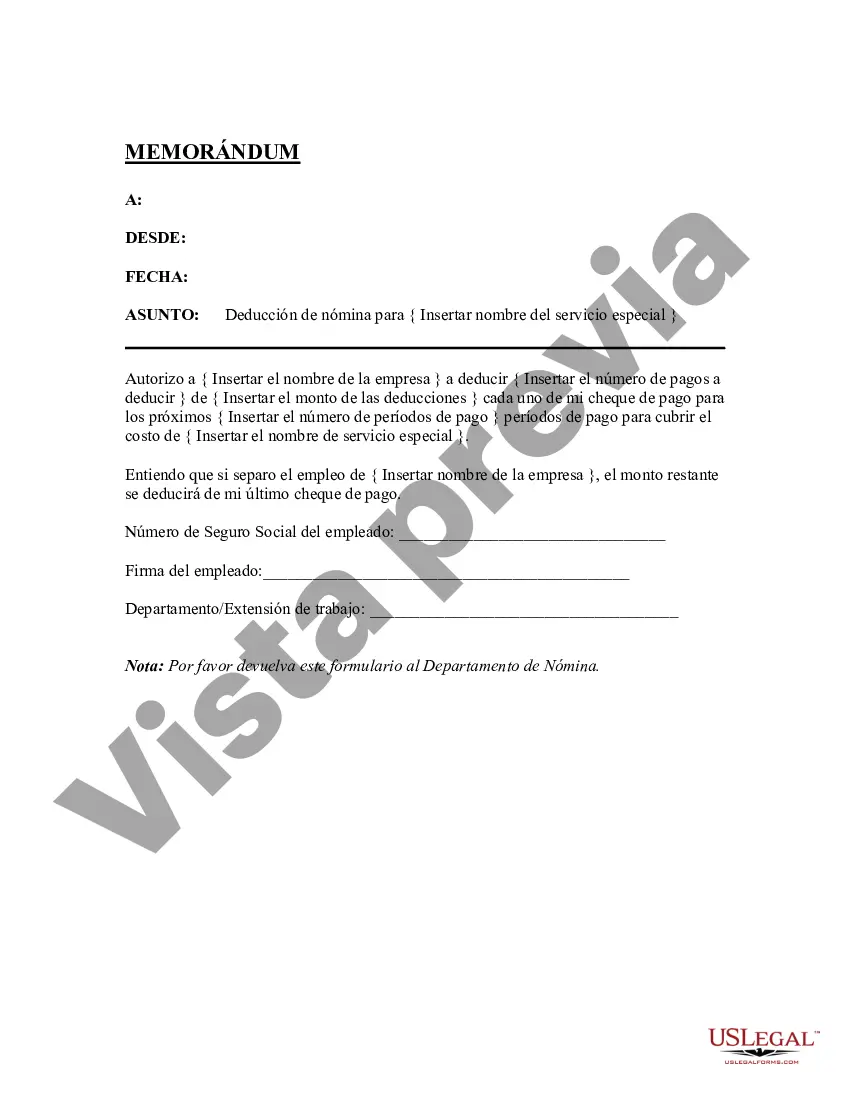

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out North Dakota Deducción De Nómina - Servicios Especiales?

If you have to complete, download, or printing legal record templates, use US Legal Forms, the greatest variety of legal varieties, that can be found on the Internet. Utilize the site`s simple and easy hassle-free search to discover the documents you need. Different templates for business and person uses are sorted by groups and suggests, or search phrases. Use US Legal Forms to discover the North Dakota Payroll Deduction - Special Services with a handful of mouse clicks.

When you are already a US Legal Forms buyer, log in to the bank account and click on the Acquire switch to find the North Dakota Payroll Deduction - Special Services. Also you can gain access to varieties you previously acquired in the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the proper town/land.

- Step 2. Utilize the Review option to look through the form`s articles. Never forget to learn the information.

- Step 3. When you are not satisfied with the type, utilize the Research discipline at the top of the screen to discover other models from the legal type format.

- Step 4. Once you have identified the shape you need, click on the Get now switch. Pick the prices program you favor and add your credentials to register for an bank account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal bank account to perform the purchase.

- Step 6. Select the file format from the legal type and download it on the device.

- Step 7. Complete, change and printing or indication the North Dakota Payroll Deduction - Special Services.

Every single legal record format you buy is yours permanently. You possess acces to each type you acquired within your acccount. Click on the My Forms section and pick a type to printing or download yet again.

Contend and download, and printing the North Dakota Payroll Deduction - Special Services with US Legal Forms. There are millions of professional and status-particular varieties you may use for your business or person requirements.