Title: Understanding the North Dakota Demand for Payment of Account by Business to Debtor Introduction: A demand for payment of account is a crucial tool utilized by businesses in North Dakota to collect outstanding debts from debtors. In this comprehensive guide, we will delve into the intricacies of the North Dakota Demand for Payment of Account by Business to Debtor, exploring its purpose, legal requirements, and types. 1. What is a North Dakota Demand for Payment of Account by Business to Debtor? A North Dakota Demand for Payment of Account by Business to Debtor refers to a formal notification sent by a business to a debtor, requesting the immediate settlement of an overdue account. This demand serves as the initial step towards debt collection and highlights the legal obligations of the debtor to clear outstanding debts. 2. Purpose and Legal Requirements: The primary purpose of a North Dakota Demand for Payment of Account by Business to Debtor is to initiate the process of collecting unpaid debts. Certain legal requirements must be met for the demand to be considered valid and enforceable, including: — Clearly stating the amount owed, including any interest or fees that may have accrued. — Providing a reasonable timeframe for the debtor to respond or settle the debt. — Ensuring the demand is sent in writing and delivered to the debtor's known address. 3. Different Types of North Dakota Demand for Payment of Account by Business to Debtor: There are a few variations of the North Dakota Demand for Payment of Account, depending on the specific circumstances of the debt. Listed below are a few common types: — Demand for payment of account for goods or services rendered: This type of demand is used when a business has provided goods or services to a debtor, and the debtor fails to remit payment within the agreed-upon terms. — Demand for payment of account for unpaid invoices or bills: This type of demand is commonly used in situations where a debtor has not settled invoices or bills by their due dates. — Demand for payment of account for outstanding loans or credit: This type of demand is utilized when a debtor has defaulted or failed to make scheduled payments on a loan or credit agreement. 4. Steps and Best Practices: To ensure a North Dakota Demand for Payment of Account by Business to Debtor is effective, businesses should consider the following steps and best practices: — Clearly state the purpose of the demand, the outstanding amount, and any interest or fees incurred. — Provide a deadline for payment or response, typically between 10 and 30 days. — Include any evidence or documentation supporting the debt, such as contracts, invoices, or signed agreements. — Maintain professional and cordial language in the demand, adhering to legal requirements and avoiding harassment or threats. — Consider seeking legal counsel if the debtor does not respond or settle the outstanding debt within the specified timeframe. Conclusion: The North Dakota Demand for Payment of Account by Business to Debtor is an essential component of debt collection processes for businesses operating within the state. It serves as a formal request for the immediate settlement of an unpaid debt, outlining the legal requirements and obligations of the debtor. By understanding the purpose, legal requirements, and variations of this demand, businesses can enhance their chances of successfully collecting outstanding debts in North Dakota.

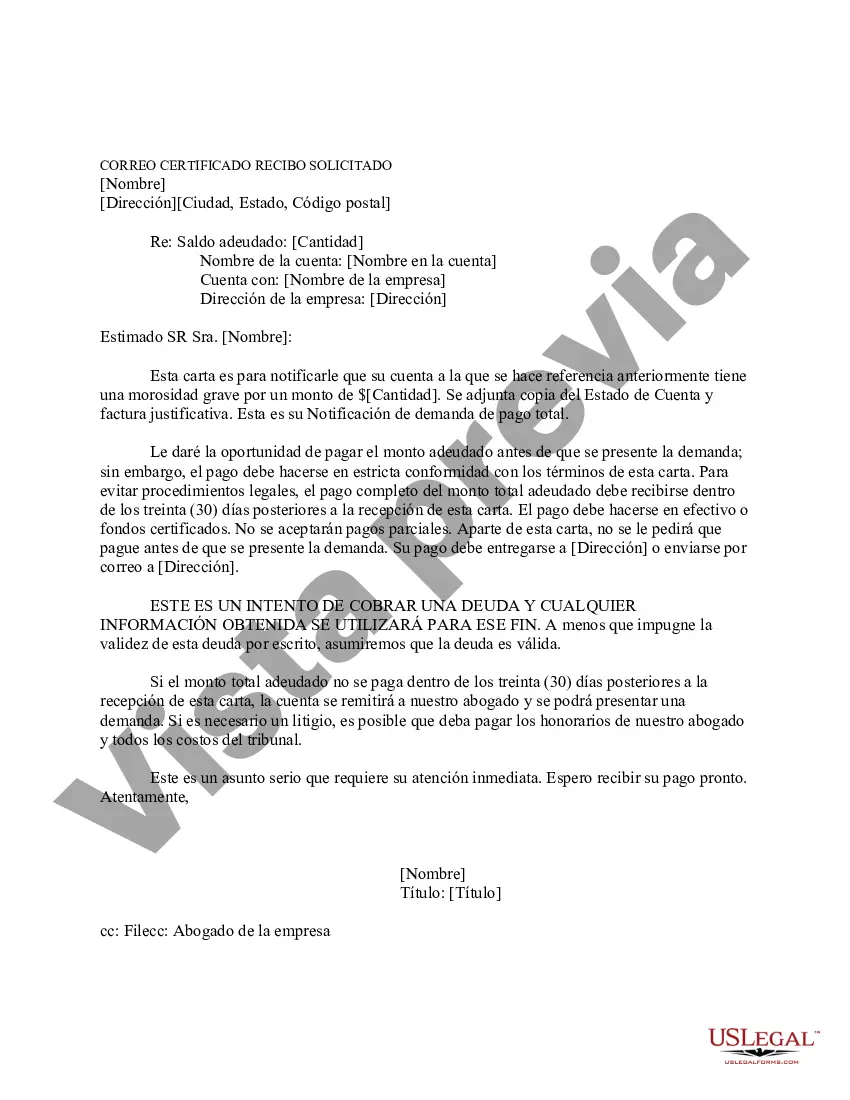

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Demanda de Pago de Cuenta por Empresa a Deudor - Demand for Payment of Account by Business to Debtor

Description

How to fill out North Dakota Demanda De Pago De Cuenta Por Empresa A Deudor?

US Legal Forms - one of several most significant libraries of legitimate varieties in the United States - provides an array of legitimate file layouts it is possible to down load or produce. Using the internet site, you can find thousands of varieties for company and person functions, categorized by types, states, or keywords and phrases.You will find the most up-to-date models of varieties much like the North Dakota Demand for Payment of Account by Business to Debtor within minutes.

If you have a membership, log in and down load North Dakota Demand for Payment of Account by Business to Debtor from the US Legal Forms library. The Down load key can look on every single form you view. You have accessibility to all in the past saved varieties in the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed here are straightforward recommendations to help you get started out:

- Make sure you have chosen the right form for your personal metropolis/state. Click on the Review key to analyze the form`s information. See the form description to actually have chosen the appropriate form.

- In the event the form doesn`t fit your requirements, use the Search industry at the top of the monitor to get the the one that does.

- When you are pleased with the shape, validate your choice by clicking on the Buy now key. Then, opt for the costs plan you want and supply your credentials to sign up for the accounts.

- Method the transaction. Make use of your charge card or PayPal accounts to finish the transaction.

- Pick the formatting and down load the shape in your product.

- Make modifications. Fill up, revise and produce and signal the saved North Dakota Demand for Payment of Account by Business to Debtor.

Each design you put into your account does not have an expiry time which is your own permanently. So, in order to down load or produce one more backup, just go to the My Forms area and click around the form you want.

Get access to the North Dakota Demand for Payment of Account by Business to Debtor with US Legal Forms, by far the most extensive library of legitimate file layouts. Use thousands of professional and express-certain layouts that meet your business or person demands and requirements.