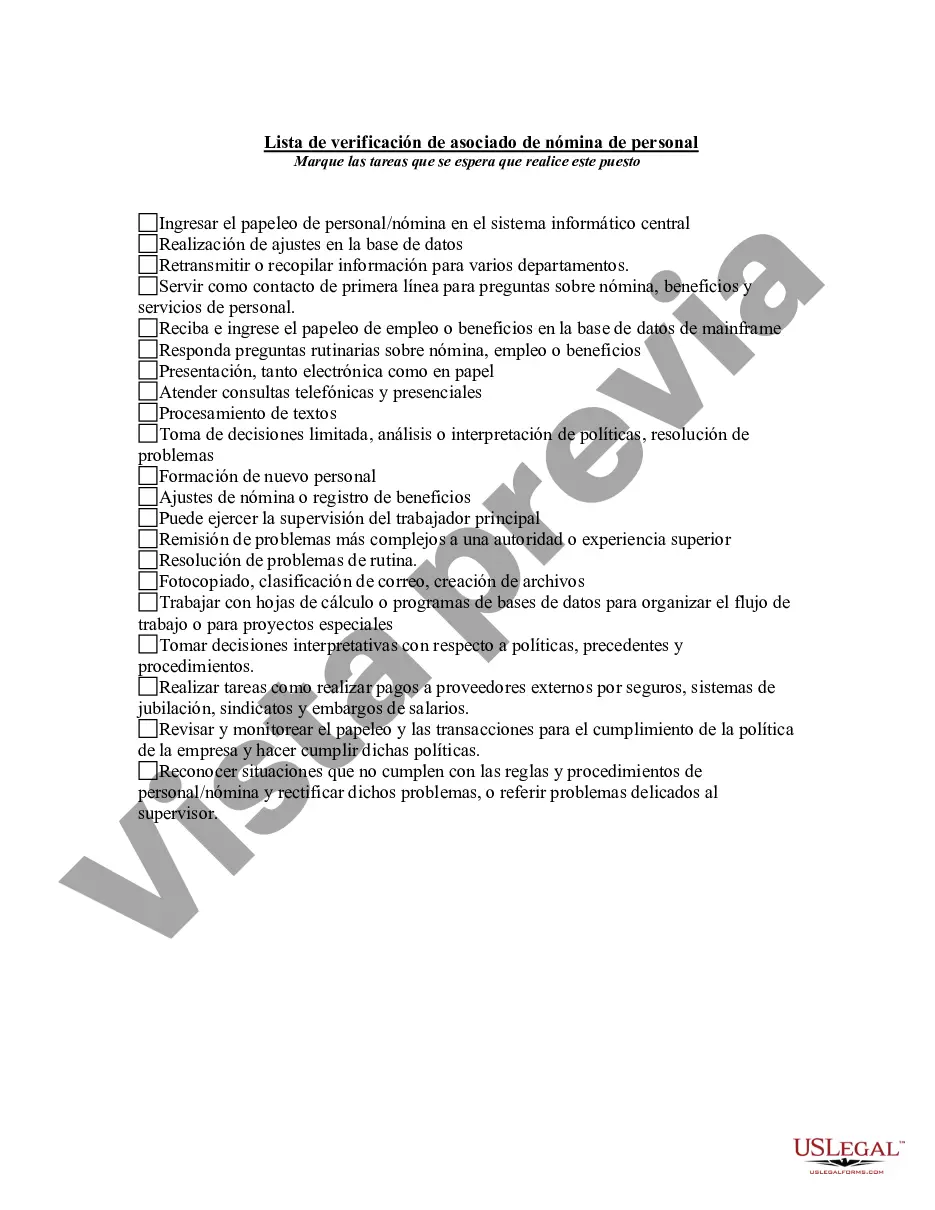

The North Dakota Personnel Payroll Associate Checklist is a comprehensive document that outlines the essential tasks and responsibilities of personnel payroll associates working in North Dakota. This checklist is crucial for ensuring accurate and timely payroll processing while adhering to the state's specific regulations and requirements. Keywords: North Dakota, personnel payroll, associate, checklist, tasks, responsibilities, accurate, timely, payroll processing, regulations, requirements. Different types of North Dakota Personnel Payroll Associate Checklists may include: 1. Monthly Payroll Processing Checklist: This checklist highlights the necessary steps to be followed each month for processing payroll accurately and on time. It includes tasks such as gathering employee work hours, calculating wages, deductions, and benefits, and preparing payroll reports. 2. Payroll Tax Compliance Checklist: This checklist specifically focuses on meeting North Dakota's payroll tax obligations. It covers tasks such as calculating and filing state payroll taxes, ensuring compliance with state tax laws, and submitting the required tax forms to the appropriate agencies. 3. New Hire Onboarding Checklist: This checklist is crucial for ensuring smooth onboarding processes when hiring new employees in North Dakota. It includes tasks such as verifying employee information, completing required paperwork, enrolling employees in benefit programs, and ensuring compliance with state and federal regulations. 4. Time and Attendance Management Checklist: This checklist revolves around effectively managing employee time and attendance records. It includes tasks such as tracking employee work hours, managing paid time off requests, addressing timekeeping discrepancies, and maintaining accurate records for payroll purposes. 5. Payroll Audit and Review Checklist: This checklist assists in conducting regular payroll audits to ensure accuracy and compliance. It involves tasks such as reviewing payroll reports, verifying calculations, reconciling discrepancies, and addressing any issues or errors promptly. 6. Year-End Payroll Checklist: This checklist focuses on year-end payroll tasks, including processing W-2 forms, preparing annual payroll reports, reconciling payroll accounts, and complying with end-of-year tax obligations set forth by the state. By utilizing these various North Dakota Personnel Payroll Associate Checklists, businesses can streamline their payroll operations and avoid potential penalties or errors. These checklists ensure that personnel payroll associates follow a structured approach, guaranteeing accurate and compliant payroll processing within the state of North Dakota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out North Dakota Lista De Verificación De Asociado De Nómina De Personal?

Finding the right legitimate papers template could be a have difficulties. Naturally, there are tons of themes accessible on the Internet, but how can you obtain the legitimate type you will need? Utilize the US Legal Forms web site. The assistance delivers a huge number of themes, including the North Dakota Personnel Payroll Associate Checklist, which you can use for company and personal requires. All the types are checked out by pros and meet federal and state requirements.

When you are presently listed, log in for your bank account and click on the Obtain key to get the North Dakota Personnel Payroll Associate Checklist. Utilize your bank account to search throughout the legitimate types you have purchased earlier. Go to the My Forms tab of your own bank account and obtain yet another duplicate in the papers you will need.

When you are a whole new user of US Legal Forms, listed below are simple guidelines that you can adhere to:

- First, make sure you have selected the proper type for your personal metropolis/state. You may look over the form making use of the Review key and look at the form description to make certain it will be the best for you.

- In the event the type will not meet your expectations, take advantage of the Seach discipline to get the proper type.

- When you are certain the form is acceptable, click on the Buy now key to get the type.

- Choose the costs prepare you would like and type in the essential information. Build your bank account and pay money for your order using your PayPal bank account or credit card.

- Choose the document formatting and down load the legitimate papers template for your device.

- Comprehensive, revise and print and signal the acquired North Dakota Personnel Payroll Associate Checklist.

US Legal Forms will be the greatest local library of legitimate types in which you will find various papers themes. Utilize the company to down load appropriately-manufactured paperwork that adhere to status requirements.