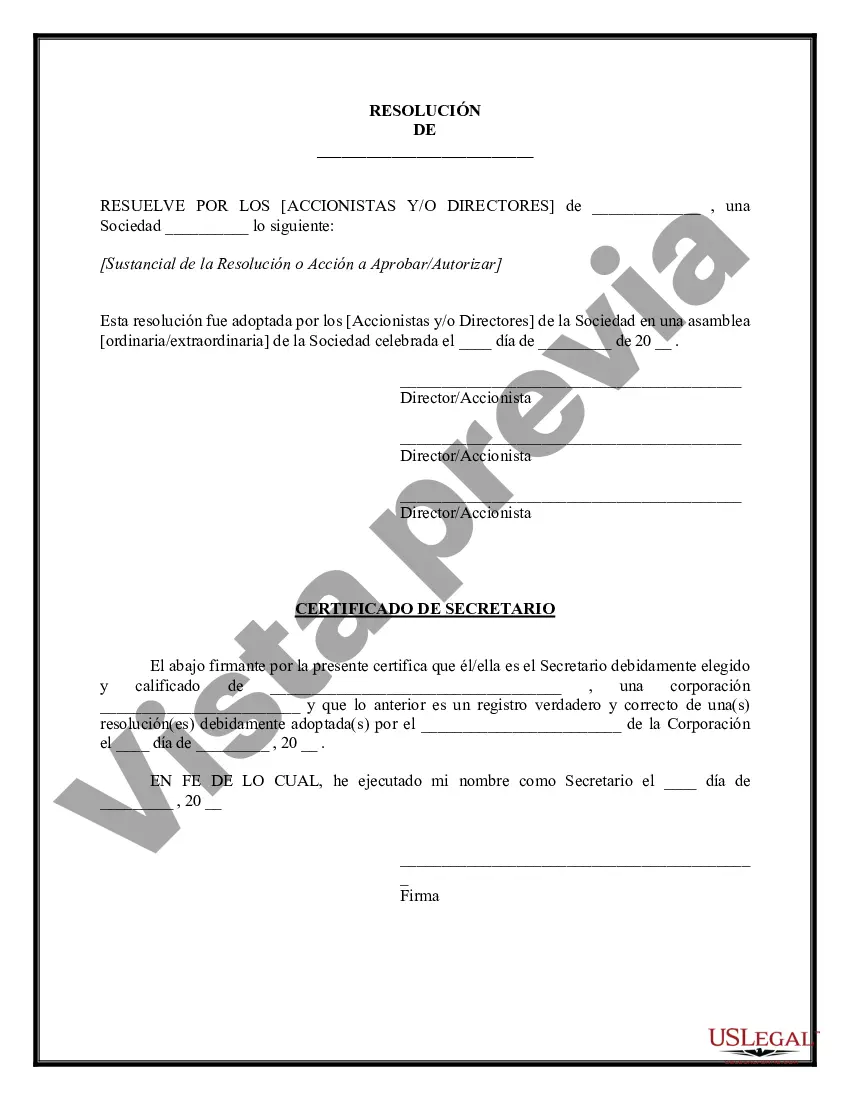

A Nebraska Corporate Resolution for Single Member LLC is a legal document that outlines the decisions and actions taken by a single member LLC (Limited Liability Company). It serves as a formal record of the choices made by the LLC's sole owner or member. This resolution is of utmost importance as it enables the member to document key steps, procedures, and changes within the LLC. It ensures efficient and transparent decision-making processes while establishing a clear chain of control and authority for the company. The Nebraska Corporate Resolution for Single Member LLC typically includes essential details such as the LLC's name, the member's name, and the date on which the resolution is adopted. It also covers various areas that may require decisions, including managing the LLC's financial and banking matters, making contracts and agreements, signing legal documents, and entering into partnerships or joint ventures. There are different types of Nebraska Corporate Resolutions for Single Member LLC that may be drafted, depending on the specific needs and requirements of the business. Some common types include: 1. Managing Financial Matters Resolution: This resolution grants the single member authority to open bank accounts, make deposits and withdrawals, manage the LLC's finances, and engage in financial transactions on behalf of the company. 2. Contractual Authority Resolution: This resolution enables the single member to enter into contracts, agreements, and transactions with third parties. It outlines the member's authority to negotiate terms, sign contracts, and make binding decisions on behalf of the LLC. 3. Appointment of Authorized Signatory Resolution: This resolution designates an authorized signatory, often the single member, who can sign legal documents, agreements, and contracts on behalf of the LLC. It clarifies the member's authority to execute necessary paperwork without needing additional approval. 4. Dissolution Resolution: In the event that the single member decides to dissolve the LLC, a dissolution resolution outlines the decision to cease business operations, settle outstanding debts, and distribute assets or profits accordingly. It is important to consider the specific needs and circumstances of the single member LLC when determining which resolutions are necessary. Seeking legal advice or consulting with a business attorney can provide valuable guidance in preparing the appropriate Nebraska Corporate Resolution for a Single Member LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Nebraska Resolución Corporativa Para Un Solo Miembro LLC?

If you need to complete, acquire, or printing lawful document web templates, use US Legal Forms, the greatest assortment of lawful types, which can be found on the Internet. Take advantage of the site`s basic and convenient research to discover the papers you will need. Various web templates for company and individual purposes are categorized by types and says, or keywords. Use US Legal Forms to discover the Nebraska Corporate Resolution for Single Member LLC in just a few clicks.

If you are previously a US Legal Forms client, log in in your profile and click the Down load key to find the Nebraska Corporate Resolution for Single Member LLC. You can even entry types you previously delivered electronically in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for the appropriate town/nation.

- Step 2. Make use of the Review option to check out the form`s content material. Do not neglect to see the explanation.

- Step 3. If you are not happy with all the form, utilize the Search discipline towards the top of the monitor to get other models from the lawful form format.

- Step 4. After you have identified the form you will need, select the Acquire now key. Choose the costs strategy you favor and add your accreditations to sign up for an profile.

- Step 5. Process the purchase. You can utilize your bank card or PayPal profile to accomplish the purchase.

- Step 6. Select the structure from the lawful form and acquire it on the product.

- Step 7. Full, modify and printing or indicator the Nebraska Corporate Resolution for Single Member LLC.

Every lawful document format you purchase is your own property eternally. You may have acces to each form you delivered electronically inside your acccount. Click the My Forms area and choose a form to printing or acquire again.

Be competitive and acquire, and printing the Nebraska Corporate Resolution for Single Member LLC with US Legal Forms. There are millions of expert and status-certain types you may use for your personal company or individual demands.