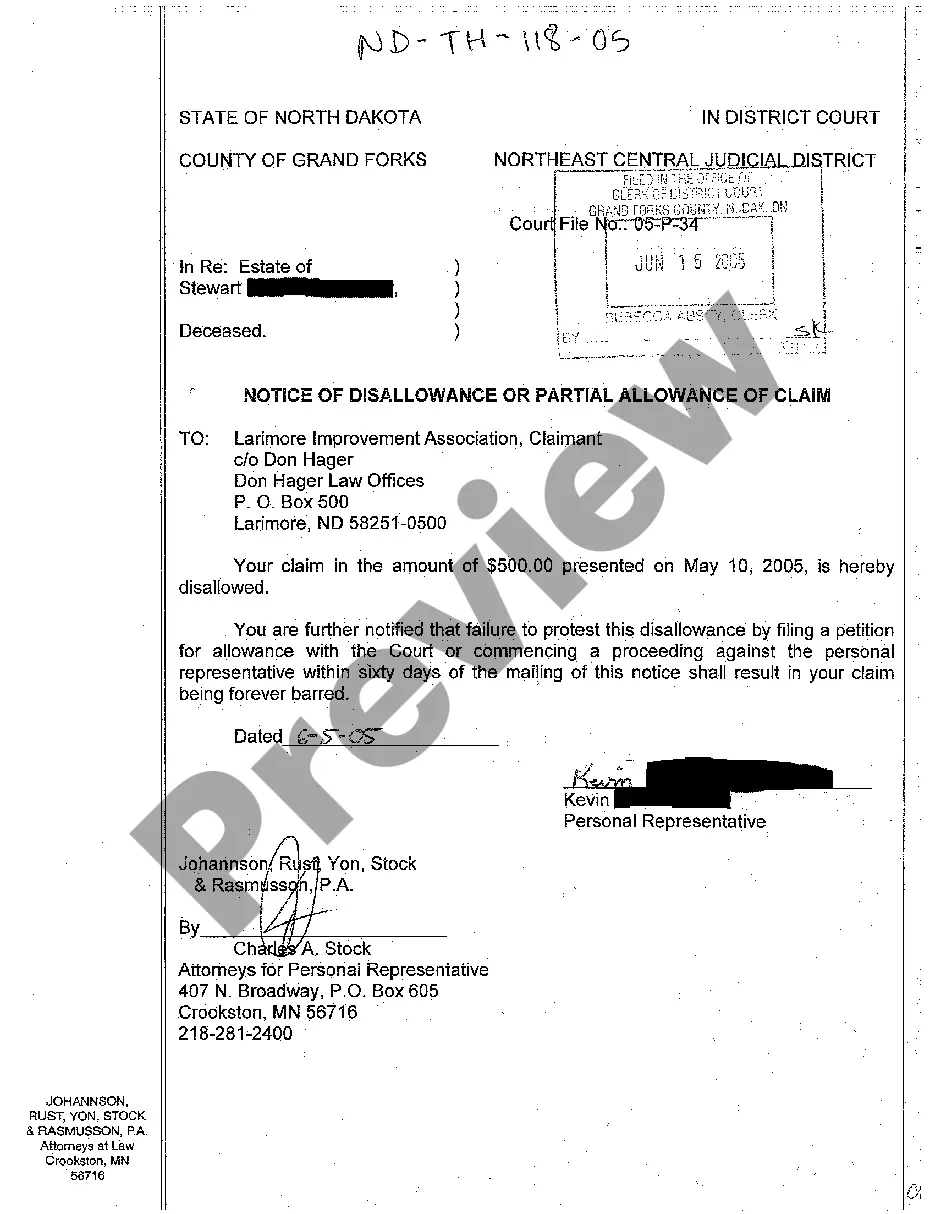

North Dakota Notice of Disallowance or Partial Allowance of Claim

Description

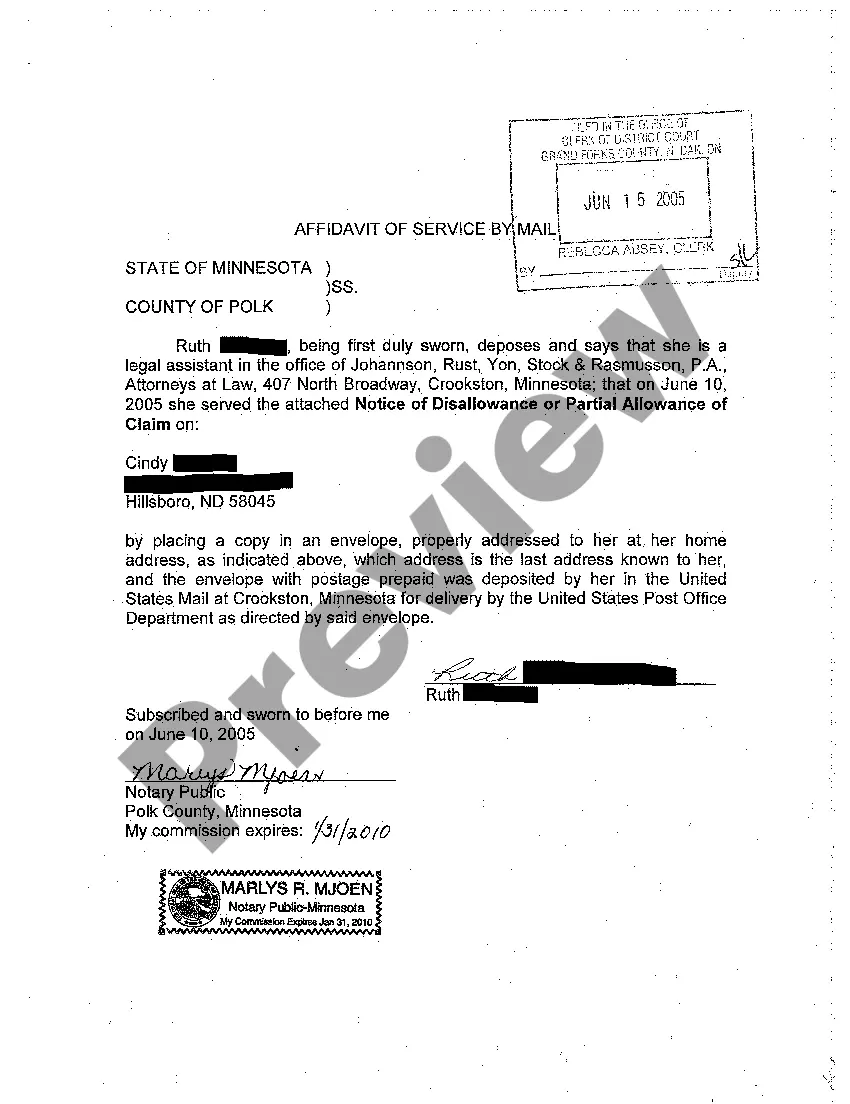

How to fill out North Dakota Notice Of Disallowance Or Partial Allowance Of Claim?

Avoid pricey attorneys and find the North Dakota Notice of Disallowance or Partial Allowance of Claim you want at a reasonable price on the US Legal Forms website. Use our simple categories function to search for and obtain legal and tax forms. Go through their descriptions and preview them prior to downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to download and complete every single template.

US Legal Forms customers basically need to log in and obtain the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the tips below:

- Ensure the North Dakota Notice of Disallowance or Partial Allowance of Claim is eligible for use where you live.

- If available, look through the description and use the Preview option before downloading the templates.

- If you’re confident the document suits you, click on Buy Now.

- If the template is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, it is possible to complete the North Dakota Notice of Disallowance or Partial Allowance of Claim manually or an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

N. upon the death of a person and beginning of probate (filing of will, etc), a person believing he/she is owed money should file a written claim (statement) promptly with the executor or administrator of the estate, who will then approve it, in whole or in part, or deny the claim.

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

Is there a time limit for a claim against a deceased estate? Yes, there is. You have only 6 months from the date of the grant of probate to make a claim. In some very limited circumstances, an extension of this time frame may be granted.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.

Paying off debts from the estate Well-established practice is that an executor will wait six months after the date of death to allow for any creditors to intimate their claims before making payment to beneficiaries.

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

A claim for reasonable financial provision must be made within six months after probate or letters of administration have been issued, although the court can extend this period in certain circumstances (eg if the applicant has not made an earlier claim because of negotiations with the executors or administrators).

There is a strict time limit within which an eligible individual can make a claim on the Estate. This is six months from the date that the Grant of Probate was issued. For this reason, Executors are advised to wait until this period has lapsed before distributing any of the Estate to the beneficiaries.