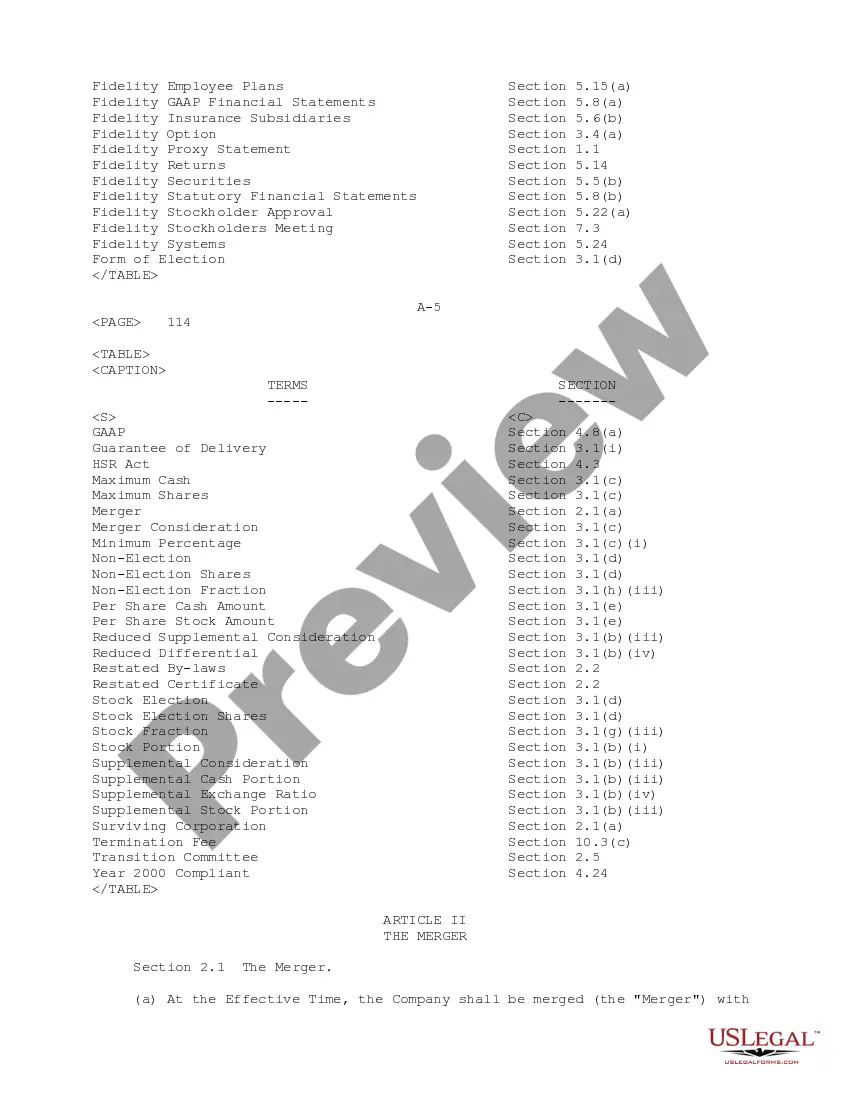

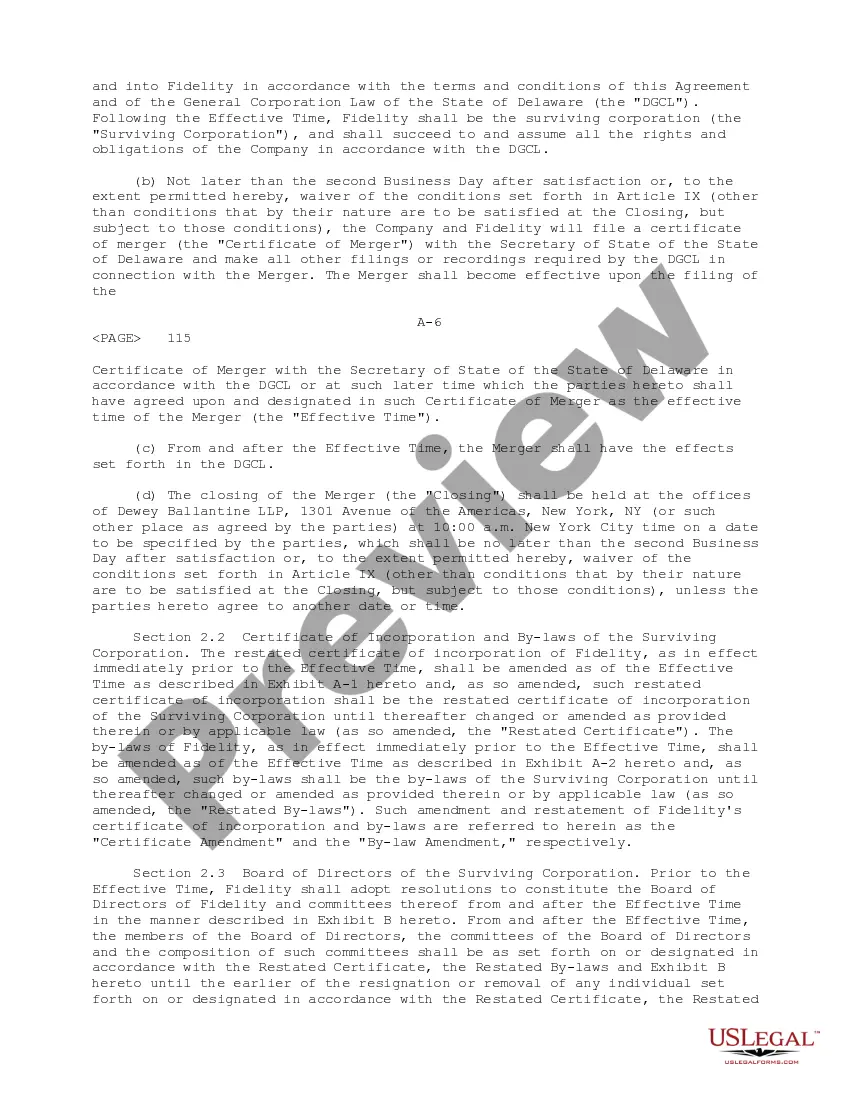

The North Dakota Agreement and Plan of Merger is a legal document that outlines the terms and conditions of the merger between Fidelity National Financial, Inc. (FNC) and Chicago Title Corp. This agreement serves as a comprehensive framework governing the consolidation of these two entities in accordance with North Dakota state laws and regulations. Keywords: North Dakota, Agreement and Plan of Merger, Fidelity National Financial, Inc., Chicago Title Corp, merger, legal document, terms and conditions, consolidation, state laws, regulations. Types of North Dakota Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp: 1. Standard Merger Agreement: This type of agreement typically includes standard clauses and provisions that outline the terms of the merger, such as shareholder rights, financial arrangements, and regulatory compliance. 2. Asset Purchase Agreement: In certain cases, the merger may result in the acquisition of specific assets of one company by the other. This agreement outlines the terms and conditions of the purchase, including the transfer of assets, liabilities, and other relevant details. 3. Stock-for-Stock Merger Agreement: A stock-for-stock merger occurs when the shareholders of one company receive stock in the surviving entity in exchange for their shares in the merging company. This agreement details the exchange ratio, voting rights, and other considerations related to the transaction. 4. Reverse Merger Agreement: In a reverse merger, a private company acquires a publicly-traded company, allowing the private company to go public indirectly. This type of agreement outlines the terms of the transaction, including the exchange of securities and the restructuring of share ownership. 5. Statutory Merger Agreement: Sometimes referred to as a "short-form merger," a statutory merger is a streamlined process where the acquiring company absorbs the target company. This agreement outlines the statutory requirements, board approvals, and shareholder consent required for the merger. These are just a few examples of the various types of North Dakota Agreement and Plan of Merger that can exist between Fidelity National Financial, Inc. and Chicago Title Corp. Each agreement will have unique provisions tailored to the specific circumstances and objectives of the merger.

North Dakota Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

How to fill out North Dakota Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

US Legal Forms - one of several most significant libraries of legitimate forms in America - delivers an array of legitimate papers web templates you are able to download or printing. Making use of the internet site, you can find a large number of forms for enterprise and specific reasons, categorized by groups, suggests, or keywords and phrases.You can get the most up-to-date variations of forms much like the North Dakota Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp in seconds.

If you already have a monthly subscription, log in and download North Dakota Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp through the US Legal Forms library. The Download button can look on each and every develop you view. You get access to all earlier acquired forms inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, listed here are simple directions to get you started out:

- Make sure you have picked out the best develop for the city/state. Click the Review button to check the form`s content. See the develop explanation to ensure that you have selected the appropriate develop.

- When the develop does not fit your demands, use the Search discipline at the top of the monitor to get the one which does.

- When you are happy with the shape, confirm your choice by visiting the Purchase now button. Then, choose the rates program you prefer and offer your accreditations to register on an accounts.

- Procedure the financial transaction. Utilize your bank card or PayPal accounts to complete the financial transaction.

- Pick the formatting and download the shape on the device.

- Make changes. Fill out, modify and printing and indicator the acquired North Dakota Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp.

Each and every design you included with your money lacks an expiry time and is also yours forever. So, if you would like download or printing another duplicate, just visit the My Forms area and then click in the develop you will need.

Gain access to the North Dakota Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp with US Legal Forms, the most extensive library of legitimate papers web templates. Use a large number of specialist and status-specific web templates that meet your company or specific demands and demands.