North Dakota Memorandum to Stop Direct Deposit

Description

How to fill out Memorandum To Stop Direct Deposit?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a diverse range of legal document formats that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of documents like the North Dakota Memorandum to Halt Direct Deposit within moments.

If you possess a registration, Log In and download the North Dakota Memorandum to Halt Direct Deposit from the US Legal Forms library. The Download option will appear on each document you view. You have access to all previously downloaded forms from the My documents section of your account.

Select the file format and download the document to your device.

Make modifications. Complete, edit, and print and sign the downloaded North Dakota Memorandum to Halt Direct Deposit. Every template you add to your account does not expire and is yours forever. Therefore, if you wish to download or print an additional version, simply visit the My documents section and click on the document you need.

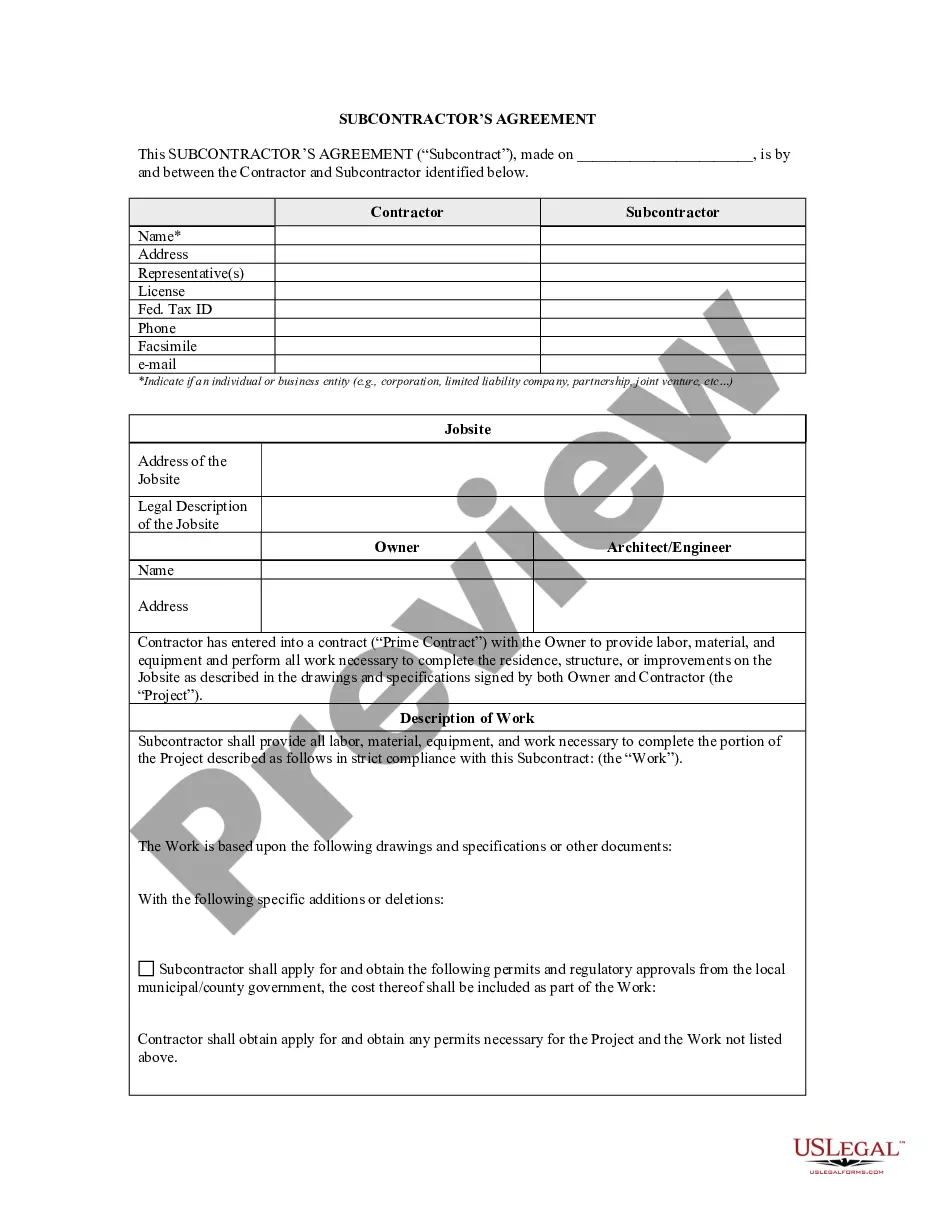

- Ensure you have selected the appropriate form for your city/state. Click the Preview option to review the document's details.

- Check the form description to confirm that you have chosen the correct one.

- If the document does not fit your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the document, validate your choice by clicking on the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to create an account.

- Process the transaction. Utilize your credit card or PayPal account to complete the purchase.

Form popularity

FAQ

The only way to get the money back is to work with the employee or contractor directly. If the entire amount of the direct deposit isn't available in the employee or contractor bank account, the reversal will be rejected, and no funds will be recovered.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a stop payment order. This instructs your bank to stop allowing the company to take payments from your account.

Employee Requests Direct Deposit be Stopped Depending on the situation, they may instruct the employee to reopen their account or contact the bank for assistance. If they determine the payment should be stopped, the payroll office can complete the stop pending form.

Cancellation by the employee: You may stop participating in direct deposit at any time by notifying your payroll office and completing a new Direct Deposit Enrollment Form. On a new form, check the Cancel Box, fill in your name, Social Security number then sign and date the form.

Disputes and unsuccessful reversals The only way to get the money back is to work with the employee or contractor directly. If the entire amount of the direct deposit isn't available in the employee or contractor bank account, the reversal will be rejected, and no funds will be recovered.