Title: North Dakota Resolution of Meeting of LLC Members to Loan Money: A Comprehensive Guide Introduction: In North Dakota, LLC members have the authority to make important decisions regarding the operations and financial matters of their business entity. One such decision that may occur is the adoption of a resolution to loan money. This article aims to provide a detailed description of what exactly a North Dakota Resolution of Meeting of LLC Members to Loan Money entails, including its purpose, requirements, and potential types. 1. Understanding the Purpose of a North Dakota Resolution of Meeting of LLC Members to Loan Money: — Clarifying the need for capital infusion: The resolution explains the necessity of securing a loan to support the LLC's financial requirements, such as expanding operations, covering unexpected expenses, or investing in new opportunities. — Establishing LLC member agreement: It serves as a formal agreement among the members to lend funds to the LLC, outlining the terms and conditions of the loan. 2. Key Elements and Requirements of a North Dakota Resolution of Meeting of LLC Members to Loan Money: — Date and venue of the LLC meeting: The resolution should provide details about when and where the LLC members convened to reach this decision. — Quorum requirement: Mention the minimum number or percentage of members required to be present for the resolution to be deemed valid. — Description of the loan: Specify the purpose, amount, interest rate, repayment terms, and any additional conditions related to the loan. — Signatures: Include the names and signatures of all LLC members who participated in the meeting. 3. Different Types of North Dakota Resolution of Meeting of LLC Members to Loan Money: While the primary aim of the resolution remains the same across all instances, it can be categorized into various types based on the nature of the loan, such as: — Working Capital Loan Resolution: Aimed at increasing available funds for daily operations, payroll, or managing short-term financial obligations. — Expansion Loan Resolution: Designed to support the LLC's growth initiatives, such as opening a new branch, investing in additional equipment, or entering new markets. — Bridge Loan Resolution: In situations where the LLC requires short-term financing to cover immediate expenses until a long-term solution is obtained. — Acquisition or Merger Loan Resolution: When the LLC aims to finance the purchase or merger of another business entity, this resolution ensures the availability of capital. Conclusion: A North Dakota Resolution of Meeting of LLC Members to Loan Money represents a significant decision made by LLC members to address the financial needs of their business. By adopting a comprehensive resolution, LCS ensure transparency, agreement, and legal compliance while securing the necessary funds for their operations and strategic goals. It is important to consult legal counsel or utilize reputable templates to ensure accuracy and adequacy of the resolution.

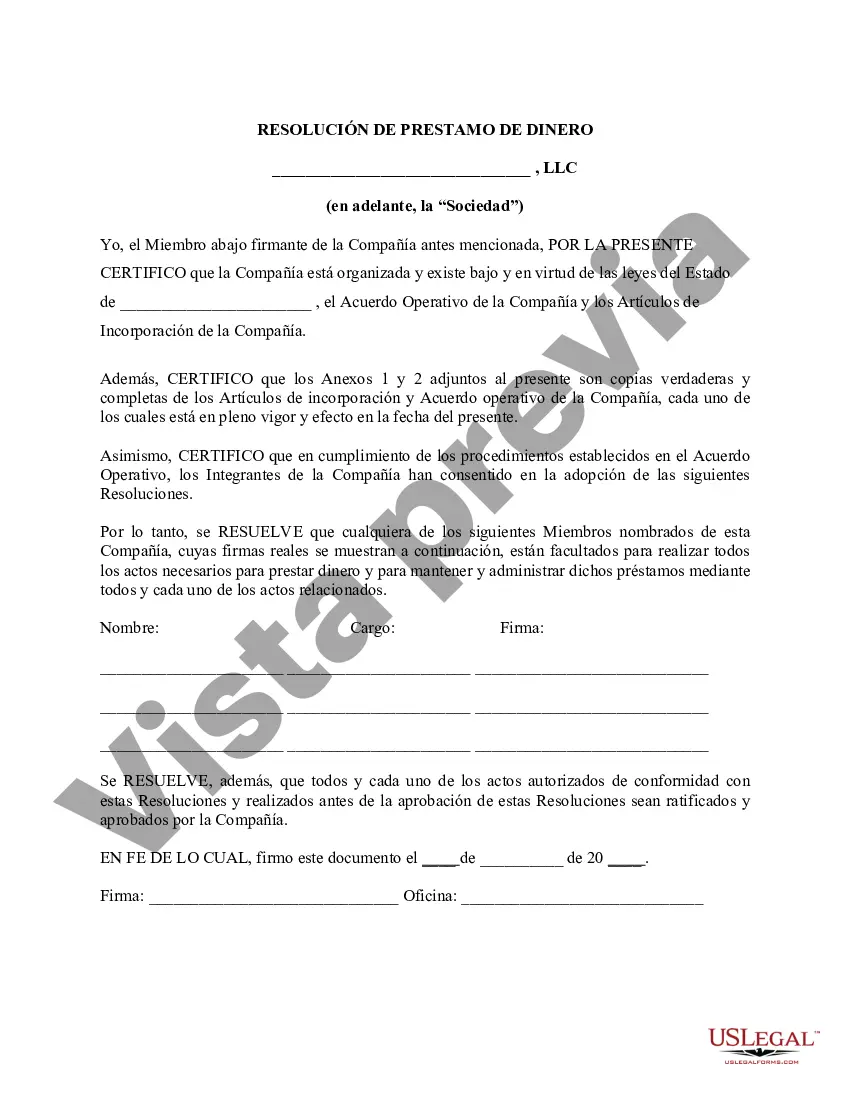

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Resolución de la reunión de los miembros de la LLC para prestar dinero - Resolution of Meeting of LLC Members to Loan Money

Description

How to fill out North Dakota Resolución De La Reunión De Los Miembros De La LLC Para Prestar Dinero?

Are you inside a position that you will need paperwork for either business or person reasons just about every day time? There are tons of legal record web templates available online, but getting versions you can rely isn`t straightforward. US Legal Forms gives 1000s of form web templates, much like the North Dakota Resolution of Meeting of LLC Members to Loan Money, which can be published in order to meet state and federal specifications.

When you are already knowledgeable about US Legal Forms website and possess your account, basically log in. After that, you may acquire the North Dakota Resolution of Meeting of LLC Members to Loan Money design.

Should you not provide an accounts and want to begin using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is to the appropriate town/county.

- Make use of the Preview option to review the form.

- Look at the outline to actually have selected the right form.

- In the event the form isn`t what you are searching for, use the Research industry to get the form that fits your needs and specifications.

- Whenever you obtain the appropriate form, simply click Acquire now.

- Pick the costs plan you would like, submit the required info to generate your account, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free file format and acquire your version.

Find every one of the record web templates you may have bought in the My Forms menus. You may get a more version of North Dakota Resolution of Meeting of LLC Members to Loan Money whenever, if possible. Just go through the necessary form to acquire or print the record design.

Use US Legal Forms, the most substantial selection of legal types, to conserve some time and prevent faults. The support gives skillfully produced legal record web templates that can be used for a selection of reasons. Generate your account on US Legal Forms and begin making your way of life easier.