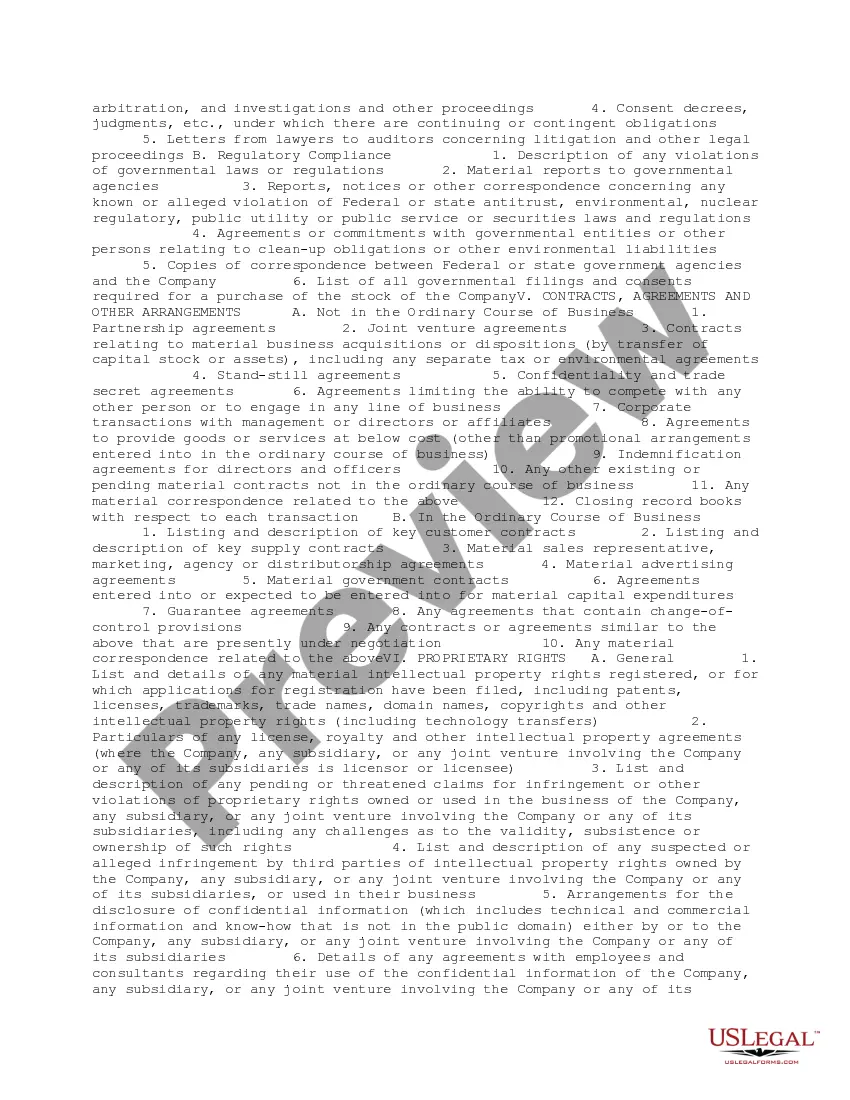

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

North Dakota Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

Finding the appropriate authentic document template can be somewhat challenging. Naturally, there are numerous templates accessible on the internet, but how can you obtain the genuine form you require.

Use the US Legal Forms website. The service offers thousands of templates, such as the North Dakota Request for Due Diligence Documents from a Technology Company, which can be utilized for both business and personal needs. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Download button to acquire the North Dakota Request for Due Diligence Documents from a Technology Company. Use your account to browse through the legal forms you have previously obtained. Visit the My documents tab in your account to obtain another copy of the document you require.

Select the file format and download the legal document template for your needs. Complete, edit, print, and sign the acquired North Dakota Request for Due Diligence Documents from a Technology Company. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- First, make sure you have selected the correct form for your area/region.

- You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not satisfy your requirements, use the Search field to locate the correct form.

- Once you are confident the form is appropriate, click the Buy Now button to obtain the form.

- Choose the pricing plan you want and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Technology due diligence refers to the in-depth examination of a company's technology assets and practices before making a significant investment. It includes reviewing software, hardware, IT infrastructure, and compliance with regulations. When filing a North Dakota Request for Due Diligence Documents from a Technology Company, conducting thorough technology due diligence helps identify risks and confirms the value of the investment.

The 4 P's of due diligence include People, Product, Processes, and Partnerships. Assessing each of these areas helps create a comprehensive understanding of a company's overall health. When making a North Dakota Request for Due Diligence Documents from a Technology Company, considering these elements ensures that you have a well-rounded view of potential risks and opportunities.

Due diligence in technology involves assessing the IT systems, software, and data security measures of a company. This process ensures that the technology assets are reliable, secure, and meet industry standards. Effective due diligence is crucial during a North Dakota Request for Due Diligence Documents from a Technology Company, as it helps mitigate risks and informs better decision-making.

North Dakota's data breach notification law requires businesses to notify individuals of any data breach that compromises personal information. This law aims to protect citizens' data and ensure transparency. Understanding this regulation is essential when approaching a North Dakota Request for Due Diligence Documents from a Technology Company. It helps anticipate potential legal implications related to data security.

Due diligence is the investigation or audit of a potential investment or acquisition. It involves evaluating the financial, legal, and operational aspects to confirm facts before moving forward. For instance, in a North Dakota Request for Due Diligence Documents from a Technology Company, due diligence helps ensure you understand all risks and opportunities associated with the technology assets involved.

A technical due diligence (DD) refers to the evaluation of a company's technology assets and practices. This process examines software, hardware, and related systems to assess their performance and security. Understanding these elements is crucial, especially when making a North Dakota Request for Due Diligence Documents from a Technology Company. It ensures that potential risks are identified before making any significant decisions.

To obtain a copy of the articles of organization in North Dakota, you need to visit the North Dakota Secretary of State's website. They provide access to various business documents, including articles of organization. You can request a copy online or by mail, ensuring you have the necessary information about the company. This process may also be relevant in your North Dakota Request for Due Diligence Documents from a Technology Company.

Financial due diligence requires various documents, including financial statements, tax returns, and accounts receivable reports. These documents reveal a company’s financial health and help identify potential issues. By making a North Dakota Request for Due Diligence Documents from a Technology Company, you can gain access to these vital records and ensure a thorough evaluation before proceeding with any business arrangements.

Due diligence documents are essential records that provide insight into a company's operations, finances, and legal standing. These documents help stakeholders assess the risk and viability of a transaction. When you submit a North Dakota Request for Due Diligence Documents from a Technology Company, you obtain crucial information that can influence your decision-making process.