What Is A Ucc1 Filing

Description

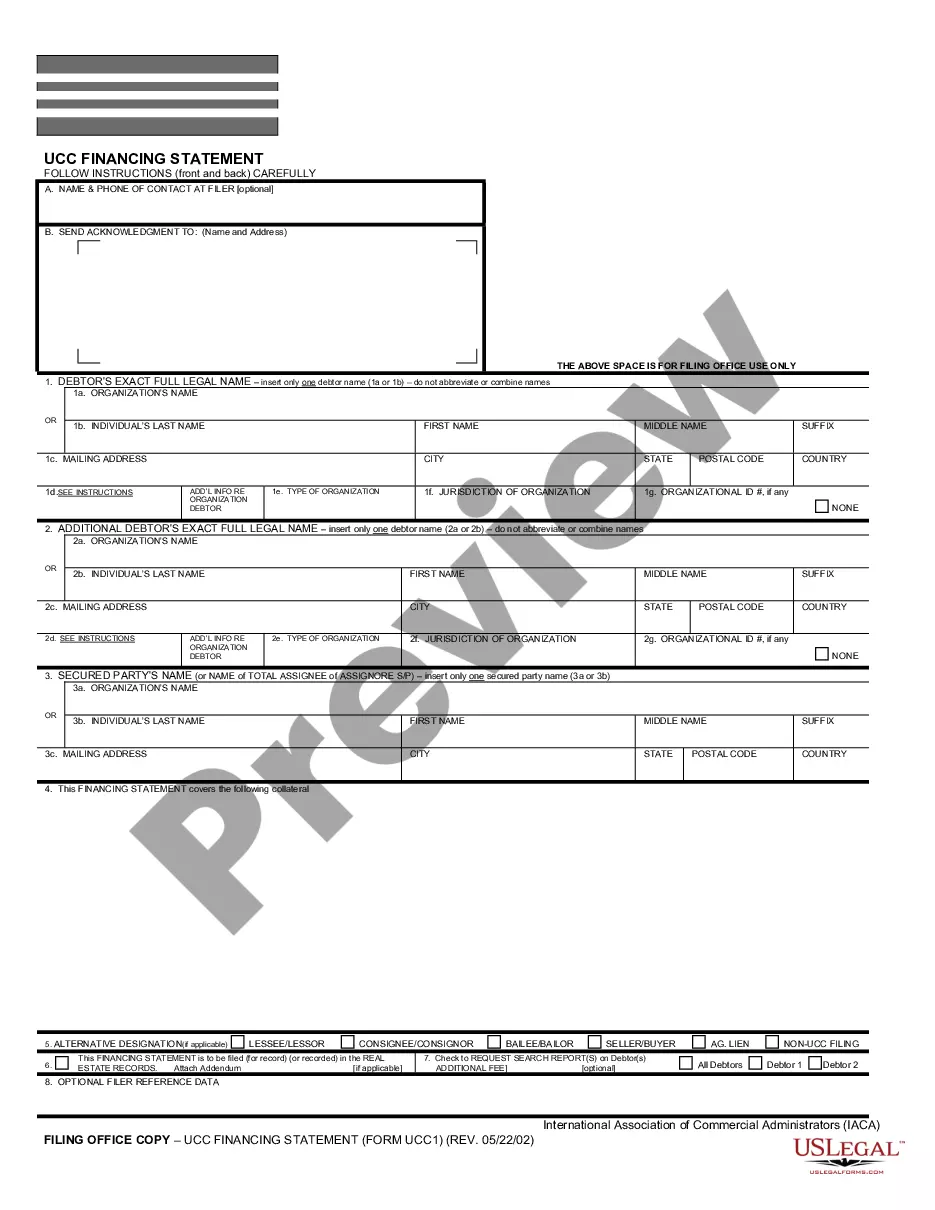

How to fill out North Dakota UCC1 Financing Statement?

- Log in to your US Legal Forms account if you're a returning user and click the Download button for your desired form. Ensure your subscription is active; if not, renew it according to your plan.

- For first-time users, start by browsing the Preview mode and form description to confirm you have selected the appropriate form for your requirements.

- If the document you need is not suitable, utilize the Search tab above to find the correct form that aligns with your jurisdiction's needs.

- Once you locate the right document, click on the Buy Now button and choose a subscription plan that fits your needs. Registration is required to access the full library.

- Complete your purchase by entering your credit card or PayPal information to finalize the transaction.

- Finally, download the form to your device to complete it. You can also find it later in the My Forms section of your profile.

By following these straightforward steps, you can quickly acquire your North Dakota UCC1 Financing Statement and ensure that you are well-equipped to complete your legal obligations accurately.

Start your journey with US Legal Forms today and gain access to over 85,000 legally sound forms and expert assistance!

Form popularity

FAQ

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

You should file a UCC-1 Financing Statement with the secretary of state's office in the state where the debtor is incorporated or located. If the collateral is real property, then you should also file a UCC-1 with the county recorder's office in the county where the debtor's real property is located.

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

Why file a UCC-3 form? The UCC-3 is the Swiss-Army-Knife of forms. Unlike a UCC 1, a UCC 3 can be used for multiple purposes. The actions one can take are Amendment, Assignment, Continuation, and Termination.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.