The Federal Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. Also, this Act can apply when a person applies for a job or even a policy of insurance when certain investigations are made of the applicant.

Investigative Consumer Reports are special types of consumer report not commonly used by credit and collection professionals. This report differs from the typical report used for the extension of consumer credit because it is can include information regarding a consumer's character, general reputation, and personal characteristics obtained through interviews with neighbors, friends, business associates, etc.

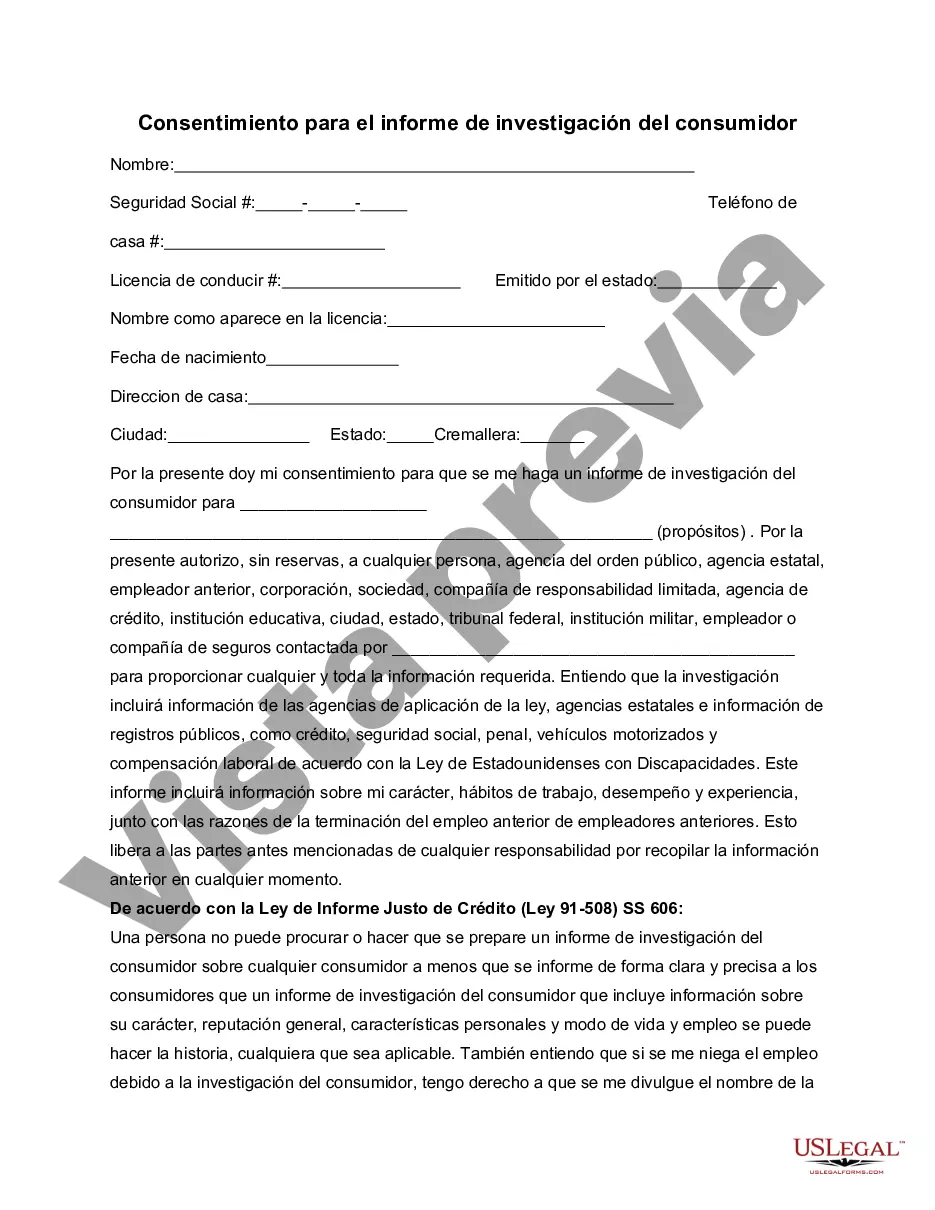

Nebraska Consents to Investigative Consumer Report refers to a legal document that grants permission to conduct an investigative consumer report on an individual in the state of Nebraska. This report generally encompasses a thorough investigation of an individual's personal, professional, and financial history, which may include but is not limited to, their credit history, criminal records, employment records, education verification, and other relevant information. Keywords associated with Nebraska Consent to Investigative Consumer Report include "Nebraska," "consent," "investigative consumer report," "permission," "personal history," "professional history," "financial history," "credit history," "criminal records," "employment records," "education verification," and "relevant information." This document is typically used by employers or businesses seeking to evaluate a potential employee's background or by landlords assessing a potential tenant's reliability and trustworthiness. In both instances, obtaining this consent is vital for compliance with state and federal laws, ensuring that individuals' privacy rights are protected. While there may not be specific types of Nebraska Consent to Investigative Consumer Reports, different organizations may have slight variations in the content and format of the document. However, the ultimate purpose of the consent remains the same — to obtain explicit permission from the individual to conduct a comprehensive investigation into their background and history. It is important to note that under the Fair Credit Reporting Act (FCRA) in the United States, which governs the use of consumer reports, individuals must be notified and provide consent before an investigative consumer report is conducted. This requirement ensures transparency and allows individuals to review any potential adverse findings and dispute inaccuracies. Nebraska Consents to Investigative Consumer Report, therefore, serves as a legal safeguard that protects individuals while allowing employers, landlords, or other authorized entities to make informed decisions based on an individual's background and history. By granting consent, individuals acknowledge and accept the potential consequences of such investigations, ensuring a fair and unbiased process.Nebraska Consents to Investigative Consumer Report refers to a legal document that grants permission to conduct an investigative consumer report on an individual in the state of Nebraska. This report generally encompasses a thorough investigation of an individual's personal, professional, and financial history, which may include but is not limited to, their credit history, criminal records, employment records, education verification, and other relevant information. Keywords associated with Nebraska Consent to Investigative Consumer Report include "Nebraska," "consent," "investigative consumer report," "permission," "personal history," "professional history," "financial history," "credit history," "criminal records," "employment records," "education verification," and "relevant information." This document is typically used by employers or businesses seeking to evaluate a potential employee's background or by landlords assessing a potential tenant's reliability and trustworthiness. In both instances, obtaining this consent is vital for compliance with state and federal laws, ensuring that individuals' privacy rights are protected. While there may not be specific types of Nebraska Consent to Investigative Consumer Reports, different organizations may have slight variations in the content and format of the document. However, the ultimate purpose of the consent remains the same — to obtain explicit permission from the individual to conduct a comprehensive investigation into their background and history. It is important to note that under the Fair Credit Reporting Act (FCRA) in the United States, which governs the use of consumer reports, individuals must be notified and provide consent before an investigative consumer report is conducted. This requirement ensures transparency and allows individuals to review any potential adverse findings and dispute inaccuracies. Nebraska Consents to Investigative Consumer Report, therefore, serves as a legal safeguard that protects individuals while allowing employers, landlords, or other authorized entities to make informed decisions based on an individual's background and history. By granting consent, individuals acknowledge and accept the potential consequences of such investigations, ensuring a fair and unbiased process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.